- Canada

- /

- Healthcare Services

- /

- TSX:CSH.UN

Chartwell Retirement Residences (TSE:CSH.UN) Is Due To Pay A Dividend Of CA$0.051

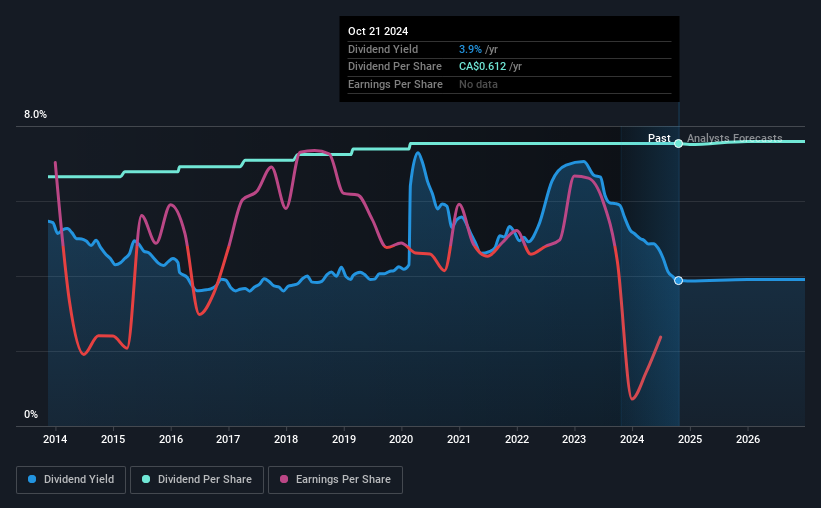

Chartwell Retirement Residences (TSE:CSH.UN) will pay a dividend of CA$0.051 on the 15th of November. This payment means that the dividend yield will be 3.9%, which is around the industry average.

View our latest analysis for Chartwell Retirement Residences

Chartwell Retirement Residences Might Find It Hard To Continue The Dividend

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Chartwell Retirement Residences is not generating a profit, and despite this is paying out most of its free cash flow as a dividend. Paying a dividend while unprofitable is generally considered an aggressive policy, and with limited funds retained for reinvestment, growth may be slow.

Over the next year, EPS is forecast to expand by 89.9%. This is the right direction to be moving, but it is not enough to achieve profitability. Unless this happens fairly soon, the dividend could start to come under pressure.

Chartwell Retirement Residences Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The annual payment during the last 10 years was CA$0.54 in 2014, and the most recent fiscal year payment was CA$0.612. This means that it has been growing its distributions at 1.3% per annum over that time. Dividends have grown relatively slowly, which is not great, but some investors may value the relative consistency of the dividend.

The Dividend Has Limited Growth Potential

Investors could be attracted to the stock based on the quality of its payment history. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the past five years, it looks as though Chartwell Retirement Residences' EPS has declined at around 40% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

We should note that Chartwell Retirement Residences has issued stock equal to 13% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Chartwell Retirement Residences' Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. Although they have been consistent in the past, we think the payments are a little high to be sustained. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 4 warning signs for Chartwell Retirement Residences you should be aware of, and 2 of them are concerning. Is Chartwell Retirement Residences not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CSH.UN

Chartwell Retirement Residences

Chartwell is in the business of serving and caring for Canada's seniors, committed to its vision of Making People's Lives BETTER and to providing a happier, healthier, and more fulfilling life experience for its residents.

Reasonable growth potential with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success