- Canada

- /

- Healthcare Services

- /

- TSX:WELL

WELL Health Technologies (TSX:WELL) Eyes Growth with M&A Pipeline Despite Earnings Challenges

Reviewed by Simply Wall St

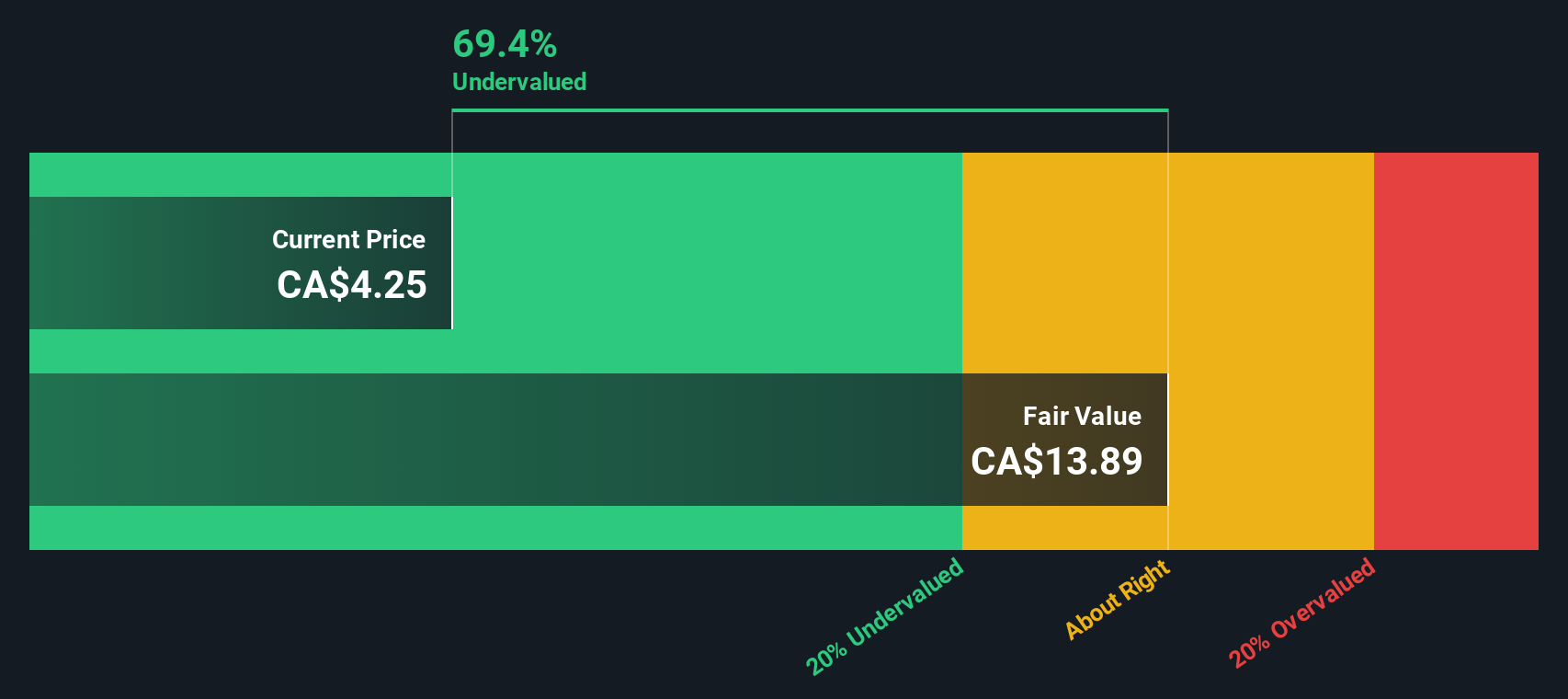

WELL Health Technologies (TSX:WELL) has recently showcased outstanding financial performance, achieving record revenue of $251.7 million in Q3 2024, a 23% increase from the previous year, driven by significant organic growth and a surge in patient visits. Despite these achievements, the company faces challenges such as projected earnings decline and interest coverage concerns, while also exploring growth opportunities through an active M&A pipeline and new service offerings. The company report delves into WELL's core advantages, potential constraints, growth avenues, and external threats impacting its future trajectory.

