- Canada

- /

- Personal Products

- /

- CNSX:LEEF

Can You Imagine How Icanic Brands' (CSE:ICAN) Shareholders Feel About The 33% Share Price Increase?

Icanic Brands Company Inc. (CSE:ICAN) shareholders might be concerned after seeing the share price drop 20% in the last quarter. But that doesn't change the fact that the returns over the last year have been respectable. After all, the stock has performed better than the market's return of (32%) over the last year, and is up 33%.

Check out our latest analysis for Icanic Brands

Given that Icanic Brands didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Icanic Brands saw its revenue grow by 116%. That's stonking growth even when compared to other loss-making stocks. The solid 33% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. So quite frankly it could be a good time to investigate Icanic Brands in some detail. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

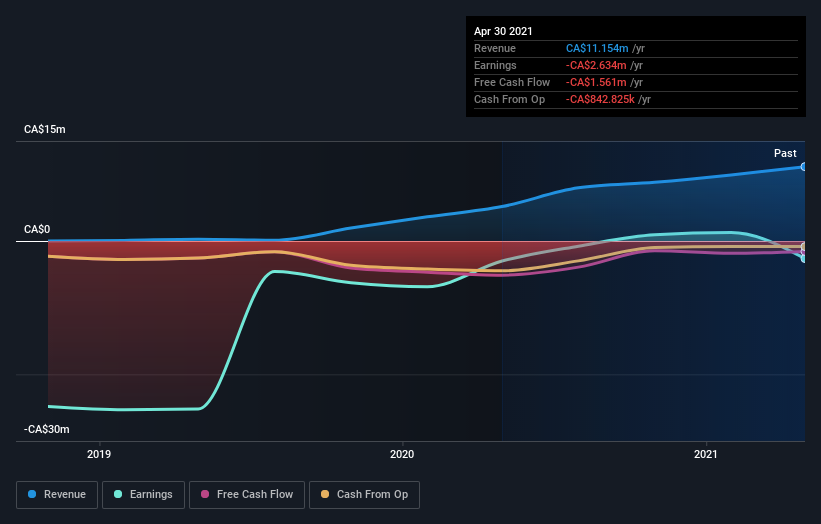

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Icanic Brands' financial health with this free report on its balance sheet.

A Different Perspective

With a TSR of 33% over the last year, Icanic Brands shareholders would be reasonably content, given that's not far from the broader market return of 32%. Unfortunately the share price is down 20% over the last quarter. It may simply be that the share price got ahead of itself, although you might want to check for any weak results. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Icanic Brands is showing 2 warning signs in our investment analysis , you should know about...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:LEEF

Leef Brands

Operates as a cannabis branded products manufacturer in the United States.

Medium-low and slightly overvalued.

Market Insights

Community Narratives