Can Intact Financial’s Olympic Sponsorship Shift the Brand Narrative for TSX:IFC Investors?

Reviewed by Sasha Jovanovic

- Intact Insurance recently announced a multi-year national partnership with the Canadian Olympic Committee and Team Canada, including official sponsorship of athlete William Dandjinou ahead of the 2026 Milano Cortina Olympic Winter Games and a nationwide campaign with CBC/Radio-Canada celebrating athlete and community stories.

- This partnership expands Intact's brand reach and community engagement through high-profile sports sponsorship and supports the development of sports across Canada as part of Team Canada 2035 initiatives.

- We'll explore how Intact's new collaboration with Team Canada may strengthen its brand visibility and reshape the company's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Intact Financial Investment Narrative Recap

To be a shareholder in Intact Financial, you need to believe in the company's potential to sustain premium growth by leveraging its market leadership and adaptability despite ongoing industry challenges like softening rates and regulatory pressures. The recent Olympic partnership, while positive for brand visibility and community engagement, is unlikely to materially impact near-term catalysts such as earnings growth or profit margins, nor does it address core risks tied to weather-driven catastrophe losses or competitive pressures.

Of the latest company announcements, the upcoming Q3 2025 earnings release and conference call on November 4 and 5 stands out as most relevant for investors keen on short-term catalysts. These results will provide a real-time check on underlying profitability and give insight into whether Intact is maintaining growth momentum in its core insurance operations, regardless of recent sponsorship campaigns.

However, with this optimism comes the potential for unexpected volatility if climate-related catastrophe events ...

Read the full narrative on Intact Financial (it's free!)

Intact Financial's outlook anticipates CA$23.7 billion in revenue and CA$3.0 billion in earnings by 2028. This projection assumes a 7.0% annual revenue decline and a CA$0.7 billion increase in earnings from the current CA$2.3 billion.

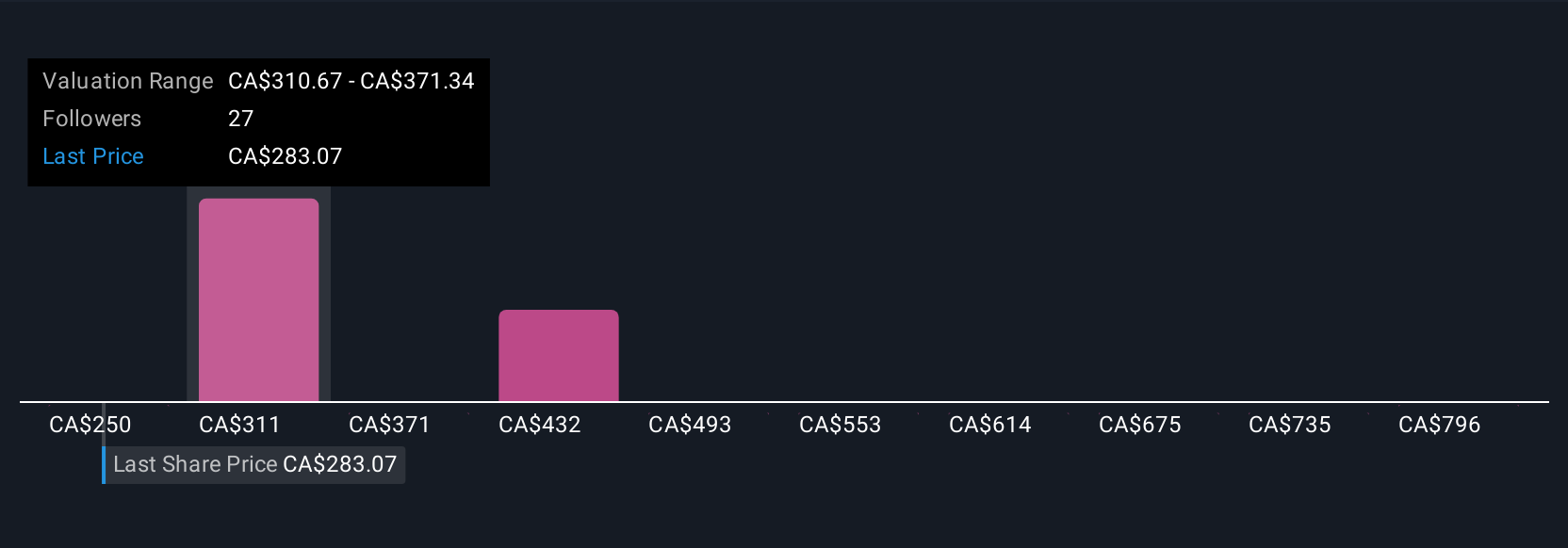

Uncover how Intact Financial's forecasts yield a CA$326.69 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Fair value estimates from 7 Simply Wall St Community members range from CA$254 to CA$856.69 per share. Many participants are weighing climate-driven catastrophe risks and the impact these may have on future results, underlining the importance of considering different viewpoints in your assessment.

Explore 7 other fair value estimates on Intact Financial - why the stock might be worth over 3x more than the current price!

Build Your Own Intact Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intact Financial research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Intact Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intact Financial's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IFC

Intact Financial

Through its subsidiaries, provides property and casualty insurance products to individuals and businesses in Canada, the United States, the United Kingdom, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives