- Canada

- /

- Healthcare Services

- /

- TSX:DNTL

dentalcorp Holdings Ltd.'s (TSE:DNTL) 27% Price Boost Is Out Of Tune With Revenues

dentalcorp Holdings Ltd. (TSE:DNTL) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

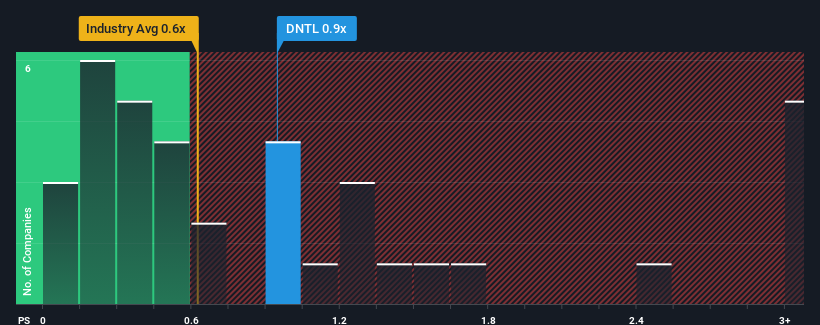

Although its price has surged higher, there still wouldn't be many who think dentalcorp Holdings' price-to-sales (or "P/S") ratio of 0.9x is worth a mention when the median P/S in Canada's Healthcare industry is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for dentalcorp Holdings

How Has dentalcorp Holdings Performed Recently?

With revenue growth that's inferior to most other companies of late, dentalcorp Holdings has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on dentalcorp Holdings.What Are Revenue Growth Metrics Telling Us About The P/S?

dentalcorp Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 109% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 4.0% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 7.7% per year, which is noticeably more attractive.

In light of this, it's curious that dentalcorp Holdings' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From dentalcorp Holdings' P/S?

dentalcorp Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of dentalcorp Holdings' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You should always think about risks. Case in point, we've spotted 2 warning signs for dentalcorp Holdings you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:DNTL

dentalcorp Holdings

Through its subsidiaries, provides health care services by acquiring and partnering with dental practices in Canada.

Good value with reasonable growth potential.

Market Insights

Community Narratives