Fairfax Financial Holdings (TSX:FFH) Valuation: Gauging Value After $700 Million Debt Financing and Strategic Cash Moves

Reviewed by Simply Wall St

If you are following Fairfax Financial Holdings (TSX:FFH), this week’s completion of a CAD 700 million debt financing could catch your attention. Fairfax just wrapped up two sizable issuances: CAD 400 million of 4.45% Senior Notes due 2035, and CAD 300 million of 5.10% Senior Notes due 2055. Management is keeping its options open for how to deploy the proceeds, mentioning uses like refinancing existing obligations, pursuing acquisitions or investments, or simply strengthening the cash position. This kind of move can signal a strategic pivot or an effort to enhance flexibility, which often gives investors plenty to talk about.

This fresh financing arrives as momentum in Fairfax’s stock has been building, with shares up nearly 53% in the past year and climbing more than 22% year-to-date. While the past month was a touch softer, the past three months still saw over 3% gains. Recent years have brought gains well ahead of broader markets, and Fairfax has a reputation for opportunistic moves and disciplined capital allocation. With revenue up but net income growth lagging a bit, investors are rightly asking what comes next, especially with some cash now waiting on the sidelines.

After this year’s impressive rally and the latest moves to bolster firepower, is Fairfax offering value here, or is the market already anticipating its next big win?

Most Popular Narrative: 7% Undervalued

According to community narrative, Fairfax Financial Holdings is currently considered undervalued, with its fair value estimated to be about 7% higher than its current market price. This perspective assumes that future earnings and margin expectations justify a higher share price than presently reflected in the market.

The market may be overestimating the sustainability of Fairfax's elevated net investment income, as current results are heavily boosted by high interest rates and strong gains on fixed income portfolios. If global rates moderate or decline, this tailwind could reverse, materially lowering net earnings. Recent gross premium growth in emerging markets (such as Central/Eastern Europe, South Africa, and Asia) may create expectations of outsized future revenue and margin expansion. However, ongoing FX headwinds, contract losses, and operational challenges (for example, in Gulf Insurance and Latin America) could constrain growth and compress net margins.

Could Fairfax defy the market’s cautious optimism, or meet the bold growth assumptions fueling this valuation? The secret ingredients are a tricky mix of future earnings, top-line expansion, and margin shifts, all under intense analyst scrutiny. Want to unravel which forward-looking metrics support these projections, and what must go exactly right to reach that price target? Don’t miss the full narrative—it is packed with analyst logic and surprising assumptions that could change how you view Fairfax’s outlook.

Result: Fair Value of $2,613 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, robust investment income or ongoing international premium growth could invalidate the cautious outlook. These factors could give Fairfax the ingredients to outperform expectations.

Find out about the key risks to this Fairfax Financial Holdings narrative.Another View: The SWS DCF Model

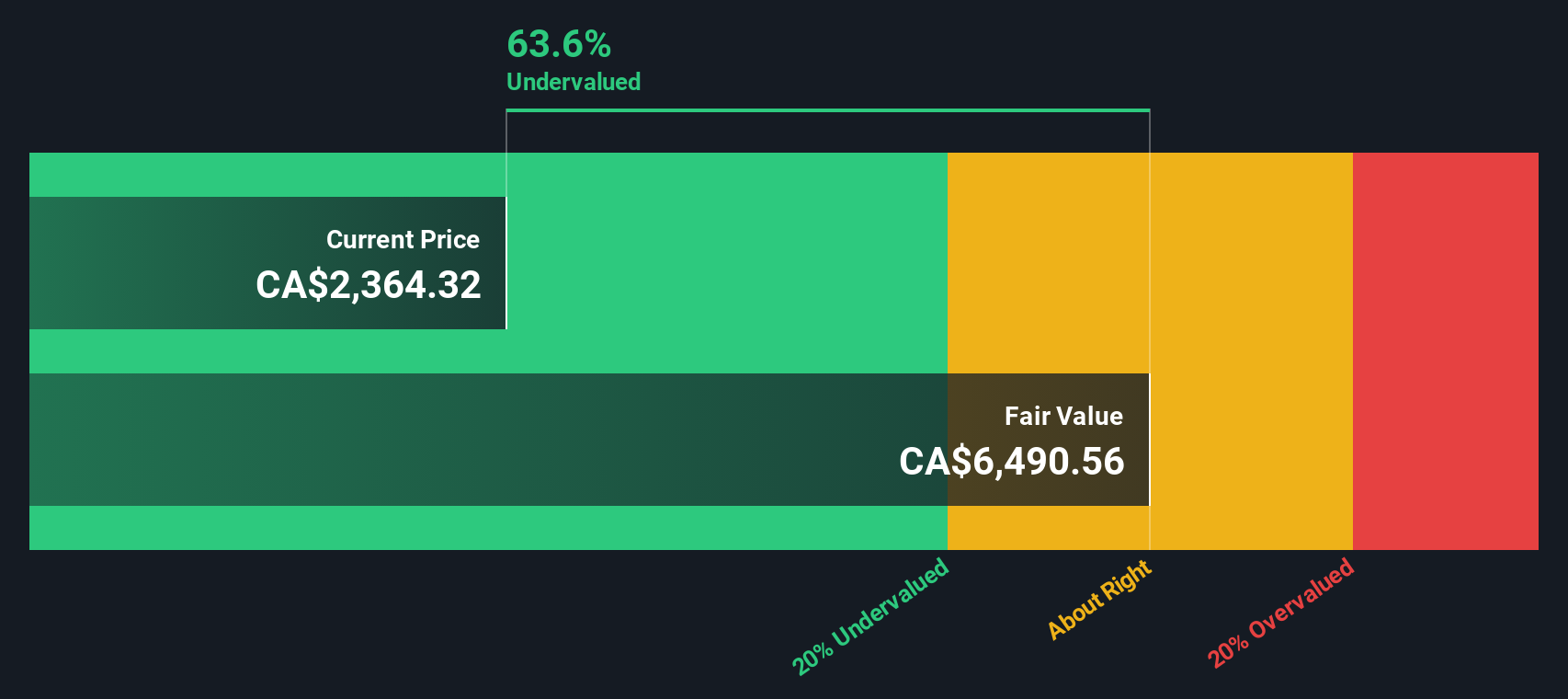

Looking from a different angle, our DCF model suggests Fairfax could be much further below its intrinsic value than the market thinks. This approach considers future cash flows and leads to a much deeper undervaluation. Could this imply the market is missing something significant, or is it simply being too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fairfax Financial Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fairfax Financial Holdings Narrative

If you are curious to dig deeper or want to examine Fairfax from your unique perspective, it is quick and easy to build your own view in just a few minutes. do it your way.

A great starting point for your Fairfax Financial Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why focus on just one opportunity when the market is filled with many hidden gems? Enhance your portfolio’s potential and stay ahead with new investing angles that you might otherwise overlook. Let Simply Wall Street’s Smart Screener guide you directly to the next big thing before others discover it.

- Identify high-yield opportunities and strengthen your income stream when you dividend stocks with yields > 3% that are rewarding investors with yields above 3%.

- Explore the ongoing growth driven by healthcare innovation through our selection of healthcare AI stocks powering advancements in medical technology and artificial intelligence.

- Leverage the potential of blockchain advances by finding rare opportunities among cryptocurrency and blockchain stocks where digital assets and advanced payment systems are transforming the financial industry.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FFH

Fairfax Financial Holdings

Through its subsidiaries, provides property and casualty insurance and reinsurance, and investment management services in the United States, Canada, the Middle East, Asia, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives