Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Viemed Healthcare, Inc. (TSE:VMD) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Viemed Healthcare

How Much Debt Does Viemed Healthcare Carry?

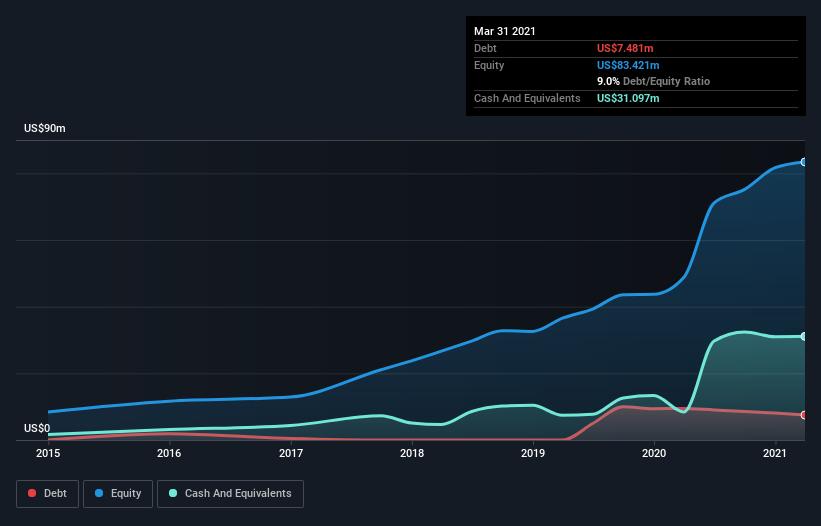

You can click the graphic below for the historical numbers, but it shows that Viemed Healthcare had US$7.48m of debt in March 2021, down from US$9.45m, one year before. But it also has US$31.1m in cash to offset that, meaning it has US$23.6m net cash.

A Look At Viemed Healthcare's Liabilities

According to the last reported balance sheet, Viemed Healthcare had liabilities of US$21.9m due within 12 months, and liabilities of US$7.73m due beyond 12 months. Offsetting this, it had US$31.1m in cash and US$13.3m in receivables that were due within 12 months. So it actually has US$14.8m more liquid assets than total liabilities.

This short term liquidity is a sign that Viemed Healthcare could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Viemed Healthcare has more cash than debt is arguably a good indication that it can manage its debt safely.

In addition to that, we're happy to report that Viemed Healthcare has boosted its EBIT by 84%, thus reducing the spectre of future debt repayments. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Viemed Healthcare can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Viemed Healthcare has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Viemed Healthcare actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

While it is always sensible to investigate a company's debt, in this case Viemed Healthcare has US$23.6m in net cash and a decent-looking balance sheet. And it impressed us with free cash flow of US$29m, being 117% of its EBIT. The bottom line is that we do not find Viemed Healthcare's debt levels at all concerning. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 4 warning signs for Viemed Healthcare (of which 1 makes us a bit uncomfortable!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:VMD

Viemed Healthcare

Through its subsidiaries, provides home medical equipment (HME) and post-acute respiratory healthcare services in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026