- Canada

- /

- Healthtech

- /

- TSXV:EKG

It's Probably Less Likely That CardioComm Solutions, Inc.'s (CVE:EKG) CEO Will See A Huge Pay Rise This Year

In the past three years, the share price of CardioComm Solutions, Inc. (CVE:EKG) has struggled to generate growth for its shareholders. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 08 December 2021. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

See our latest analysis for CardioComm Solutions

How Does Total Compensation For Etienne Grima Compare With Other Companies In The Industry?

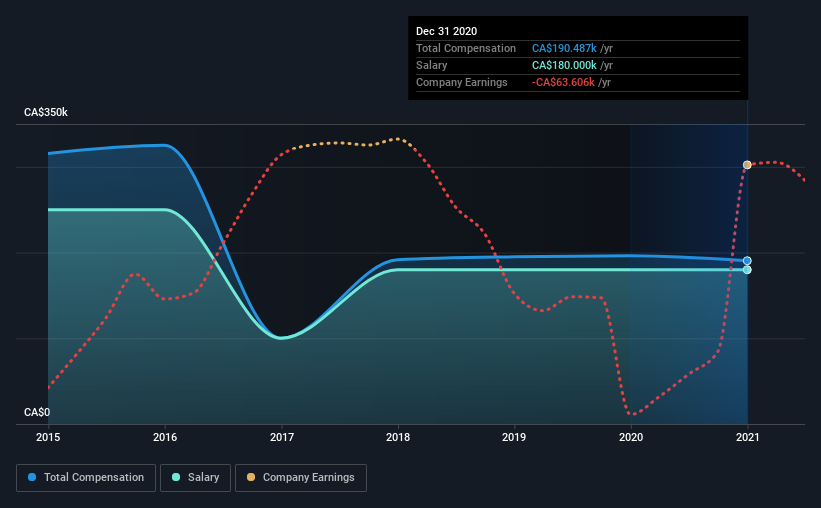

Our data indicates that CardioComm Solutions, Inc. has a market capitalization of CA$5.3m, and total annual CEO compensation was reported as CA$190k for the year to December 2020. That is, the compensation was roughly the same as last year. Notably, the salary which is CA$180.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below CA$256m, we found that the median total CEO compensation was CA$198k. So it looks like CardioComm Solutions compensates Etienne Grima in line with the median for the industry. What's more, Etienne Grima holds CA$325k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$180k | CA$180k | 94% |

| Other | CA$10k | CA$16k | 6% |

| Total Compensation | CA$190k | CA$196k | 100% |

On an industry level, roughly 89% of total compensation represents salary and 11% is other remuneration. Our data reveals that CardioComm Solutions allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

CardioComm Solutions, Inc.'s Growth

CardioComm Solutions, Inc.'s earnings per share (EPS) grew 12% per year over the last three years. It saw its revenue drop 11% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has CardioComm Solutions, Inc. Been A Good Investment?

Given the total shareholder loss of 14% over three years, many shareholders in CardioComm Solutions, Inc. are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 7 warning signs for CardioComm Solutions (5 are concerning!) that you should be aware of before investing here.

Important note: CardioComm Solutions is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:EKG

CardioComm Solutions

Develops advanced software and hardware products, and core laboratory reading services related to electrocardiogram (ECG) and ambulatory arrhythmia monitoring systems for medical and consumer markets worldwide.

Moderate risk with weak fundamentals.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026