- Canada

- /

- Healthcare Services

- /

- TSX:DR

Should You Worry About Medical Facilities Corporation's (TSE:DR) CEO Pay?

In 2017, Rob Horrar was appointed CEO of Medical Facilities Corporation (TSE:DR). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for Medical Facilities

How Does Rob Horrar's Compensation Compare With Similar Sized Companies?

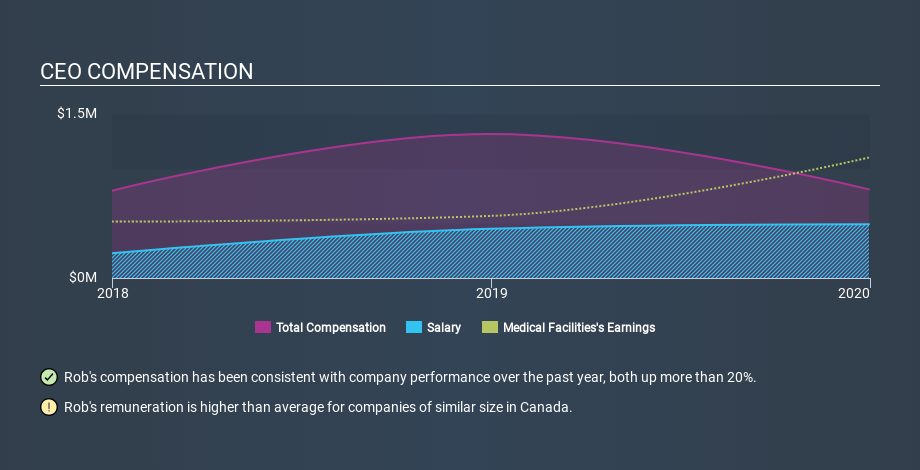

At the time of writing, our data says that Medical Facilities Corporation has a market cap of CA$137m, and reported total annual CEO compensation of US$810k for the year to December 2019. That's less than last year. We think total compensation is more important but we note that the CEO salary is lower, at US$492k. We examined a group of similar sized companies, with market capitalizations of below US$200m. The median CEO total compensation in that group is US$155k.

Next, let's break down remuneration compositions to understand how the industry and company compare with each other. Speaking on an industry level, we can see that nearly 56% of total compensation represents salary, while the remainder of 44% is other remuneration. Medical Facilities is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation

Thus we can conclude that Rob Horrar receives more in total compensation than the median of a group of companies in the same market, and of similar size to Medical Facilities Corporation. However, this doesn't necessarily mean the pay is too high. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous. The graphic below shows how CEO compensation at Medical Facilities has changed from year to year.

Is Medical Facilities Corporation Growing?

Over the last three years Medical Facilities Corporation has shrunk its earnings per share by an average of 13% per year (measured with a line of best fit). In the last year, its revenue is up 1.9%.

Few shareholders would be pleased to read that earnings per share are lower over three years. And the modest revenue growth over 12 months isn't much comfort against the reduced earnings per share. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Shareholders might be interested in this free visualization of analyst forecasts.

Has Medical Facilities Corporation Been A Good Investment?

Since shareholders would have lost about 67% over three years, some Medical Facilities Corporation shareholders would surely be feeling negative emotions. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

We compared the total CEO remuneration paid by Medical Facilities Corporation, and compared it to remuneration at a group of similar sized companies. We found that it pays well over the median amount paid in the benchmark group.

Neither earnings per share nor revenue have been growing sufficiently to impress us, over the last three years. Over the same period, investors would have come away with nothing in the way of share price gains. This analysis suggests to us that the CEO is paid too generously! CEO compensation is an important area to keep your eyes on, but we've also identified 6 warning signs for Medical Facilities (1 is potentially serious!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:DR

Medical Facilities

Through its subsidiaries, owns and operates specialty surgical hospitals and ambulatory surgery center in the United States.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026