- Canada

- /

- Metals and Mining

- /

- TSXV:CELL

Discover Grid Battery Metals And 2 Other TSX Penny Stocks

Reviewed by Simply Wall St

As we move through the year, Canadian markets are navigating a landscape of mixed signals, where inflation remains a concern but corporate earnings show resilience. Amid these market dynamics, investors often seek opportunities in smaller companies that combine potential growth with solid fundamentals. Penny stocks, though sometimes seen as relics of past market trends, continue to offer intriguing possibilities for those willing to explore beyond the mainstream. In this article, we'll examine three TSX penny stocks that stand out for their financial strength and growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.84 | CA$182.79M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$14.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.71 | CA$438.56M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$1.99 | CA$220.49M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$647.19M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.90 | CA$397.63M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.89 | CA$180.58M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.15 | CA$230.15M | ★★★★☆☆ |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Grid Battery Metals (TSXV:CELL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Grid Battery Metals Inc. is engaged in the acquisition, exploration, and development of brine-based lithium and mineral resource properties in Canada and the United States, with a market cap of CA$3.77 million.

Operations: Grid Battery Metals Inc. currently does not report any revenue segments.

Market Cap: CA$3.77M

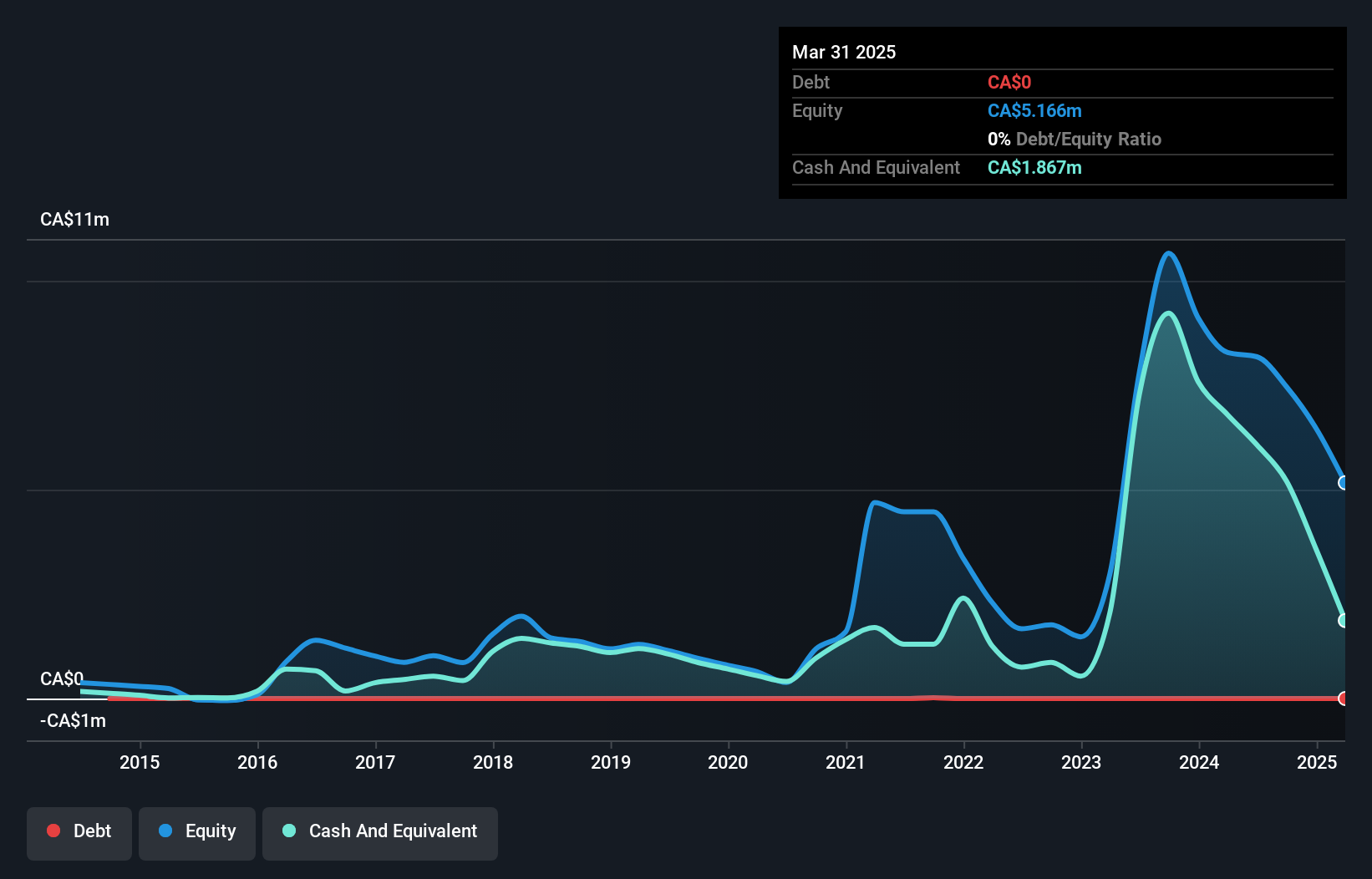

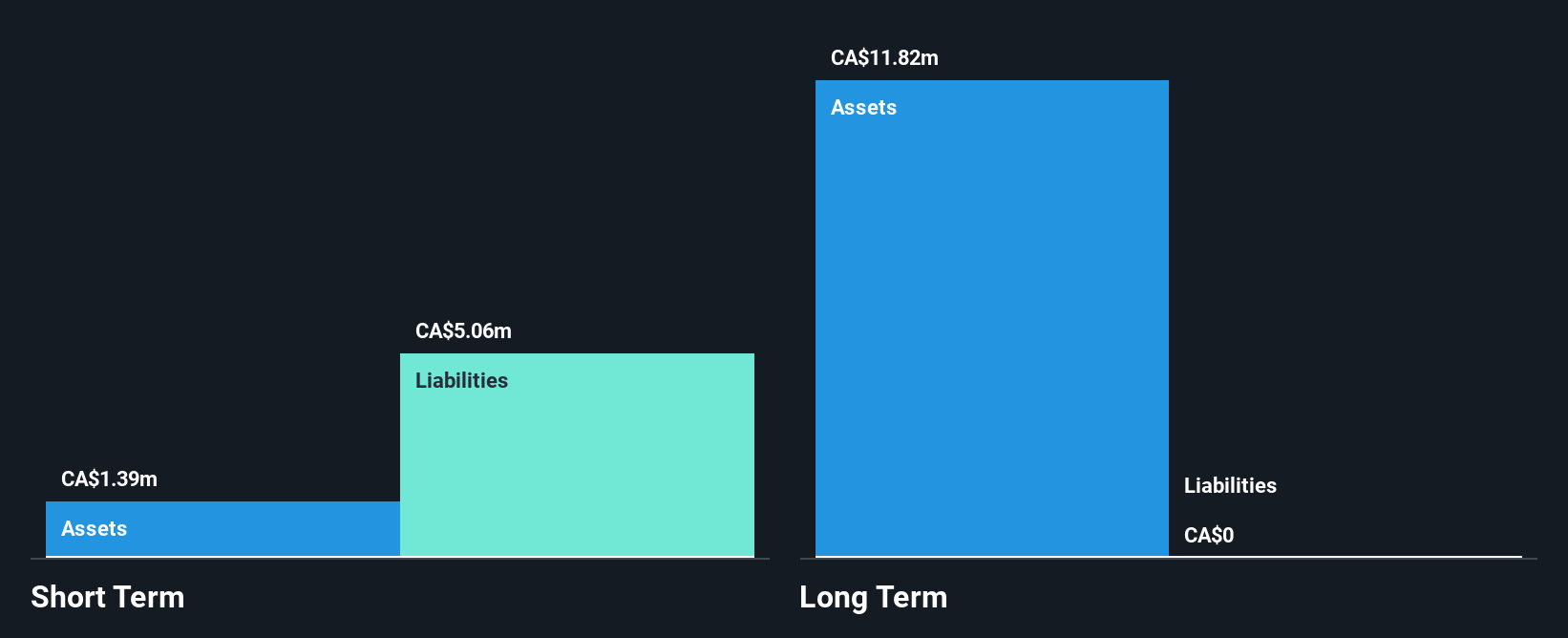

Grid Battery Metals Inc. is pre-revenue with a market cap of CA$3.77 million, focusing on lithium exploration in strategic locations like Clayton Valley, Nevada. The recent drilling program revealed promising lithium concentrations up to 8070 ppm, suggesting potential for economic extraction despite the company's current unprofitability and negative return on equity. Its financial position shows resilience, with short-term assets significantly outweighing liabilities and no debt burden. However, volatility remains high at 33%, reflecting market uncertainty typical of penny stocks. With sufficient cash runway for over a year, Grid Battery Metals is positioned to continue its exploration efforts without immediate financial strain.

- Click here and access our complete financial health analysis report to understand the dynamics of Grid Battery Metals.

- Learn about Grid Battery Metals' historical performance here.

Nova Leap Health (TSXV:NLH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nova Leap Health Corp. and its subsidiaries offer home and home health care services in the United States and Canada, with a market cap of CA$23.57 million.

Operations: The company's revenue is derived from its operations in Canada, contributing $3.78 million, and the United States, generating $21.94 million.

Market Cap: CA$23.57M

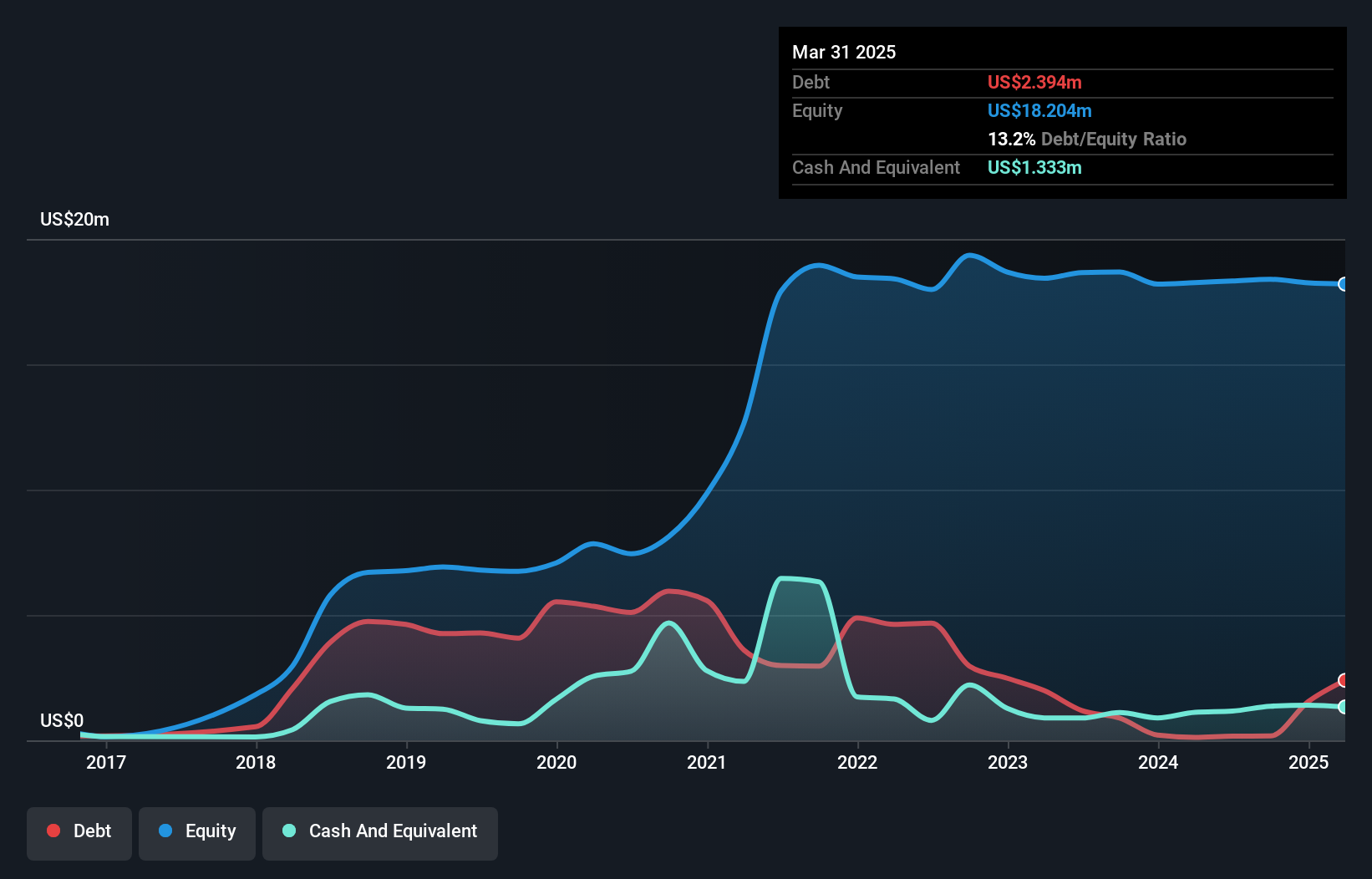

Nova Leap Health Corp., with a market cap of CA$23.57 million, leverages its operations in Canada and the U.S., generating revenues of $3.78 million and $21.94 million respectively. Despite being unprofitable, the company has significantly reduced its debt-to-equity ratio over five years to 0.9% and maintains a stable cash runway exceeding three years due to positive free cash flow growth. Recent amendments to their credit agreement with BMO Bank of Montreal provide an additional $7 million for strategic acquisitions, supporting long-term growth despite challenges like negative return on equity and historical earnings decline.

- Take a closer look at Nova Leap Health's potential here in our financial health report.

- Explore historical data to track Nova Leap Health's performance over time in our past results report.

Wishpond Technologies (TSXV:WISH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wishpond Technologies Ltd. offers marketing-focused online business solutions across the United States, Canada, and internationally, with a market cap of CA$17.37 million.

Operations: The company generates CA$23.00 million in revenue from its Internet Software & Services segment.

Market Cap: CA$17.37M

Wishpond Technologies Ltd., with a market cap of CA$17.37 million, is navigating the penny stock landscape with a focus on innovative AI-driven solutions like its SalesCloser virtual agent. Despite being unprofitable, Wishpond has improved its financial position by reducing losses over five years and maintaining sufficient cash runway for more than three years. The company's recent patent filing for enhanced state manager technology highlights its commitment to advancing conversational AI capabilities, potentially boosting customer interaction efficiency across industries. While short-term liabilities exceed assets, stable weekly volatility and no long-term liabilities indicate some resilience in volatile markets.

- Jump into the full analysis health report here for a deeper understanding of Wishpond Technologies.

- Learn about Wishpond Technologies' future growth trajectory here.

Key Takeaways

- Navigate through the entire inventory of 936 TSX Penny Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CELL

Grid Battery Metals

Engages in the acquisition, exploration, evaluation, and development of mineral resource properties in Canada and the United States.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives