- Canada

- /

- Healthtech

- /

- TSXV:THNK

Why Investors Shouldn't Be Surprised By Think Research Corporation's (CVE:THNK) 26% Share Price Plunge

The Think Research Corporation (CVE:THNK) share price has fared very poorly over the last month, falling by a substantial 26%. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

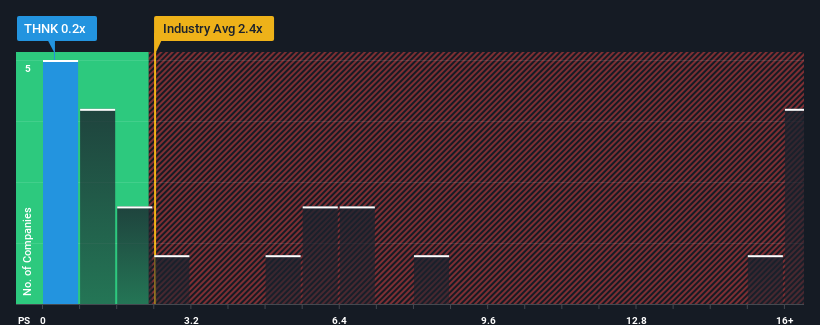

Since its price has dipped substantially, Think Research's price-to-sales (or "P/S") ratio of 0.2x might make it look like a strong buy right now compared to the wider Healthcare Services industry in Canada, where around half of the companies have P/S ratios above 6.4x and even P/S above 12x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Think Research

How Has Think Research Performed Recently?

With revenue growth that's inferior to most other companies of late, Think Research has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Think Research's future stacks up against the industry? In that case, our free report is a great place to start.How Is Think Research's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Think Research's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 14% during the coming year according to the three analysts following the company. With the industry predicted to deliver 44% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Think Research's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Think Research's P/S Mean For Investors?

Think Research's P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Think Research's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 4 warning signs for Think Research that you should be aware of.

If these risks are making you reconsider your opinion on Think Research, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Think Research might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:THNK

Think Research

Think Research Corporation provides knowledge-based digital health software solutions in Canada, the United States, and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives