- Canada

- /

- Medical Equipment

- /

- TSXV:MIR

We Take A Look At Whether MedMira Inc.'s (CVE:MIR) CEO May Be Underpaid

The solid performance at MedMira Inc. (CVE:MIR) has been impressive and shareholders will probably be pleased to know that CEO Hermes Chan has delivered. At the upcoming AGM on 04 February 2022, they will get a chance to hear the board review the company results, discuss future strategy and cast their vote on any resolutions such as executive remuneration. Here we will show why we think CEO compensation is appropriate and discuss the case for a pay rise.

Check out our latest analysis for MedMira

How Does Total Compensation For Hermes Chan Compare With Other Companies In The Industry?

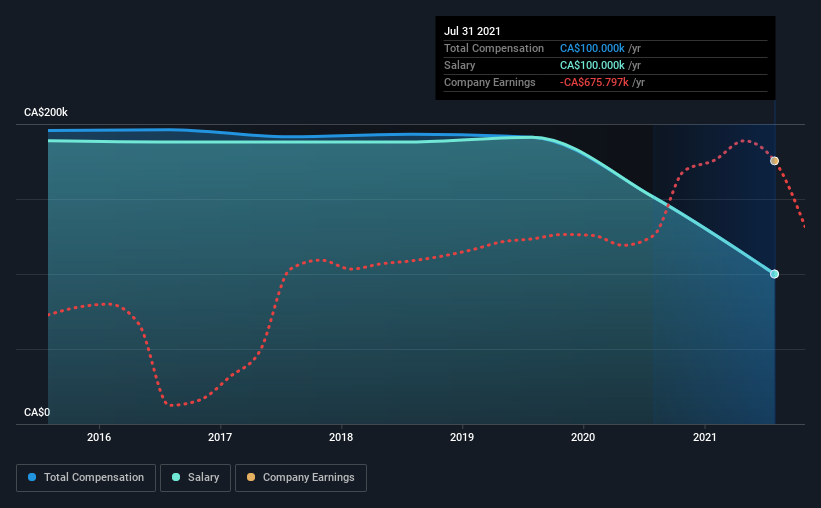

At the time of writing, our data shows that MedMira Inc. has a market capitalization of CA$122m, and reported total annual CEO compensation of CA$100k for the year to July 2021. We note that's a decrease of 34% compared to last year. Notably, the salary of CA$100k is the entirety of the CEO compensation.

For comparison, other companies in the industry with market capitalizations below CA$255m, reported a median total CEO compensation of CA$317k. In other words, MedMira pays its CEO lower than the industry median. Moreover, Hermes Chan also holds CA$509k worth of MedMira stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | CA$100k | CA$151k | 100% |

| Other | - | - | - |

| Total Compensation | CA$100k | CA$151k | 100% |

On an industry level, roughly 77% of total compensation represents salary and 23% is other remuneration. At the company level, MedMira pays Hermes Chan solely through a salary, preferring to go down a conventional route. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

MedMira Inc.'s Growth

MedMira Inc. has seen its earnings per share (EPS) increase by 34% a year over the past three years. It saw its revenue drop 69% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has MedMira Inc. Been A Good Investment?

Boasting a total shareholder return of 1,650% over three years, MedMira Inc. has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

MedMira pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Some shareholders will probably be more lenient on CEO compensation in the upcoming AGM given the pleasing performance of the company recently. In saying that, some shareholders may feel that the more important issues to be addressed may be how the management plans to steer the company towards sustainable profitability in the future.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 5 warning signs for MedMira you should be aware of, and 2 of them make us uncomfortable.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:MIR

MedMira

A biotechnology company, researches, develops, manufactures, and commercializes rapid diagnostics and technology platforms in North America, Europe, and internationally.

Moderate risk with weak fundamentals.

Similar Companies

Market Insights

Community Narratives