Power Corporation of Canada (TSX:POW) Valuation: Assessing the Impact of New CAD 150M Preferred Share Offering

Reviewed by Simply Wall St

Power Corporation of Canada (TSX:POW) has completed a fixed-income offering and issued CAD 150 million in 5.65% preferred shares. This new batch of non-convertible preferred shares adds to their capital base and could attract interest from income-focused investors.

See our latest analysis for Power Corporation of Canada.

Power Corporation of Canada’s share price has gathered impressive momentum throughout 2024, with a robust year-to-date share price return of 63.14% and a 60.14% total shareholder return over the past year. The market’s optimism appears to be building as a result of recent capital-raising moves, while investors reassess long-term growth and income potential. This has contributed to a sustained upswing supported by both recent news and broader sector confidence.

If this kind of performance has you curious about other opportunities, it may be the perfect moment to broaden your view and discover fast growing stocks with high insider ownership

Yet with Power Corporation of Canada’s remarkable rally and optimistic headlines, investors now face a key question: does the current share price reflect all the good news, or is there still a genuine buying opportunity?

Most Popular Narrative: 15.1% Overvalued

Compared to the last close price of CA$71.91, the most widely followed narrative sees fair value at CA$62.50. This suggests that recent exuberance may be running ahead of long-term fundamentals. In this context, core business drivers and future financial assumptions play a defining role in determining whether today’s price can be justified.

“Demographic trends and digital innovation are driving consistent asset inflows, recurring fee revenue, and long-term earnings growth across wealth and asset management platforms. Expansion in alternative and sustainable investments, coupled with operational efficiencies, is supporting margin improvement and positioning for continued shareholder returns.”

Want to know what’s fueling this high price? Key numbers behind the narrative include aggressive projections for sales growth, efficiency gains, and future profit multiples. Ready to find out what bold assumptions analysts are betting on to back up that fair value? Dive in for the full story behind the price.

Result: Fair Value of $62.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the outlook could change if regulatory shifts disrupt key subsidiaries or if alternative investments fail to deliver stable and long-term earnings growth.

Find out about the key risks to this Power Corporation of Canada narrative.

Another View: Testing the DCF Model

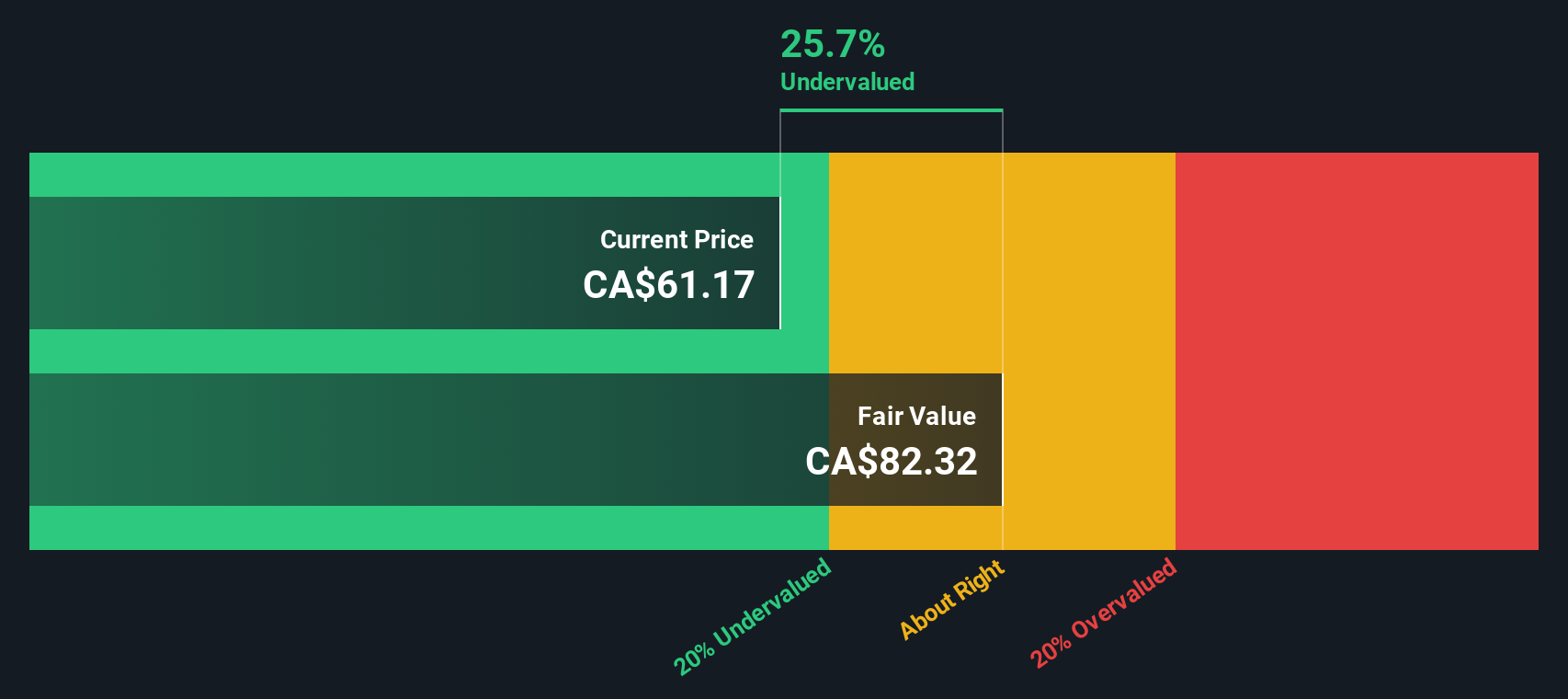

While the popular narrative points to overvaluation based on price-to-earnings comparisons, our SWS DCF model takes a different approach and estimates fair value at CA$88.59, which is well above the current share price. This signals that, depending on your assumptions, there may be hidden value here. Are the current multiples missing something? Is the market right to be cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Power Corporation of Canada for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 922 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Power Corporation of Canada Narrative

If you see things differently or are keen to investigate the figures yourself, you can build a personal narrative in just a few minutes. Do it your way

A great starting point for your Power Corporation of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Opportunities? Uncover Your Next Smart Move

Don’t let today’s trends pass you by. Give yourself an edge by zeroing in on stocks backed by powerful data and fresh ideas using Simply Wall Street’s tailored screeners. Make your next investment count. Every click could reveal tomorrow’s winners.

- Take charge of your income strategy and uncover these 15 dividend stocks with yields > 3% offering yields above 3% for steady potential returns.

- Power up your portfolio by targeting these 25 AI penny stocks that are pushing boundaries in artificial intelligence and automation.

- Spot overlooked bargains before the crowd and track down these 922 undervalued stocks based on cash flows for compelling value based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:POW

Power Corporation of Canada

An international management and holding company, provides financial services in North America, Europe, and Asia.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.