- Canada

- /

- Healthcare Services

- /

- TSX:CSH.UN

Chartwell Retirement Residences' (TSE:CSH.UN) Price In Tune With Revenues

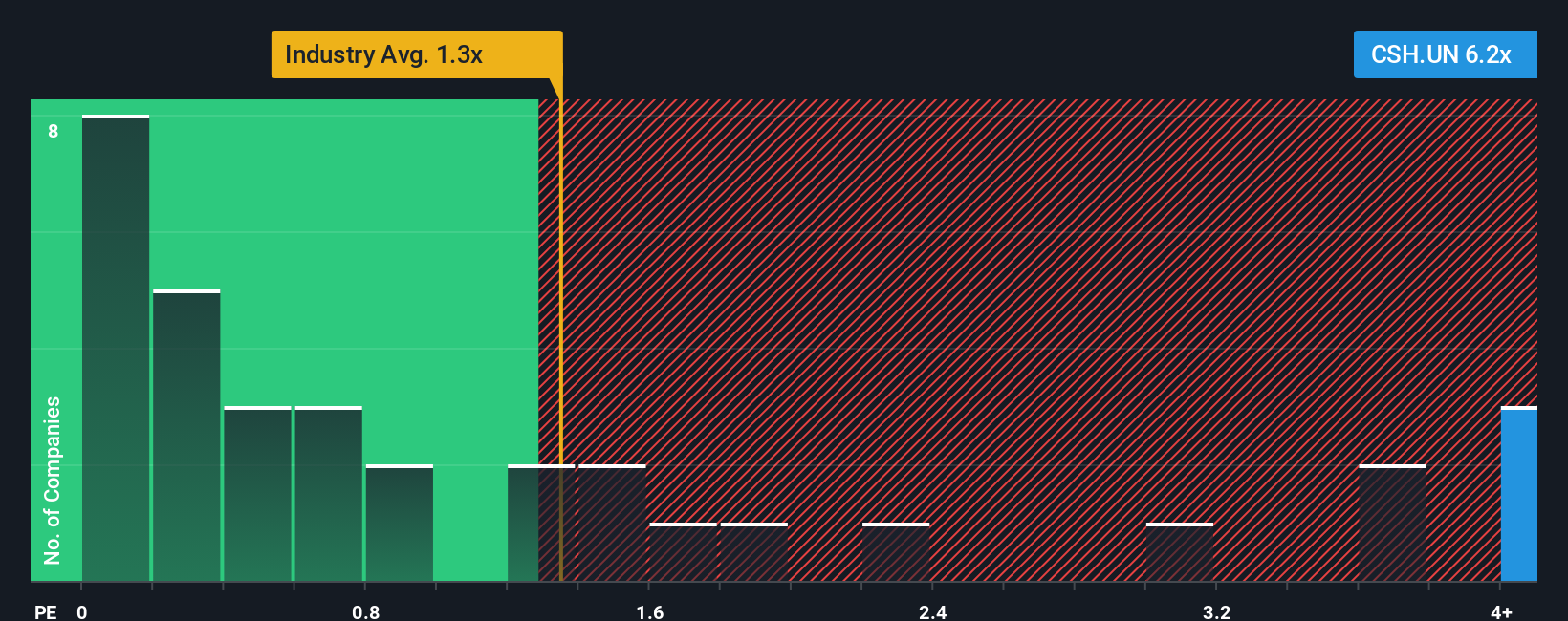

When close to half the companies in the Healthcare industry in Canada have price-to-sales ratios (or "P/S") below 1.3x, you may consider Chartwell Retirement Residences (TSE:CSH.UN) as a stock to avoid entirely with its 6.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Chartwell Retirement Residences

What Does Chartwell Retirement Residences' P/S Mean For Shareholders?

Chartwell Retirement Residences could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Chartwell Retirement Residences' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Chartwell Retirement Residences' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 26%. The strong recent performance means it was also able to grow revenue by 45% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 22% over the next year. With the industry only predicted to deliver 18%, the company is positioned for a stronger revenue result.

With this information, we can see why Chartwell Retirement Residences is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Chartwell Retirement Residences' P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Chartwell Retirement Residences maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Healthcare industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It is also worth noting that we have found 3 warning signs for Chartwell Retirement Residences (1 is significant!) that you need to take into consideration.

If you're unsure about the strength of Chartwell Retirement Residences' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CSH.UN

Chartwell Retirement Residences

Chartwell is in the business of serving and caring for Canada's seniors, committed to its vision of Making People's Lives BETTER and to providing a happier, healthier, and more fulfilling life experience for its residents.

Reasonable growth potential with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success