Can You Imagine How BioNeutra Global's (CVE:BGA) Shareholders Feel About The 33% Share Price Increase?

The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. To wit, the BioNeutra Global Corporation (CVE:BGA) share price is 33% higher than it was a year ago, much better than the market return of around 0.02% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! Having said that, the longer term returns aren't so impressive, with stock gaining just 7.1% in three years.

Check out our latest analysis for BioNeutra Global

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year BioNeutra Global grew its earnings per share, moving from a loss to a profit. When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

We think that the revenue growth of 24% could have some investors interested. Many businesses do go through a faze where they have to forgo some profits to drive business development, and sometimes its for the best.

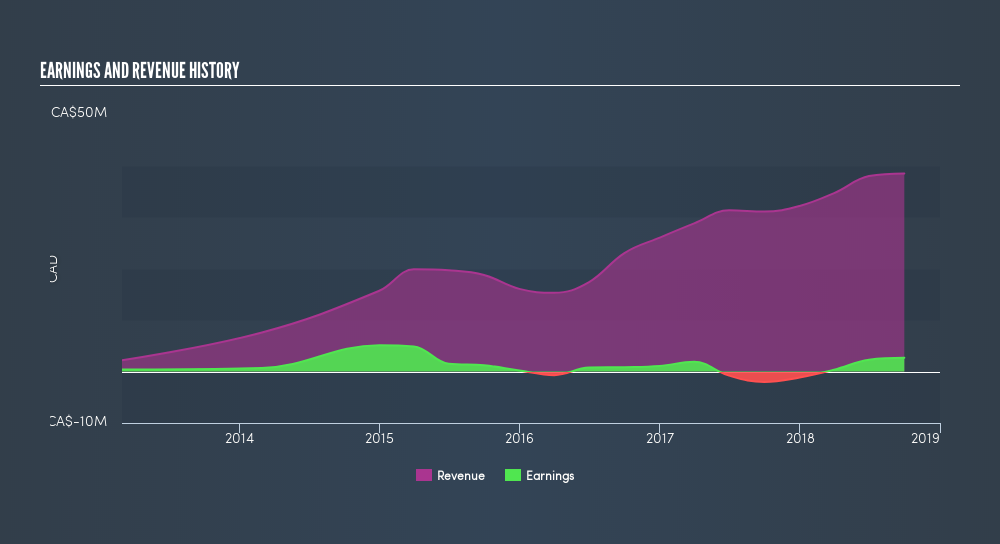

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

A Different Perspective

Pleasingly, BioNeutra Global's total shareholder return last year was 33%. That's better than the annualized TSR of 2.3% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting BioNeutra Global on your watchlist. Is BioNeutra Global cheap compared to other companies? These 3 valuation measures might help you decide.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSXV:BGA

BioNeutra Global

Engages in the research and development, production, and commercialization of food for nutraceutical, functional, and mainstream food and beverage products, with a focus on oligosaccharides.

Slight and slightly overvalued.

Market Insights

Community Narratives