How Investors Are Reacting To Power Corporation of Canada (TSX:POW) CA$150 Million Preferred Share Issuance

Reviewed by Simply Wall St

- Power Corporation of Canada recently completed a follow-on equity offering, raising CA$150 million through the issuance of 6 million Series H Preferred Shares at CA$25 each.

- This additional capital injection could have important effects on the company's capital structure, funding flexibility, and future financing costs.

- We will explore how this preferred share issuance may influence Power Corporation's investment narrative, particularly its balance sheet management and growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Power Corporation of Canada Investment Narrative Recap

To be a shareholder in Power Corporation of Canada, you must believe in its capacity to generate steady profits from core businesses like Great-West Lifeco and IGM Financial, while capitalizing on digital transformation and alternative asset growth. The recent CA$150 million preferred share issuance provides incremental funding flexibility but does not materially change the current key catalyst, sustained asset inflows fueling recurring earnings, or the biggest near-term risk, earnings volatility linked to its insurance and wealth management holdings.

One particularly relevant announcement is the ongoing share buyback, including 2.1 million shares repurchased in recent months. While the buyback program aims to enhance per-share value and signal confidence from management, the fresh capital raise through preferred shares may offset some of this impact in the short term as it alters the balance sheet mix.

By contrast, investors should be aware that Power Corporation’s reliance on insurance and wealth management subsidiaries leaves it exposed if regulatory...

Read the full narrative on Power Corporation of Canada (it's free!)

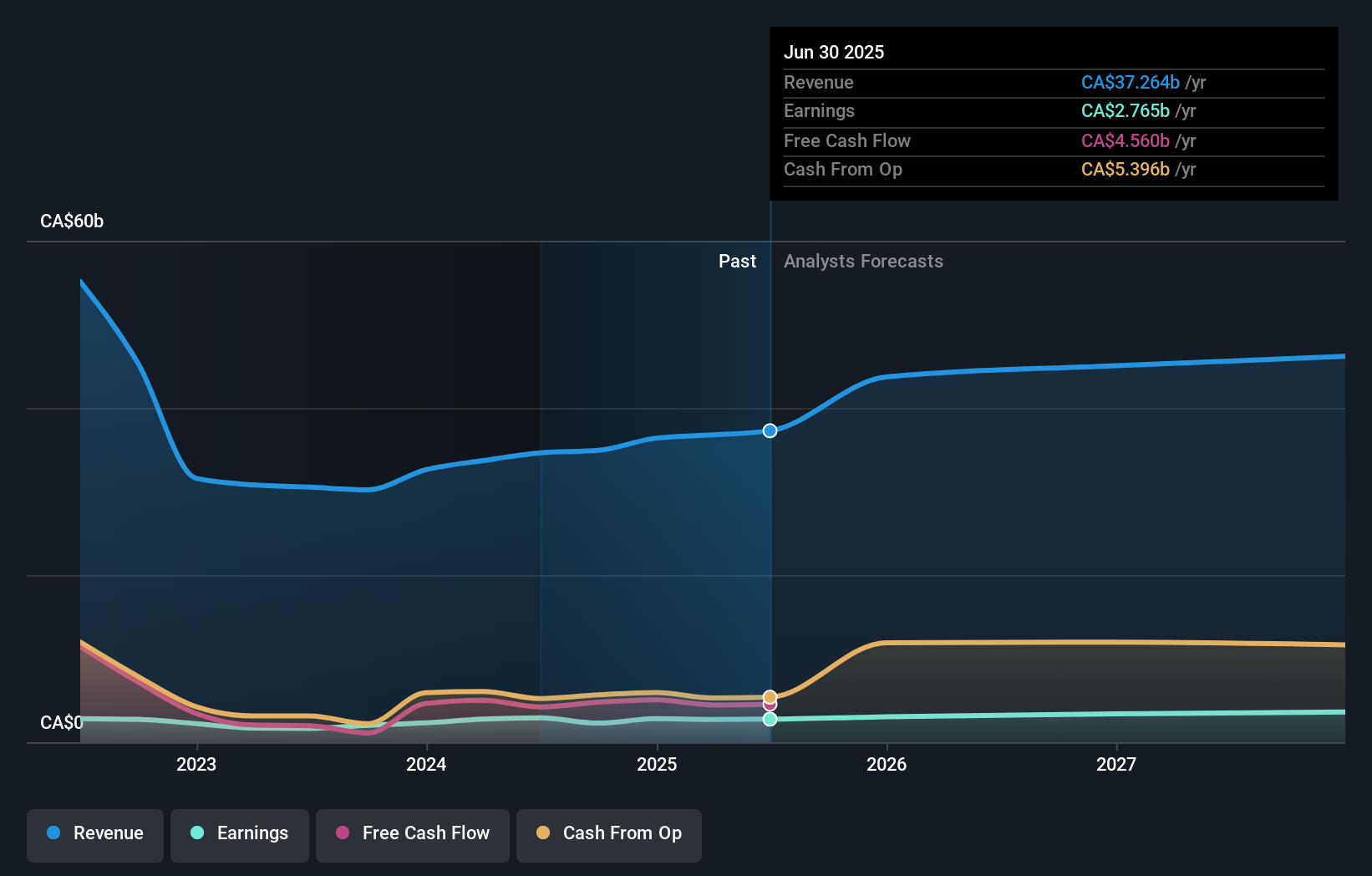

Power Corporation of Canada's outlook anticipates CA$47.0 billion in revenue and CA$3.5 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 8.1% and represents a CA$0.7 billion increase in earnings from the current CA$2.8 billion.

Uncover how Power Corporation of Canada's forecasts yield a CA$59.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Eight individual fair value estimates from the Simply Wall St Community span CA$39.80 to CA$81.25, reflecting a broad spectrum of outlooks. This range of investor opinions stands alongside the company’s robust recurring fee revenue as a key driver of Power Corporation’s future performance.

Explore 8 other fair value estimates on Power Corporation of Canada - why the stock might be worth as much as 42% more than the current price!

Build Your Own Power Corporation of Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Power Corporation of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Power Corporation of Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Power Corporation of Canada's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:POW

Power Corporation of Canada

An international management and holding company, provides financial services in North America, Europe, and Asia.

Undervalued established dividend payer.

Market Insights

Community Narratives