- Canada

- /

- Medical Equipment

- /

- TSX:OPS

Opsens Inc. (TSE:OPS) Just Reported And Analysts Have Been Lifting Their Price Targets

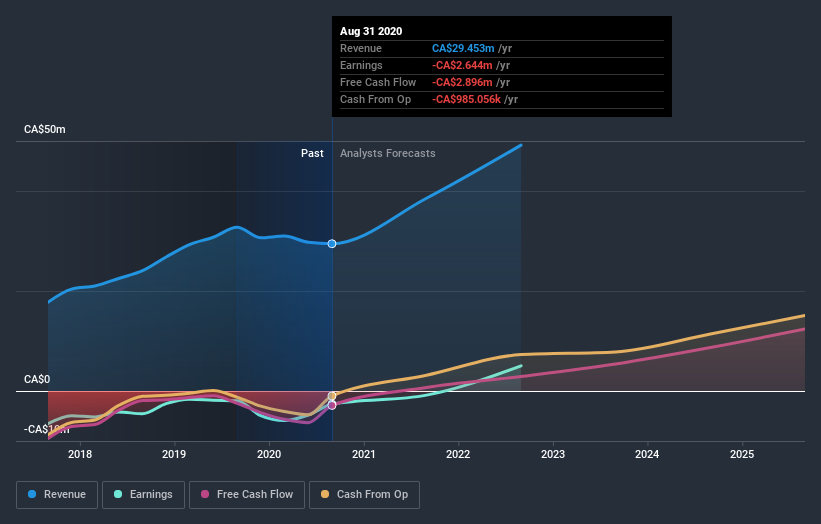

Opsens Inc. (TSE:OPS) shareholders are probably feeling a little disappointed, since its shares fell 7.1% to CA$0.92 in the week after its latest annual results. Revenues of CA$29m arrived in line with expectations, although statutory losses per share were CA$0.03, an impressive 25% smaller than what broker models predicted. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

View our latest analysis for Opsens

After the latest results, the four analysts covering Opsens are now predicting revenues of CA$38.5m in 2021. If met, this would reflect a huge 31% improvement in sales compared to the last 12 months. Opsens is also expected to turn profitable, with statutory earnings of CA$0.005 per share. In the lead-up to this report, the analysts had been modelling revenues of CA$40.0m and earnings per share (EPS) of CA$0.013 in 2021. The analysts seem less optimistic after the recent results, reducing their sales forecasts and making a pretty serious reduction to earnings per share numbers.

The average price target climbed 7.0% to CA$1.90despite the reduced earnings forecasts, suggesting that this earnings impact could be a positive for the stock, once it passes. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Opsens analyst has a price target of CA$3.00 per share, while the most pessimistic values it at CA$1.50. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. Next year brings more of the same, according to the analysts, with revenue forecast to grow 31%, in line with its 30% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 46% per year. So it's pretty clear that Opsens is expected to grow slower than similar companies in the same industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Unfortunately, they also downgraded their revenue estimates, and our data indicates revenues are expected to perform worse than the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Opsens going out to 2022, and you can see them free on our platform here..

However, before you get too enthused, we've discovered 2 warning signs for Opsens that you should be aware of.

If you’re looking to trade Opsens, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:OPS

Opsens

Opsens Inc. develops, manufactures, installs, and sells fiber optic sensors for cardiovascular interventions.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026