Great-West Lifeco (TSX:GWO): Assessing Valuation as Shares Climb Over 8% in the Past Month

Reviewed by Simply Wall St

See our latest analysis for Great-West Lifeco.

Great-West Lifeco’s recent rally is part of a much broader positive picture, with its share price up nearly 24% year to date and total shareholder return hitting an impressive 29% over the past year. Momentum has been building steadily, and investors seem increasingly optimistic about the company’s growth outlook and risk profile.

If you’re wondering what other companies could be on the verge of similar momentum shifts, this is a great moment to discover fast growing stocks with high insider ownership

With shares rallying and recent gains stacking up, investors now face the critical question of whether Great-West Lifeco’s current price reflects all that future growth or if there is still room for buyers to benefit.

Most Popular Narrative: 3% Overvalued

With Great-West Lifeco’s fair value narrative just shy of the current share price, market expectations now rest on ambitious growth and structural changes. The valuation gap has narrowed, and conviction hinges on a bold, efficiency-led transformation.

Continued digital transformation initiatives, including the adoption of AI and process automation, are expected to materially enhance operational efficiency, supporting a structurally lower cost base and improving net margins over the medium term.

What numbers drive this optimism? The full narrative hints at profit margins shaped by automation, projected growth, and a premium future earnings multiple, higher than industry averages. Want the inside story behind these bullish assumptions? See what powers this fair value calculation.

Result: Fair Value of $56.5 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition and fee compression in wealth management, as well as execution risks in digital initiatives, could challenge Great-West Lifeco’s upbeat outlook.

Find out about the key risks to this Great-West Lifeco narrative.

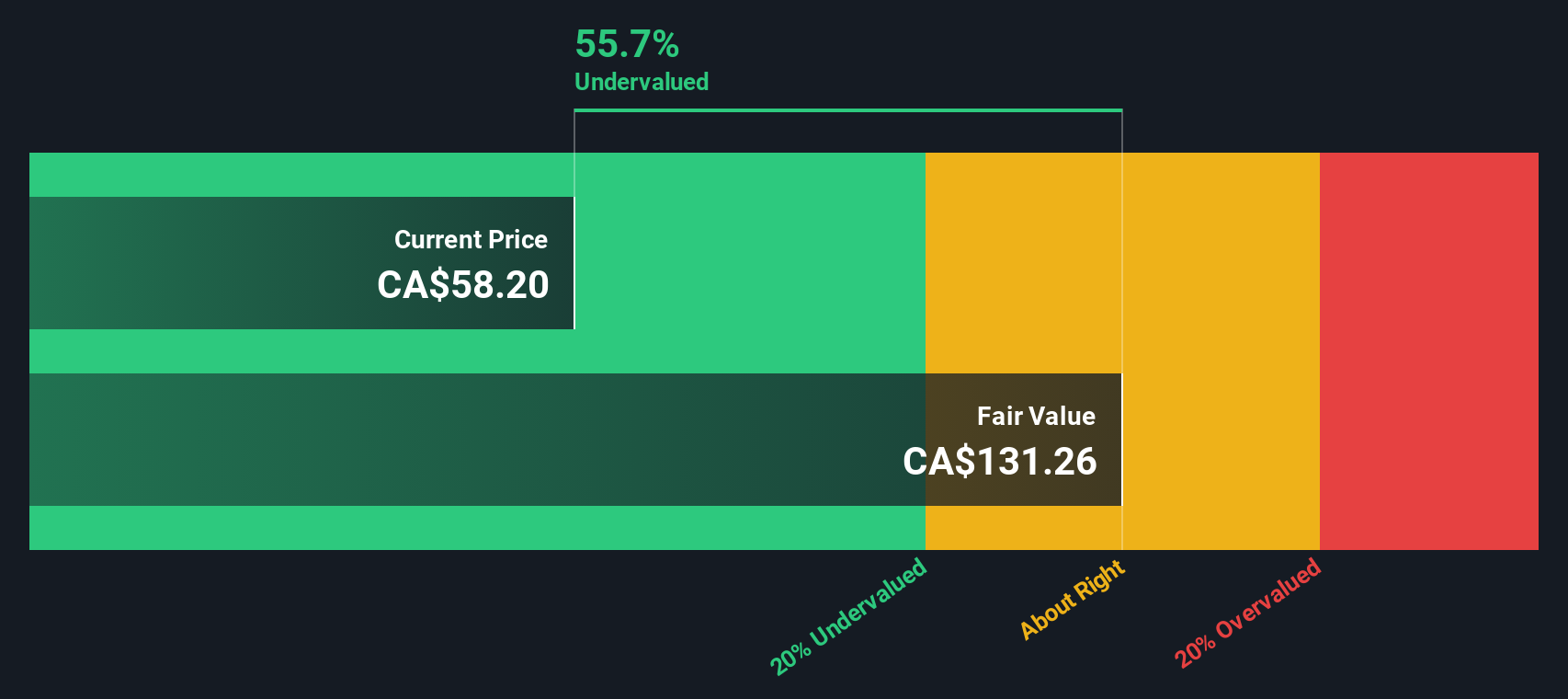

Another View: Discounted Cash Flow Points to Major Undervaluation

While the current fair value narrative leans toward Great-West Lifeco being overvalued, our SWS DCF model tells a strikingly different story. According to this method, shares are trading at a whopping 54.5% discount to fair value. This could represent a significant opportunity if these long-term cash flow estimates prove accurate. Could the consensus be underestimating this upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Great-West Lifeco for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Great-West Lifeco Narrative

If you see the numbers differently or want to construct your own story from the data, you can build a custom narrative in just minutes, Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Great-West Lifeco.

Looking for More Investment Ideas?

Don’t wait on the sidelines while other investors seize opportunities. Take action with these powerful stock ideas and give your portfolio the boost it deserves.

- Capture potential early-stage growth by accessing these 3582 penny stocks with strong financials and spot companies with strong fundamentals before the crowd catches on.

- Unlock cash flow bargains through these 876 undervalued stocks based on cash flows and track down stocks trading below their intrinsic value right now.

- Boost your income stream instantly with these 17 dividend stocks with yields > 3%, featuring shares that offer attractive yields above 3% from financially robust businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GWO

Great-West Lifeco

Engages in the life and health insurance, retirement savings, wealth and asset management, and reinsurance businesses in Canada, the United States, and Europe.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives