- Canada

- /

- Healthtech

- /

- TSXV:NURS

Hydreight Technologies (TSXV:NURS) Swings to Profit, Challenging Sector Loss Narrative

Reviewed by Simply Wall St

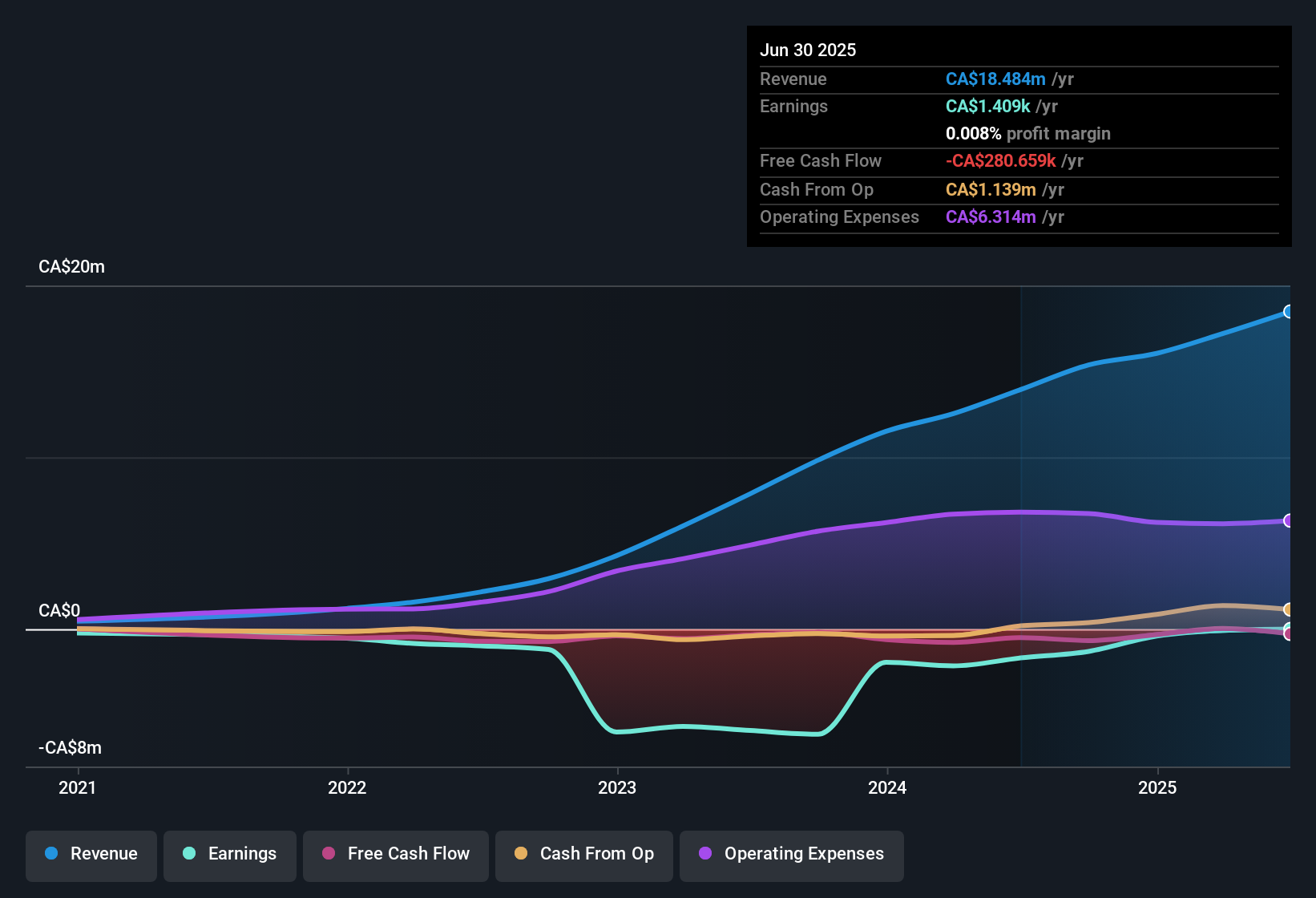

Hydreight Technologies (TSXV:NURS) has just posted its latest Q3 2025 results, reporting revenue of $5.38 million and basic EPS of 0.00111 CAD for the period. The company has seen revenue move from $4.53 million in Q2 2024 to $5.38 million in Q2 2025. Basic EPS improved from -0.002269 CAD to 0.00111 CAD over the same time frame. Margins have turned positive in recent quarters, which may influence the company's outlook.

See our full analysis for Hydreight Technologies.Next, we will put these headline numbers next to the popular narratives to figure out where market views match up and where the latest results may lead to new perspectives.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Move Firmly Positive at 0.05M CAD Net Income

- Net income (excluding extra items) reached 0.05 million CAD in the latest quarter, rising from a low of -0.09 million CAD in the same period last year.

- What stands out is that consensus narrative emphasizes ongoing challenges for fast-growing telehealth firms. However, Hydreight’s rapid net income swing into positive territory breaks the pattern of cumulative quarterly losses and highlights a turnaround that the broader digital healthcare sector rarely achieves this quickly.

- Trailing twelve month profitability now stands at a modest 0.0014 million CAD, compared to the prior year’s net loss of over -2.1 million CAD. This signals the margin reset is not a one-off but an ongoing trend.

- Profit growth is forecast at 96.1% per year, well ahead of the Canadian healthcare average. This suggests bullish market expectations are grounded in unusual execution for this sector.

Sales Multiples Run Hot: 12.5x Price/Sales

- Hydreight trades at a price-to-sales ratio of 12.5x, noticeably higher than the North American healthcare sector average of 3.5x and its immediate peer group at 7.1x.

- The prevailing narrative notes that, despite Hydreight’s shares trading 84.1% below their DCF fair value (30.79 CAD vs current share price of 4.88 CAD), the high sales multiple may become a sticking point for cautious investors who see peer valuations as a limiting factor.

- Bears can cite these relative valuation premiums as a reason to be selective, especially since no immediate risk events have narrowed the gap to industry norms in the past year.

- While valuation risk exists, the DCF discount implies longer-term upside if high forecasted growth rates materialize. The path may be volatile if sector multiples revert.

Share Dilution Adds Complexity for Investors

- Shareholder dilution was recorded over the last twelve months, even as the company transitioned from losses to profitability and rapid revenue expansion.

- According to consensus narrative, investors must weigh the upside of 62.4% projected annual revenue growth against dilution risk. No new risk events have emerged, but the greater share count impacts per-share metrics.

- Critics highlight that dilution can blunt some of the earnings per share benefits of high growth. Net income is up, but so is the share count.

- Still, dilution has not stopped the company from achieving trailing twelve-month profitability, which many sector peers have yet to match.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Hydreight Technologies's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Hydreight's rapid move to profitability, its elevated price-to-sales ratio and dilution risk highlight potential overvaluation compared to sector peers.

If you want stronger upside without the valuation concerns, discover these 932 undervalued stocks based on cash flows that offer more attractive entry points and growth potential now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hydreight Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NURS

Hydreight Technologies

Provides operates in the digital health technology sector in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.