- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3491

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, global markets are grappling with geopolitical tensions and concerns over consumer spending, which have led to a decline in major U.S. stock indices despite initial gains earlier in the week. Amid these uncertainties, investors are closely monitoring high-growth tech stocks as potential opportunities, given their capacity for innovation and resilience in challenging economic climates.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Yggdrazil Group | 52.42% | 134.19% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

SM Entertainment (KOSDAQ:A041510)

Simply Wall St Growth Rating: ★★★★☆☆

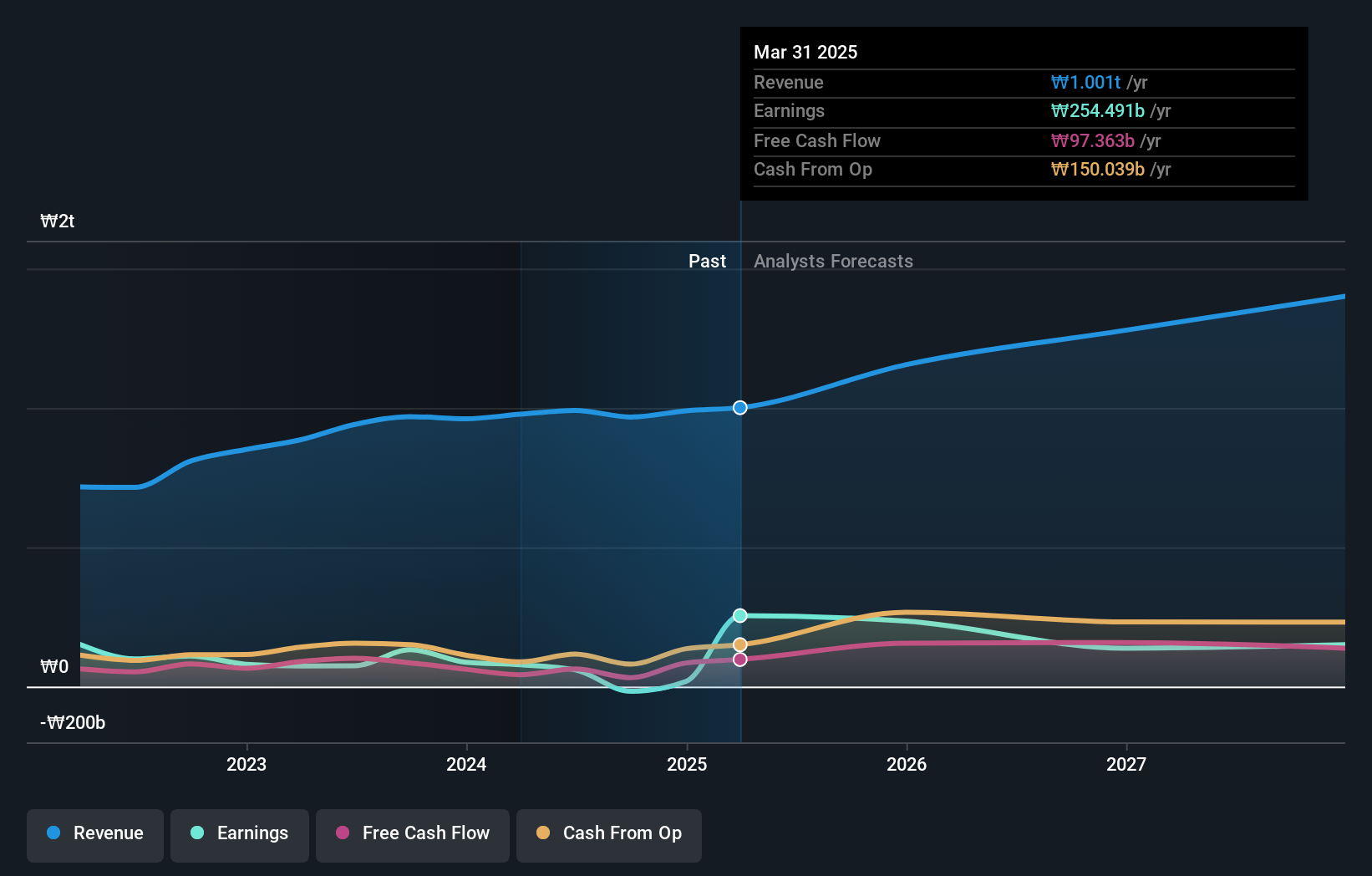

Overview: SM Entertainment Co., Ltd. is a South Korean company involved in music production, talent management, and content publication with a market cap of ₩2.34 trillion.

Operations: SM Entertainment generates revenue primarily through its entertainment segment, excluding advertising agency activities, which contributes ₩871.42 billion. The company also earns from its advertising agency operations, adding ₩80.94 billion to its revenue streams.

SM Entertainment, poised for a transformative leap, is expected to see its revenue grow by 11.1% annually, outpacing the South Korean market's growth of 9.3%. This entertainment juggernaut is navigating towards profitability with an impressive projected earnings surge of 75.6% per year over the next three years. Despite current unprofitability, strategic R&D investments are shaping future capabilities, reflecting in their recent Q4 2024 earnings call optimism. With a low forecasted return on equity at 13.7%, the company's financial maneuvers and market positioning suggest robust potential in leveraging cultural trends and digital expansion.

- Delve into the full analysis health report here for a deeper understanding of SM Entertainment.

Examine SM Entertainment's past performance report to understand how it has performed in the past.

Universal Microwave Technology (TPEX:3491)

Simply Wall St Growth Rating: ★★★★★★

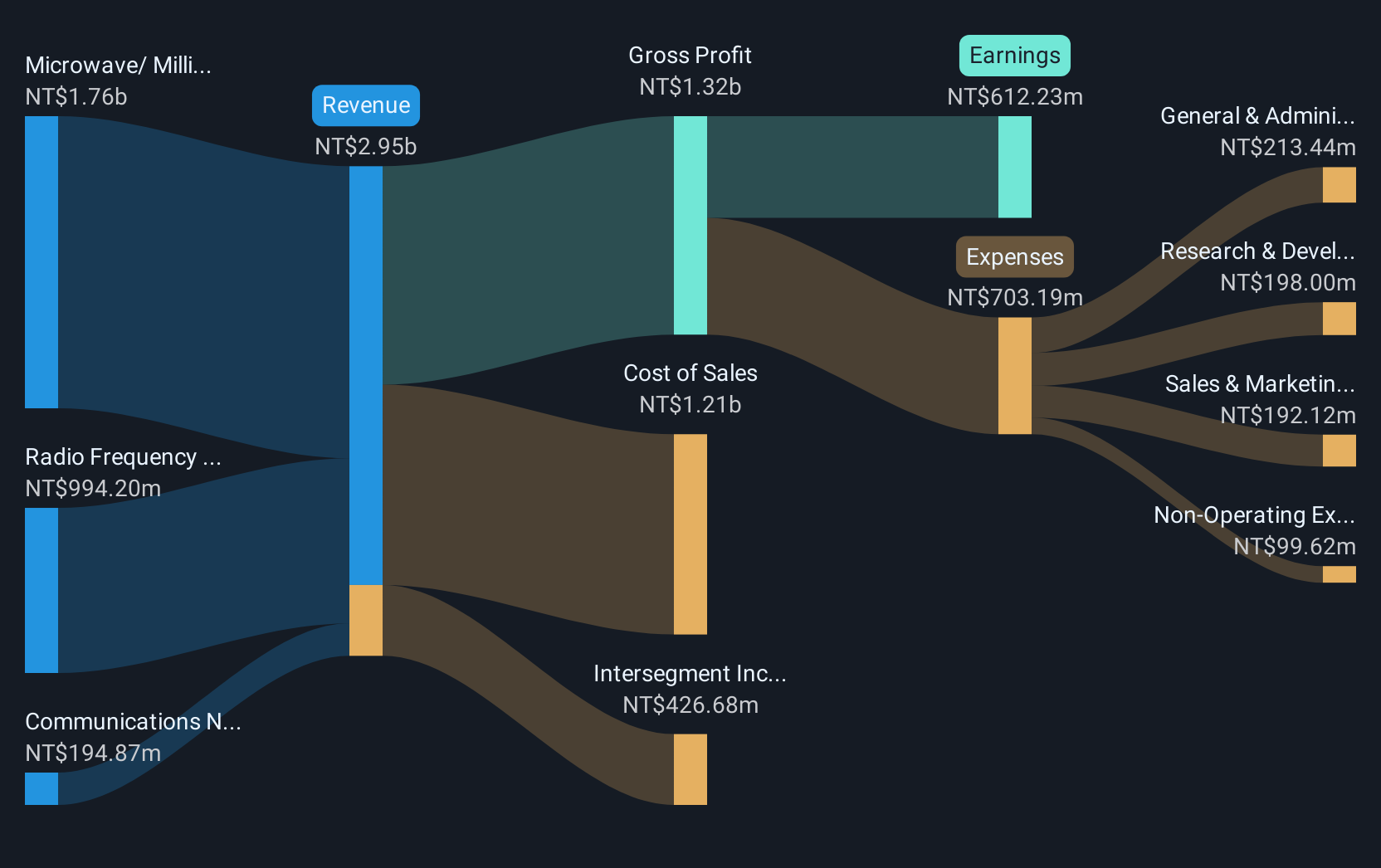

Overview: Universal Microwave Technology, Inc. operates in the microwave and millimeter wave wireless communication industry across various regions including Taiwan, China, Asia, Europe, the United States, and Oceania with a market capitalization of NT$27.77 billion.

Operations: The company generates revenue primarily from its Microwave/Millimeter Wave Products and Radio Frequency Products, contributing NT$1.26 billion and NT$1.06 billion respectively. Additionally, it offers Communications Network Engineering Services, which add NT$214.58 million to its revenue stream.

Universal Microwave Technology, with a striking annual revenue growth of 34.6%, significantly outpaces the broader TW market's 11.8% expansion. This robust increase is complemented by an impressive forecast of earnings growth at 46% annually, dwarfing the industry average of 17.5%. Investing heavily in R&D, the firm allocated funds strategically to fuel innovations, evident from its recent special call event on December 2, 2024. These financial maneuvers not only underscore its aggressive growth strategy but also highlight its potential to reshape industry standards through technological advancements.

- Navigate through the intricacies of Universal Microwave Technology with our comprehensive health report here.

Learn about Universal Microwave Technology's historical performance.

kneat.com (TSX:KSI)

Simply Wall St Growth Rating: ★★★★★☆

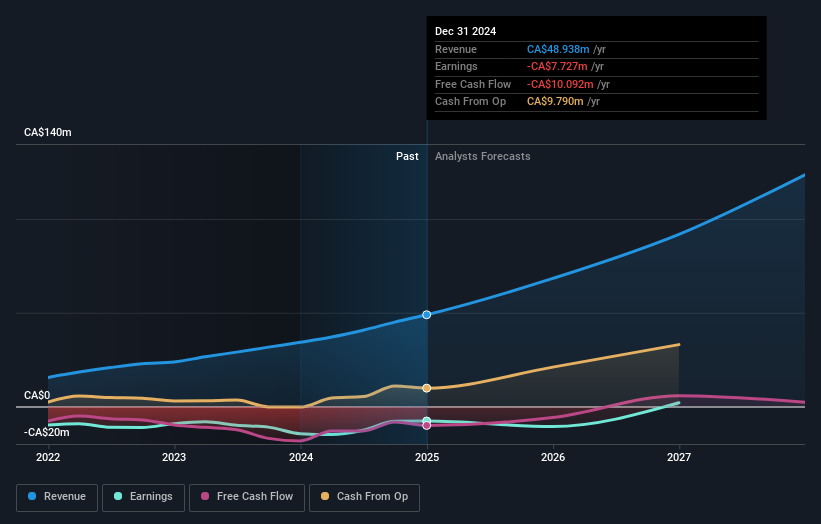

Overview: Kneat.com, Inc., along with its subsidiaries, specializes in designing, developing, and supplying software for data and document management in regulated environments across North America, Europe, and the Asia Pacific, with a market cap of CA$615.45 million.

Operations: The company generates revenue through the provision of software solutions tailored for data and document management in regulated industries across multiple regions, including North America, Europe, and the Asia Pacific. Its business model focuses on delivering specialized software that meets regulatory compliance needs.

Kneat.com, inc., with its robust annualized revenue growth of 24.4%, is outpacing the Canadian market's average by a significant margin. The company's earnings are also set to soar, with an anticipated growth rate of 58.8% per year, showcasing its potential in the high-tech sector. Recently, Kneat secured multiple three-year Master Services Agreements to digitize validation processes for major global companies in health sciences and food and drink production. These partnerships not only expand Kneat’s client base but also reinforce its role in streamlining complex compliance procedures through innovative software solutions, marking it as a formidable player in tech-driven operational enhancements.

- Click to explore a detailed breakdown of our findings in kneat.com's health report.

Gain insights into kneat.com's historical performance by reviewing our past performance report.

Summing It All Up

- Click here to access our complete index of 803 Global High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3491

Universal Microwave Technology

Operates in microwave/mmwave wireless communication industry in Taiwan, China, Asia, Europe, the United States, and Oceania.

Outstanding track record with high growth potential.

Market Insights

Community Narratives