HLS Therapeutics Inc. (TSE:HLS) will pay a dividend of US$0.05 on the 15th of September. The dividend yield is 1.1% based on this payment, which is a little bit low compared to the other companies in the industry.

See our latest analysis for HLS Therapeutics

HLS Therapeutics' Distributions May Be Difficult To Sustain

Even a low dividend yield can be attractive if it is sustained for years on end. Even though HLS Therapeutics is not generating a profit, it is still paying a dividend. It is also not generating any free cash flow, we definitely have concerns when it comes to the sustainability of the dividend.

Over the next year, EPS is forecast to expand by 72.9%. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. Unless this happens fairly soon, the dividend could start to come under pressure.

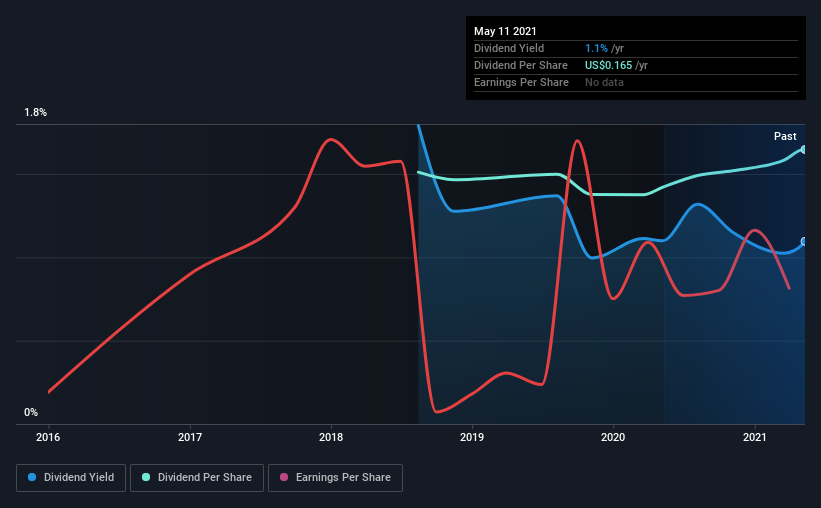

HLS Therapeutics Doesn't Have A Long Payment History

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. Since 2018, the first annual payment was US$0.15, compared to the most recent full-year payment of US$0.16. This means that it has been growing its distributions at 2.9% per annum over that time. HLS Therapeutics hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

Dividend Growth May Be Hard To Come By

Investors could be attracted to the stock based on the quality of its payment history. However, things aren't all that rosy. In the last five years, HLS Therapeutics' earnings per share has shrunk at approximately 6.2% per annum. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

We're Not Big Fans Of HLS Therapeutics' Dividend

Overall, while some might be pleased that the dividend wasn't cut, we think this may help HLS Therapeutics make more consistent payments in the future. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. Overall, this doesn't get us very excited from an income standpoint.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 2 warning signs for HLS Therapeutics that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HLS Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:HLS

HLS Therapeutics

A specialty pharmaceutical company, acquires and commercializes pharmaceutical products for the treatment of psychiatric disorders, central nervous system, and cardiovascular disease in Canada, the United States, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026