Power Corp (TSX:POW) Valuation Insight Following $150 Million Preferred Share Offering

Reviewed by Kshitija Bhandaru

Power Corporation of Canada (TSX:POW) has wrapped up a $150 million fixed-income offering, issuing 5.75% non-cumulative preferred shares. This kind of move often sparks conversation about how the company is approaching its capital management and future growth plans.

See our latest analysis for Power Corporation of Canada.

Following the preferred share offering, Power Corporation of Canada has seen only modest shifts in its share price. However, the company’s one-year total shareholder return still outpaces its short-term price movements. Momentum appears steady rather than accelerating, suggesting that investors remain focused on long-term fundamentals and capital management decisions.

If big capital moves get you thinking about what’s next in the market, now is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With the company’s long-term returns outpacing its recent price moves, investors are left wondering if Power Corporation of Canada is trading at a discount to its true value, or if the market has already priced in future growth.

Most Popular Narrative: Fairly Valued

Power Corporation of Canada closed at CA$60.14, just above the most popular narrative's fair value of CA$59. This close match paints a picture of analysts seeing minimal room for big price moves ahead, grounding current expectations around the company’s fundamentals.

The company is benefiting from digital innovation and technology-led transformation, as evidenced by double-digit AUM growth at digital platforms like Wealthsimple and record flows at IG Wealth. These enhancements are expected to provide continued access to new customer segments and improve operational efficiency, supporting both net margin expansion and revenue growth going forward.

What if a digital edge is driving future profits? This narrative hints at a playbook built not only on new technology but also on relentless expansion and surprising efficiency. Which earnings assumptions unlock the consensus price target? Click through to see the game-changing projections at the heart of this valuation.

Result: Fair Value of $59 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected regulatory shifts or underperformance from key financial subsidiaries could quickly invalidate the current consensus regarding Power Corporation's fair value.

Find out about the key risks to this Power Corporation of Canada narrative.

Another View: What Does the SWS DCF Model Suggest?

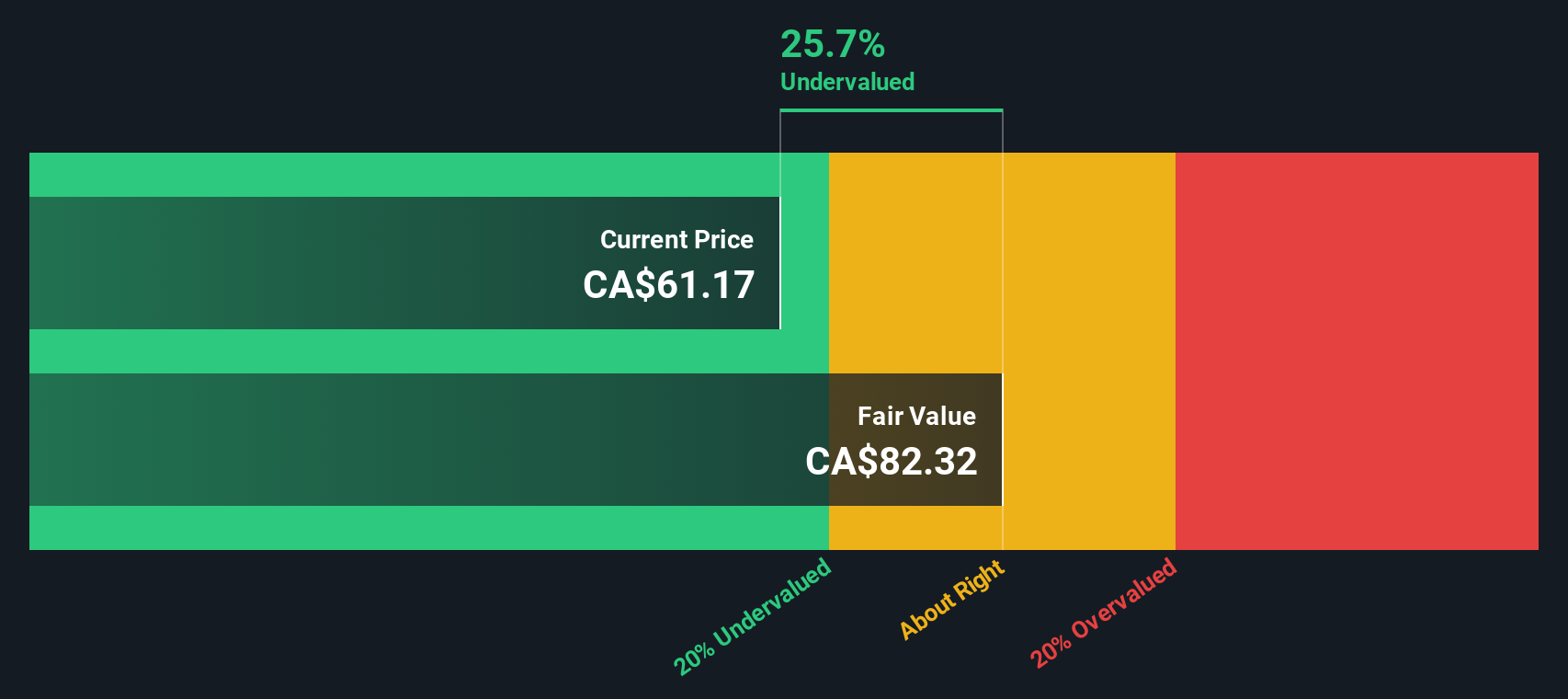

While analysts’ consensus and price-to-earnings comparisons suggest Power Corporation of Canada is fairly valued, our SWS DCF model arrives at a different conclusion. According to this approach, shares are trading nearly 27% below their estimated fair value. This finding indicates the market may be underappreciating future cash flows. Could this gap be an unexpected opportunity or a sign of optimism included in long-term projections?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Power Corporation of Canada Narrative

If this perspective does not quite align with yours or you prefer doing your own digging, you can craft a personalized outlook in just a few minutes by using Do it your way

A great starting point for your Power Corporation of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep an eye on emerging opportunities before the rest of the market catches on. Don't let the next wave of growth slip past you. Put these powerful tools to work now:

- Uncover exceptional yields with these 19 dividend stocks with yields > 3%, offering attractive income and strong payout histories every savvy portfolio needs.

- Get ahead of industry disruption by pinpointing tomorrow's leaders among these 24 AI penny stocks, making breakthroughs in automation and machine learning.

- Strengthen your watchlist with these 896 undervalued stocks based on cash flows, which the market may be overlooking. This could give you a head start on value opportunities others might miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:POW

Power Corporation of Canada

An international management and holding company, provides financial services in North America, Europe, and Asia.

Undervalued established dividend payer.

Market Insights

Community Narratives