- Canada

- /

- Healthcare Services

- /

- TSXV:DOC

CloudMD Software & Services Inc.'s (CVE:DOC) 28% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

CloudMD Software & Services Inc. (CVE:DOC) shares have had a horrible month, losing 28% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 44% share price drop.

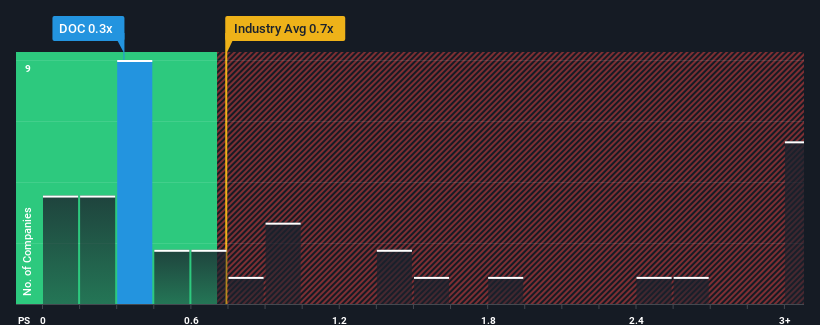

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about CloudMD Software & Services' P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Healthcare industry in Canada is also close to 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for CloudMD Software & Services

What Does CloudMD Software & Services' P/S Mean For Shareholders?

CloudMD Software & Services could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on CloudMD Software & Services will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For CloudMD Software & Services?

The only time you'd be comfortable seeing a P/S like CloudMD Software & Services' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 3.3% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 1.9% as estimated by the three analysts watching the company. That's not great when the rest of the industry is expected to grow by 19%.

With this information, we find it concerning that CloudMD Software & Services is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Bottom Line On CloudMD Software & Services' P/S

Following CloudMD Software & Services' share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

While CloudMD Software & Services' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Plus, you should also learn about these 3 warning signs we've spotted with CloudMD Software & Services.

If these risks are making you reconsider your opinion on CloudMD Software & Services, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:DOC

CloudMD Software & Services

Offers healthcare services in Canada and the United States.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026