Does Intact Financial's (TSX:IFC) Dividend Boost Signal Enduring Stability or Mask Competitive Pressures?

Reviewed by Simply Wall St

- Earlier this week, Intact Financial Corporation announced second quarter 2025 results, reporting net income of CA$867 million and earnings per share growth compared to the prior year, alongside the approval of regular common and preferred dividend payments for shareholders in September.

- The continuation of strong earnings and consistent dividend declarations reflects the company's operational momentum and management's confidence in maintaining financial stability amid ongoing market challenges.

- We’ll explore how Intact Financial’s recent earnings growth and dividend affirmation factor into the company’s updated investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Intact Financial Investment Narrative Recap

To be a shareholder in Intact Financial, you have to believe in the company’s ability to grow earnings and dividends by leveraging its scale, underwriting discipline, and technology investments across insurance markets subject to regulatory changes and competitive forces. This week’s strong Q2 earnings and dividend affirmation support that narrative but do not materially alter near-term catalysts or ease the primary risk of elevated catastrophe losses and margin pressures in Canada and the U.K.

The recently announced quarterly dividend of CA$1.33 per share is particularly relevant here, reinforcing the company’s commitment to reliable income for shareholders as it maintains confidence in its ongoing financial performance and operational consistency even while broader industry risks persist.

Yet, with persistent inflation in personal auto insurance and continued regulatory scrutiny, investors should be aware of how quickly profitability can be pressured if rate approvals lag behind claims cost trends...

Read the full narrative on Intact Financial (it's free!)

Intact Financial's outlook forecasts CA$23.2 billion in revenue and CA$3.0 billion in earnings by 2028. This projection assumes a 7.4% annual revenue decline and a CA$0.8 billion earnings increase from the current CA$2.2 billion.

Uncover how Intact Financial's forecasts yield a CA$329.31 fair value, a 16% upside to its current price.

Exploring Other Perspectives

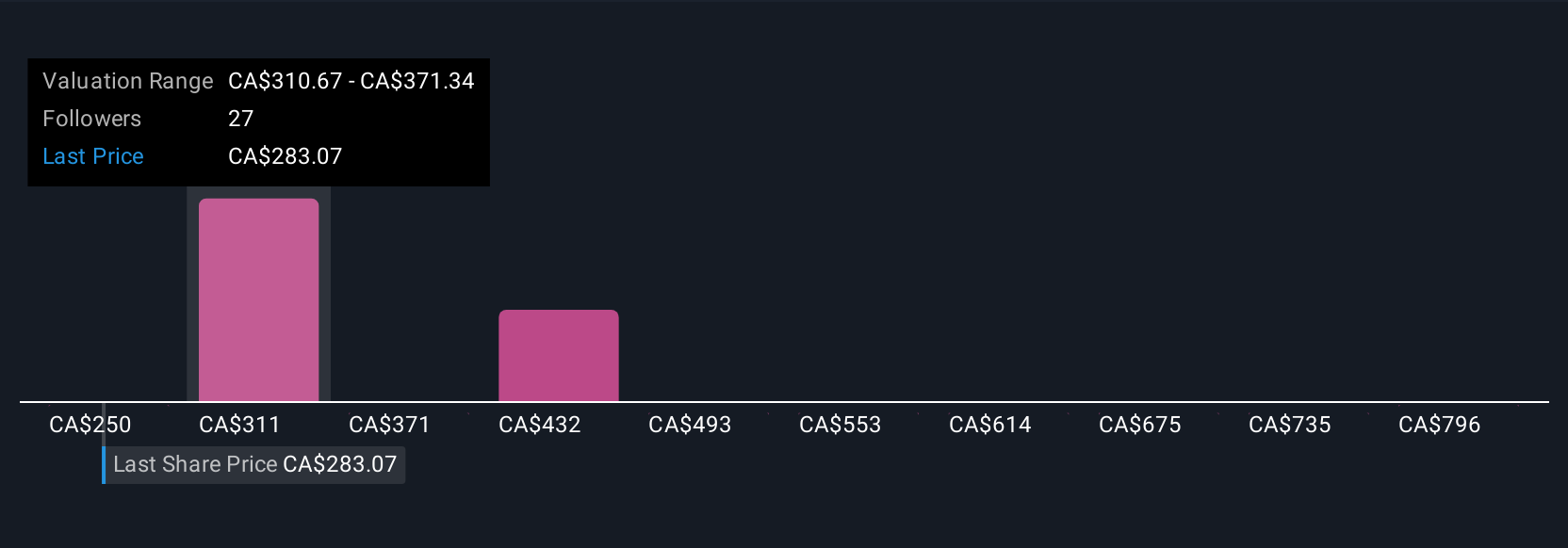

Fair value estimates from five Simply Wall St Community members range from CA$250 to CA$857 per share. While some see considerable upside, others have more caution, especially as higher-than-expected catastrophe losses remain a key risk to ongoing earnings growth and dividend stability.

Explore 5 other fair value estimates on Intact Financial - why the stock might be worth over 3x more than the current price!

Build Your Own Intact Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intact Financial research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Intact Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intact Financial's overall financial health at a glance.

No Opportunity In Intact Financial?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IFC

Intact Financial

Through its subsidiaries, provides property and casualty insurance products to individuals and businesses in Canada, the United States, the United Kingdom, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives