Intact Financial Corporation's (TSE:IFC) Share Price Could Signal Some Risk

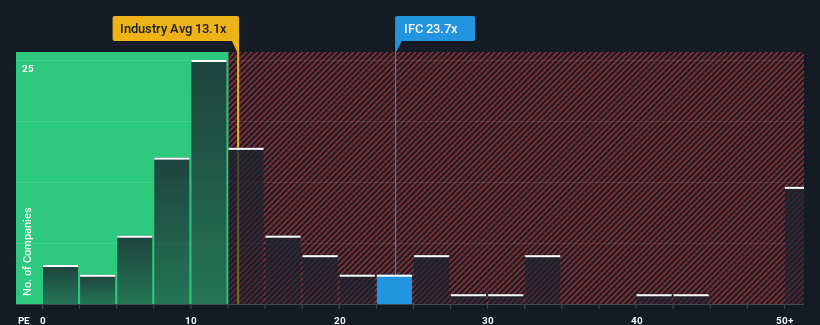

With a price-to-earnings (or "P/E") ratio of 23.7x Intact Financial Corporation (TSE:IFC) may be sending very bearish signals at the moment, given that almost half of all companies in Canada have P/E ratios under 14x and even P/E's lower than 7x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Intact Financial certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Intact Financial

Does Growth Match The High P/E?

In order to justify its P/E ratio, Intact Financial would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 77%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 8.7% per annum over the next three years. With the market predicted to deliver 13% growth each year, the company is positioned for a weaker earnings result.

With this information, we find it concerning that Intact Financial is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Intact Financial currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Intact Financial that you should be aware of.

Of course, you might also be able to find a better stock than Intact Financial. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:IFC

Intact Financial

Through its subsidiaries, provides property and casualty insurance products to individuals and businesses in Canada, the United States, the United Kingdom, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026