- Canada

- /

- Medical Equipment

- /

- TSX:PRN

We Think Profound Medical (TSE:PRN) Can Afford To Drive Business Growth

Just because a business does not make any money, does not mean that the stock will go down. Indeed, Profound Medical (TSE:PRN) stock is up 105% in the last year, providing strong gains for shareholders. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So notwithstanding the buoyant share price, we think it's well worth asking whether Profound Medical's cash burn is too risky. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Profound Medical

Does Profound Medical Have A Long Cash Runway?

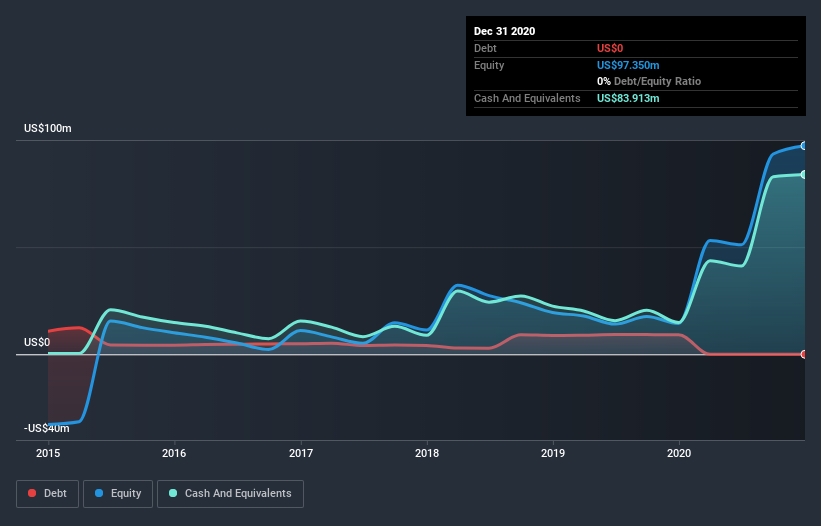

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at December 2020, Profound Medical had cash of US$84m and no debt. Looking at the last year, the company burnt through US$21m. That means it had a cash runway of about 4.0 years as of December 2020. Importantly, though, analysts think that Profound Medical will reach cashflow breakeven before then. If that happens, then the length of its cash runway, today, would become a moot point. You can see how its cash balance has changed over time in the image below.

How Well Is Profound Medical Growing?

Some investors might find it troubling that Profound Medical is actually increasing its cash burn, which is up 37% in the last year. Having said that, it's revenue is up a very solid 75% in the last year, so there's plenty of reason to believe in the growth story. The company needs to keep up that growth, if it is to really please shareholders. It seems to be growing nicely. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Profound Medical To Raise More Cash For Growth?

There's no doubt Profound Medical seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$423m, Profound Medical's US$21m in cash burn equates to about 4.9% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is Profound Medical's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way Profound Medical is burning through its cash. For example, we think its revenue growth suggests that the company is on a good path. Although its increasing cash burn does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. One real positive is that analysts are forecasting that the company will reach breakeven. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. An in-depth examination of risks revealed 2 warning signs for Profound Medical that readers should think about before committing capital to this stock.

Of course Profound Medical may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Profound Medical, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:PRN

Profound Medical

Operates as a commercial-stage medical device company that develops and markets incision-free therapeutic systems for the image guided ablation of diseased tissue in Canada, Germany, the United States, and Finland.

Flawless balance sheet with high growth potential.