We're Not Very Worried About Nextleaf Solutions's (CSE:OILS) Cash Burn Rate

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given this risk, we thought we'd take a look at whether Nextleaf Solutions (CSE:OILS) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Nextleaf Solutions

When Might Nextleaf Solutions Run Out Of Money?

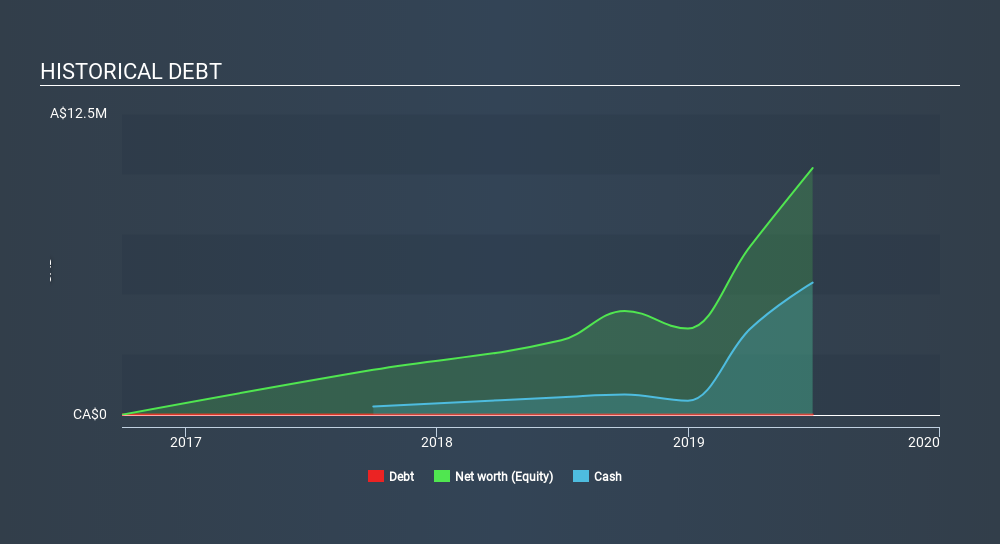

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at June 2019, Nextleaf Solutions had cash of CA$5.5m and no debt. Looking at the last year, the company burnt through CA$5.0m. So it had a cash runway of approximately 13 months from June 2019. Notably, one analyst forecasts that Nextleaf Solutions will break even (at a free cash flow level) in about 17 months. So there's a very good chance it won't need more cash, when you consider the burn rate will be reducing in that period. You can see how its cash balance has changed over time in the image below.

How Is Nextleaf Solutions's Cash Burn Changing Over Time?

In our view, Nextleaf Solutions doesn't yet produce significant amounts of operating revenue, since it reported just CA$182k in the last twelve months. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. During the last twelve months, its cash burn actually ramped up 51%. Oftentimes, increased cash burn simply means a company is accelerating its business development, but one should always be mindful that this causes the cash runway to shrink. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Nextleaf Solutions To Raise More Cash For Growth?

Given its cash burn trajectory, Nextleaf Solutions shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash to fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Nextleaf Solutions has a market capitalisation of CA$37m and burnt through CA$5.0m last year, which is 13% of the company's market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

So, Should We Worry About Nextleaf Solutions's Cash Burn?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Nextleaf Solutions's cash burn relative to its market cap was relatively promising. There's no doubt that shareholders can take a lot of heart from the fact that at least one analyst is forecasting it will reach breakeven before too long. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Notably, our data indicates that Nextleaf Solutions insiders have been trading the shares. You can discover if they are buyers or sellers by clicking on this link.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About CNSX:OILS

Nextleaf Solutions

A cannabis extraction technology company, engages in the manufacture and distribution of cannabinoid vapes, oils, and softgels in Canada.

Flawless balance sheet with questionable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion