Manulife Financial (TSX:MFC) Advances with GenAI Integration in Asia, Eyes Future Growth Despite Valuation Concerns

Reviewed by Simply Wall St

Manulife Financial (TSX:MFC) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a notable 31.2% increase in dividend payouts and innovative product launches, juxtaposed against a 16.7% drop in Q2 net sales and inflationary pressures. In the discussion that follows, we will examine Manulife's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Dive into the specifics of Manulife Financial here with our thorough analysis report.

Competitive Advantages That Elevate Manulife Financial

Manulife Financial has demonstrated strong financial health, as evidenced by its balance sheet with a total shareholder equity of CA$50.8 billion and a debt-to-equity ratio of 49.6%. The company’s management team, led by experienced executives like Roy Gori and Colin Simpson, has successfully driven growth in core earnings by 6%, with significant contributions from Asia and Global WAM segments. The strategic focus on high-quality earnings and maintaining a solid balance sheet has resulted in a reliable dividend yield of 4.02%, covered by a reasonable payout ratio of 65.2%. Additionally, Manulife's commitment to innovation is highlighted by its recent advancements in Generative Artificial Intelligence (GenAI), which aims to transform business processes and customer service across Asia.

Challenges Constraining Manulife Financial's Potential

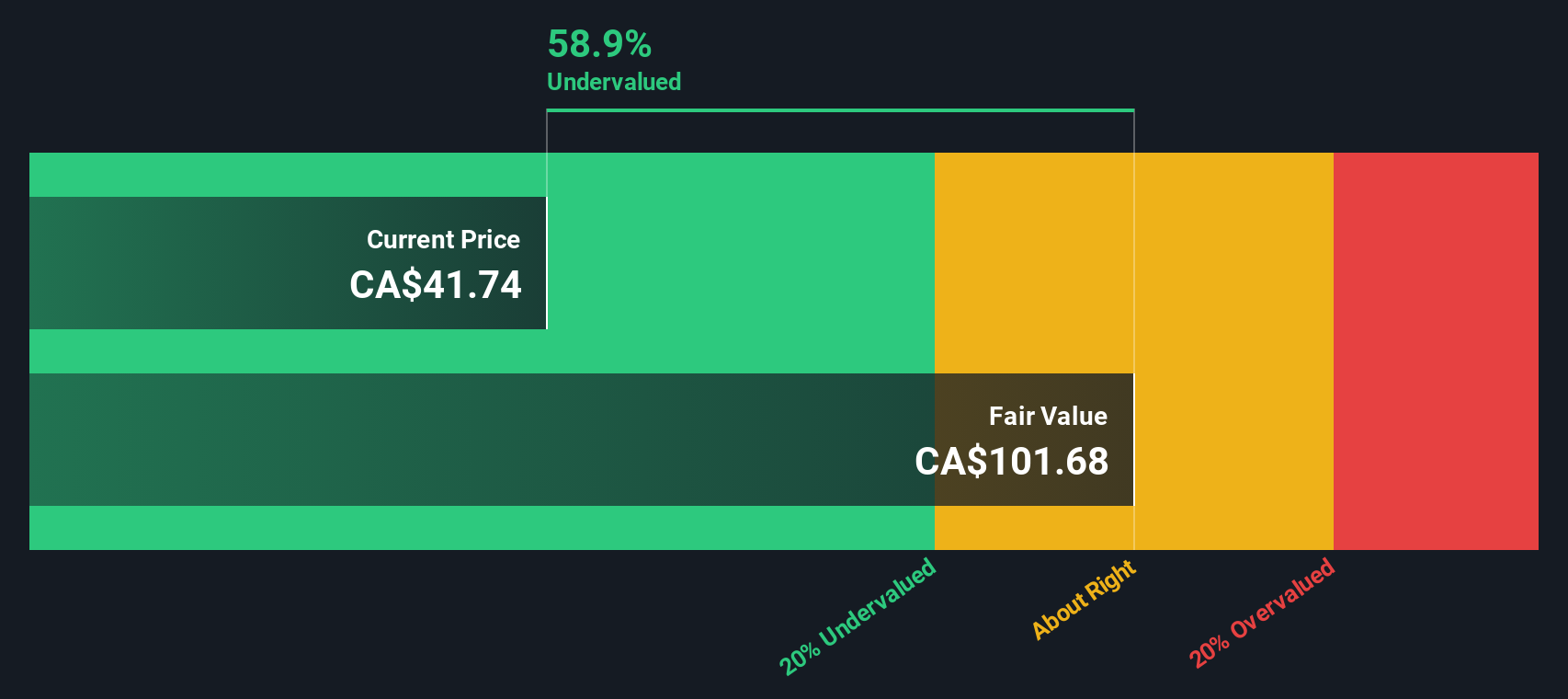

However, Manulife faces several challenges. The company's current Price-To-Earnings Ratio of 16.6x is higher than both the North American Insurance industry average of 14x and the peer average of 12.5x, indicating it may be overvalued despite trading below the estimated fair value of CA$100.64. Moreover, core earnings decreased by 11% from the prior year quarter, reflecting unfavorable net insurance expenses and higher workforce-related costs. Additionally, the company has seen lower sales in Mainland China, and the ALDA charge has widened for eight consecutive quarters, signaling ongoing financial pressures.

Potential Strategies for Leveraging Growth and Competitive Advantage

Manulife is well-positioned to capitalize on several emerging opportunities. The company's strategic initiatives in Asia, particularly the integration of GenAI to enhance customer interactions and streamline underwriting processes, are expected to drive significant growth. The Sales Agent Enablement tool and Underwriting Assistant in Singapore are notable examples of how Manulife is leveraging technology to improve efficiency and customer satisfaction. Furthermore, the company's focus on expanding its wealth management platform and capturing the growing middle class in Asia aligns with its goal of achieving an 18% plus core ROE target by 2027.

Competitive Pressures and Market Risks Facing Manulife Financial

Nevertheless, Manulife must navigate several external threats. The decline in new business CSM due to product mix and higher interest rates poses a risk to future growth. Additionally, ongoing pressure on commercial real estate could impact the company's financial performance. Competitive pressures within the insurance industry, coupled with the potential for lower sales of protection insurance products, may also challenge Manulife's market position. Despite these threats, the company continues to see benefits from business growth in core net insurance service results in Asia and Canada, highlighting the importance of strategic execution in these regions.

Conclusion

Manulife Financial exhibits significant strengths through its financial health, strategic management, and innovative advancements, particularly in Asia. However, its current Price-To-Earnings Ratio of 16.6x, higher than the industry and peer averages, suggests a premium valuation which may limit upside potential. Recent declines in core earnings and challenges in Mainland China indicate that the company's focus on leveraging technology and expanding its wealth management platform positions it well for future growth. Navigating external threats, such as higher interest rates and competitive pressures, will be crucial for sustaining its market position and achieving its long-term goals.

Turning Ideas Into Actions

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:MFC

Manulife Financial

Provides financial products and services in the United States, Canada, Asia, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion