- Canada

- /

- Healthcare Services

- /

- TSX:WELL

WELL Health Technologies (TSX:WELL) Sees Revenue Surge With 2025 Guidance Reaching A$1.40 Billion

Reviewed by Simply Wall St

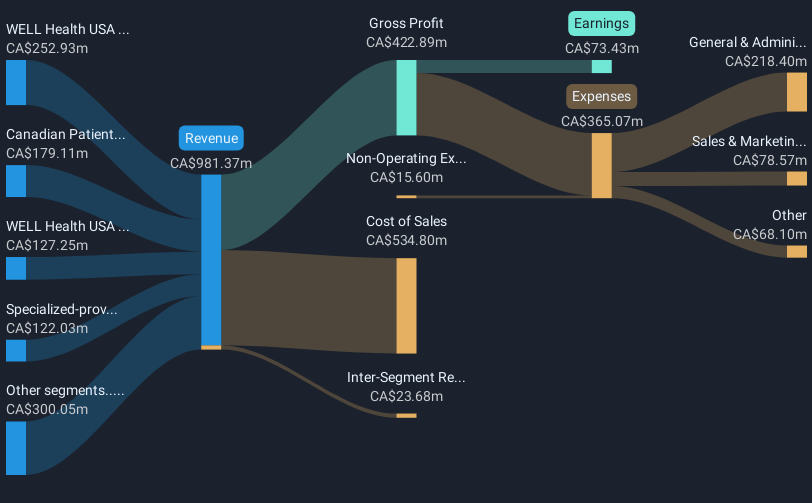

WELL Health Technologies (TSX:WELL) recently provided robust earnings and revenue guidance, projecting revenue between CAD 1.40 billion and CAD 1.45 billion for 2025. Their reported sales of CAD 920 million in 2024, up from CAD 776 million, signifies healthy growth in the healthcare technology sector. This was reflected in a 2% price rise over the past week, which aligns with broader market trends where the market gained 7%. The positive financial outlook and earnings forecast likely complemented the overall market momentum, which has been supported by upward trends in tech stocks amid easing U.S.-China trade tensions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent robust earnings and revenue projections for WELL Health Technologies, forecasting CAD 1.40 billion to CAD 1.45 billion in revenue by 2025, could influence the company's strategic growth narrative, emphasizing consolidation and expansion within the healthcare technology sector. The anticipated revenue growth is likely to benefit from market momentum and easing trade tensions that have bolstered tech stocks. These optimistic forecasts may impact the company's earnings projections, despite analysts expecting a decline in profit margins to 3.1% from 7.7%. The company's emphasis on AI-driven tools and acquisitions could streamline operations, further supporting revenue growth but potentially causing profit margins to decline over time.

Over the past five years, WELL Health Technologies has delivered a total shareholder return of 125.93%, reflecting significant long-term value creation. This return contrasts with the company's one-year performance, where it exceeded both the Canadian Market, up 7.4%, and the healthcare industry, which saw a 20.5% gain. The current share price of CAD 4.00 presents a substantial discount to the analyst consensus price target of CAD 8.39, suggesting a more than 50% potential upside if market conditions align with the analysts' expectations. Investors may need to consider how these projections align with their own analyses, especially given the expected decline in earnings growth over the next three years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WELL Health Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WELL

WELL Health Technologies

Operates as a practitioner-focused digital healthcare company in Canada, the United States, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives