Should You Be Adding Great-West Lifeco (TSE:GWO) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Great-West Lifeco (TSE:GWO). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Great-West Lifeco

Great-West Lifeco's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Over twelve months, Great-West Lifeco increased its EPS from CA$3.17 to CA$3.36. That's a modest gain of 5.9%.

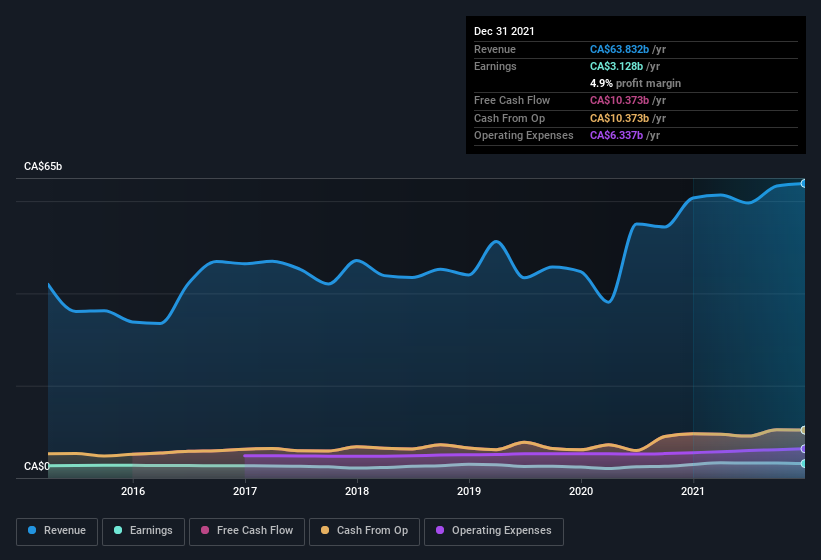

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Great-West Lifeco's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Great-West Lifeco maintained stable EBIT margins over the last year, all while growing revenue 5.2% to CA$64b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Great-West Lifeco's future profits.

Are Great-West Lifeco Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Insider selling of Great-West Lifeco shares was insignificant compared to the one buyer, over the last twelve months. To wit, Jeffrey Macoun outlaid CA$557k for shares, at about CA$29.64 per share. To me, that's probably a sign of conviction.

The good news, alongside the insider buying, for Great-West Lifeco bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have CA$32m worth of shares. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.09% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Great-West Lifeco Deserve A Spot On Your Watchlist?

One important encouraging feature of Great-West Lifeco is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Great-West Lifeco is trading on a high P/E or a low P/E, relative to its industry.

The good news is that Great-West Lifeco is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GWO

Great-West Lifeco

Engages in the life and health insurance, retirement savings, wealth and asset management, and reinsurance businesses in Canada, the United States, and Europe.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives