David Wolf became the CEO of Hamilton Thorne Ltd. (CVE:HTL) in 2011, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Hamilton Thorne pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Hamilton Thorne

How Does Total Compensation For David Wolf Compare With Other Companies In The Industry?

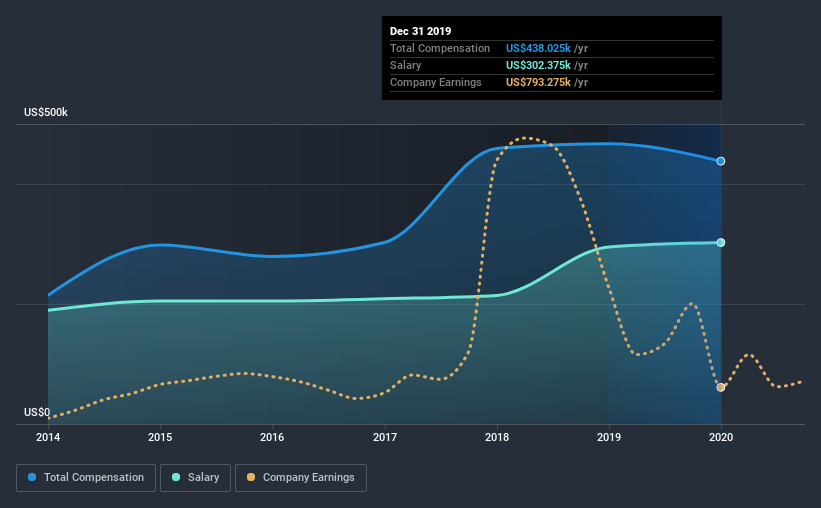

At the time of writing, our data shows that Hamilton Thorne Ltd. has a market capitalization of CA$191m, and reported total annual CEO compensation of US$438k for the year to December 2019. We note that's a small decrease of 6.3% on last year. In particular, the salary of US$302.4k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under CA$257m, the reported median total CEO compensation was US$270k. Accordingly, our analysis reveals that Hamilton Thorne Ltd. pays David Wolf north of the industry median. Furthermore, David Wolf directly owns CA$1.8m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$302k | US$295k | 69% |

| Other | US$136k | US$172k | 31% |

| Total Compensation | US$438k | US$467k | 100% |

On an industry level, around 68% of total compensation represents salary and 32% is other remuneration. There isn't a significant difference between Hamilton Thorne and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Hamilton Thorne Ltd.'s Growth Numbers

Over the last three years, Hamilton Thorne Ltd. has shrunk its earnings per share by 25% per year. Its revenue is up 18% over the last year.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Hamilton Thorne Ltd. Been A Good Investment?

Most shareholders would probably be pleased with Hamilton Thorne Ltd. for providing a total return of 86% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

As we touched on above, Hamilton Thorne Ltd. is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But Hamilton Thorne is growing its revenue, and total shareholder returns have also been pleasing for the last three years. Sadly, EPS growth did not follow suit, remaining during this time. All things considered, although EPS growth would've been nice, the positive investor returns and revenue growth lead us to believe David is appropriately paid.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 2 warning signs for Hamilton Thorne that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Hamilton Thorne or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Thorne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:HTL

Hamilton Thorne

Develops, manufactures, and sells precision instruments, laboratory equipment, consumables, software, and services for the assisted reproductive technologies (ART), research, and cell biology markets.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives