Manulife Financial (TSX:MFC) Launches C$500M Debenture Offering With New Underwriters

Reviewed by Simply Wall St

Manulife Financial (TSX:MFC) recently announced the addition of several co-lead underwriters for its CAD 500 million fixed-income offering. This significant activity in Manulife's financial maneuvers coincides with a 12% move in its stock price over the last month. The company's performance aligns with broader market trends, where the S&P 500 has displayed mixed performance, oscillating between slight decreases and sporadic gains. In this context, Manulife's news regarding its debt financing, along with routine dividend announcements and board changes, likely contributed some weight to its overall on-market returns, mirroring general positive investor sentiments.

The recent announcement by Manulife Financial about its CAD 500 million fixed-income offering could influence the company's broader narrative focused on digital transformation and growth in Asian markets. Such financial maneuvering might enhance capital availability, potentially supporting its strategic initiatives that aim at operational efficiency and market expansion. This move aligns with Manulife's efforts to manage risks and capitalize on investment opportunities, which is critical as they continue to navigate economic uncertainties.

Over the past five years, Manulife's total shareholder return, which includes share price appreciation and dividends, was 228.83%. This performance stands out compared to the recent one-year period where Manulife lagged the Canadian Insurance industry, which saw returns of 30.2%. In contrast, the company's one-year return exceeded the broader Canadian market's 10.7% gain, indicating moderate outperformance on a shorter time frame relative to the wider market trends.

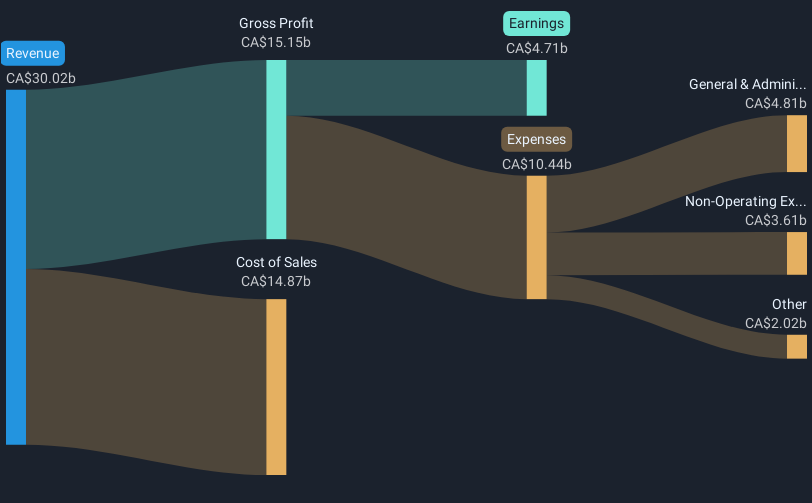

The financial developments, such as the debt financing and recurring dividends, may impact Manulife's revenue and earnings forecasts. The issuance of fixed-income securities could provide capital to support continued growth in high-priority areas, such as the Asian market and digital advancements. Analysts' price targets reflect this potential; with the current share price at CA$42.46, it remains at a discount to the consensus price target of CA$48.14, highlighting investor expectations for future growth. As Manulife aims to achieve its projected revenue of CA$81 billion by 2028, strategic investments like these will likely play an essential role in shaping its financial success and market position.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MFC

Manulife Financial

Provides financial products and services in the United States, Canada, Asia, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives