iA Financial (TSX:IAG) Valuation Spotlight as Digital Platform Launch and Q3 Results Draw Investor Interest

Reviewed by Simply Wall St

iA Financial (TSX:IAG) is catching investors' attention as Canadian life insurers gear up to report third-quarter results. The company has also just launched a web-based version of its popular EVO Insurance platform.

See our latest analysis for iA Financial.

Momentum has been building for iA Financial, as excitement over the web-based EVO Insurance rollout and the broader spotlight on Canadian lifeco profitability has likely contributed to stronger sentiment. The company’s latest share price sits at $157.34, with a solid 19.60% share price return year-to-date and an impressive 37.71% total shareholder return over the past year, showing that recent digital innovation and sector optimism are resonating with investors both short and long term.

If you’re inspired by iA’s progress but want to see what else is gaining traction, now’s the perfect time to expand your view and discover fast growing stocks with high insider ownership

The stock’s momentum and recent innovations raise a key question for investors: Is iA Financial undervalued at these levels, or has the market already factored in all of its future growth potential?

Price-to-Earnings of 14.4x: Is it justified?

iA Financial currently trades at a price-to-earnings (PE) ratio of 14.4x, which makes the shares appear more expensive than both its key North American insurance peers and the wider industry.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of company earnings. It is often used as a quick benchmark for a firm’s valuation relative to its sector. For insurance companies, which tend to have stable but slower growth profiles, a PE ratio above the sector average can indicate high market expectations for future profitability or strong investor demand.

Looking more closely, iA Financial's PE of 14.4x stands out against the North American insurance industry average of 14.1x and a peer group average of 12x. The current ratio is also higher than the company’s estimated fair PE ratio of 14x. This suggests the market is pricing in a premium, possibly reflecting management’s experience, accelerating earnings growth, and recent digital innovations. However, the premium is not extreme, so the valuation could move toward the fair ratio if expectations change.

Explore the SWS fair ratio for iA Financial

Result: Price-to-Earnings of 14.4x (OVERVALUED)

However, a sudden slowdown in earnings growth or an unexpected shift in market sentiment could quickly challenge the current optimism surrounding iA Financial’s valuation.

Find out about the key risks to this iA Financial narrative.

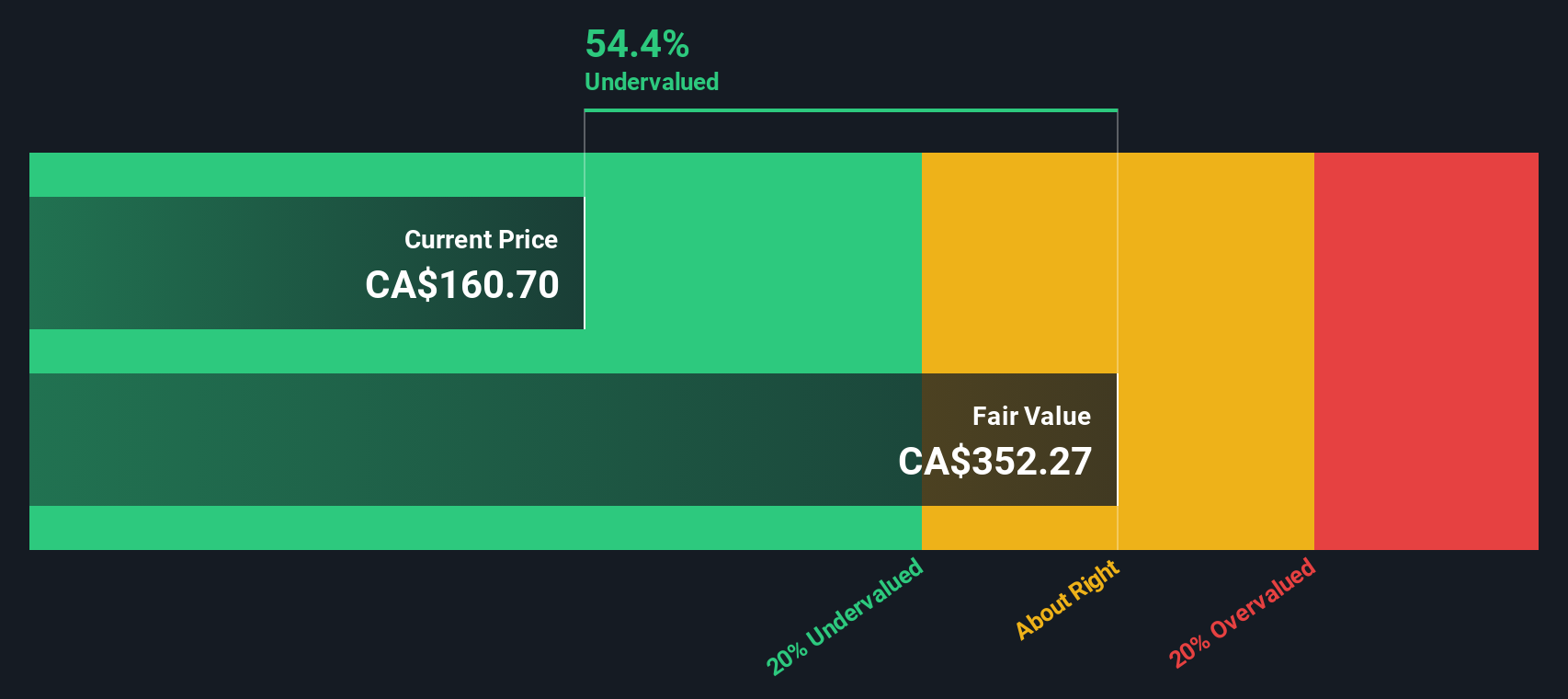

Another View: Discounted Cash Flow Signals Undervaluation

While iA Financial's share price appears expensive based on earnings, our SWS DCF model suggests a different perspective. The DCF estimate places fair value at CA$352.27 per share, which is significantly higher than the current CA$157.34 trading price. Is the market overlooking something, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out iA Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own iA Financial Narrative

If you have your own perspective on iA Financial or want to dig deeper into the data, crafting your personal view only takes a few minutes, so Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding iA Financial.

Looking for more investment ideas?

Set yourself apart from the crowd and seize opportunities others might miss. Check out these distinctive ways to expand your investing playbook right now:

- Tap into tomorrow’s trends with these 24 AI penny stocks. Give your portfolio an edge in artificial intelligence innovation and automation.

- Uncover overlooked bargains by analyzing these 874 undervalued stocks based on cash flows, where disciplined fundamentals point to significant upside based on cash flows.

- Boost your income inside and outside of market rallies by searching through these 17 dividend stocks with yields > 3% to find steady, high-yield opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iA Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IAG

iA Financial

Provides insurance and wealth management services for individual and group basis in Canada and the United States.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives