- Canada

- /

- Healthtech

- /

- TSX:VHI

Despite shrinking by CA$12m in the past week, Vitalhub (TSE:VHI) shareholders are still up 147% over 5 years

Vitalhub Corp. (TSE:VHI) shareholders have seen the share price descend 12% over the month. But that doesn't change the fact that shareholders have received really good returns over the last five years. We think most investors would be happy with the 147% return, over that period. Generally speaking the long term returns will give you a better idea of business quality than short periods can. Ultimately business performance will determine whether the stock price continues the positive long term trend.

In light of the stock dropping 10% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

Check out our latest analysis for Vitalhub

Because Vitalhub made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, Vitalhub can boast revenue growth at a rate of 49% per year. That's well above most pre-profit companies. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 20% per year, compound, during the period. So it seems likely that buyers have paid attention to the strong revenue growth. Vitalhub seems like a high growth stock - so growth investors might want to add it to their watchlist.

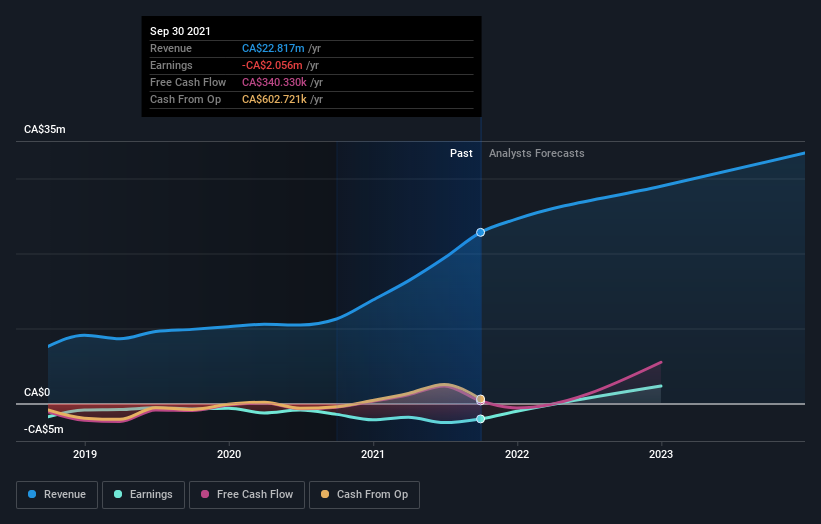

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Vitalhub's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Vitalhub provided a TSR of 3.9% over the last twelve months. But that was short of the market average. On the bright side, the longer term returns (running at about 20% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Vitalhub that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:VHI

Vitalhub

Provides technology and software solutions for health and human service providers in Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives