- Canada

- /

- Healthtech

- /

- TSXV:THNK

Little Excitement Around Think Research Corporation's (CVE:THNK) Revenues As Shares Take 28% Pounding

The Think Research Corporation (CVE:THNK) share price has fared very poorly over the last month, falling by a substantial 28%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 47% in that time.

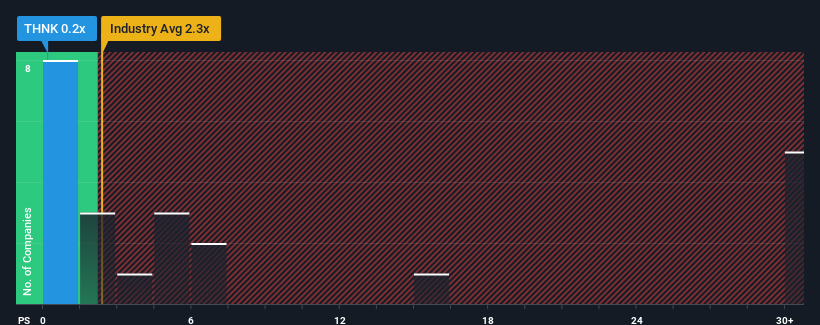

After such a large drop in price, Think Research's price-to-sales (or "P/S") ratio of 0.2x might make it look like a strong buy right now compared to the wider Healthcare Services industry in Canada, where around half of the companies have P/S ratios above 5.4x and even P/S above 23x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Think Research

What Does Think Research's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Think Research has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Think Research will help you uncover what's on the horizon.How Is Think Research's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Think Research's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were fairly tame in comparison. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 6.3% over the next year. Meanwhile, the rest of the industry is forecast to expand by 12%, which is noticeably more attractive.

With this in consideration, its clear as to why Think Research's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Think Research's P/S?

Think Research's P/S looks about as weak as its stock price lately. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Think Research maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Think Research you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Think Research might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:THNK

Think Research

Think Research Corporation provides knowledge-based digital health software solutions in Canada, the United States, and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success