Dive into the specifics of WELL Health Technologies here with our thorough analysis report.

Core Advantages Driving Sustained Success for WELL Health Technologies

WELL Health Technologies has demonstrated remarkable financial performance, particularly in the third quarter of 2024, which was highlighted by Hamed Shahbazi, Chairman and CEO, as one of the best quarters in the company's history. The company achieved record revenue of $251.7 million, marking a 23% increase from Q3 2023, driven by 23% organic growth. This strong performance was further supported by a 41% increase in patient visits, reaching 1.5 million, as noted by Shahbazi. Additionally, WELL's effective clinic transformation, emphasized by CFO Eva Fong, has been pivotal in scaling operations through enhanced resources and automation. The company's valuation, currently trading at CA$6.32, is significantly below the estimated fair value of CA$29.25, suggesting it may be undervalued in the market. This, combined with a satisfactory net debt to equity ratio of 27.7%, highlights WELL's financial health and potential for appreciation.

Challenges Constraining WELL Health Technologies's Potential

Despite its financial achievements, WELL faces several challenges that could constrain its potential. The company's earnings are projected to decline by an average of 17.4% annually over the next three years, which is a concern given the industry preference for a higher return on equity. Currently, WELL's ROE stands at 10.3%, below the generally preferred threshold of 20%. Furthermore, interest payments on its debt are not adequately covered by EBIT, with a coverage ratio of 1.6x, indicating potential financial strain. The impact of Hurricane Helen, as described by Shahbazi, resulted in a minor revenue loss estimated between $1 million and $1.5 million, underscoring the vulnerability to natural disasters.

Growth Avenues Awaiting WELL Health Technologies

WELL Health is poised to capitalize on several growth opportunities, particularly through its active M&A pipeline. As Shahbazi mentioned, the company has 17 letters of intent and pending deals that could contribute over $100 million in annual revenue, indicating strong potential for market consolidation. The recent launch of a new weight loss GLP-1 program on WELL's Virtual Care platform exemplifies its strategy to expand service offerings, leveraging both virtual and physical clinic presences. Additionally, the planned spin-out of WELL Provider Services is expected to accelerate growth, with Shahbazi expressing confidence in its potential as a strong IPO candidate on the TSX main board by 2025.

External Factors Threatening WELL Health Technologies

Several external factors pose threats to WELL's growth trajectory. Economic and regulatory challenges are anticipated to slightly cool off growth in the fourth quarter, as the company retools workflows to support compliance, according to Shahbazi. The rising interest rate environment has also kept per share metrics relatively flat over the past two years, as noted by Fong, due to higher interest charges. Moreover, competitive pressures within the fragmented Canadian healthcare market present both opportunities and challenges as WELL seeks to expand its market presence. Shahbazi highlighted the company's scale and expertise as key differentiators in navigating this competitive environment.

Conclusion

WELL Health Technologies has shown impressive financial growth, with a significant increase in revenue and patient visits, indicating strong operational performance and effective clinic transformation. Challenges such as projected earnings decline and interest coverage concerns remain. The company's strategic M&A pipeline and service expansion initiatives present substantial growth potential. Trading at CA$6.32, WELL appears significantly below its estimated fair value of CA$29.25, suggesting that the market may not fully recognize its growth prospects and financial health. This discrepancy, coupled with planned strategic initiatives, positions WELL for potential market appreciation and future success.

Key Takeaways

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if WELL Health Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WELL

WELL Health Technologies

Operates as a practitioner-focused digital healthcare company in Canada, the United States, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion