- Canada

- /

- Healthtech

- /

- CNSX:HBFG

The Bull Case For Happy Belly Food Group (CNSX:HBFG) Could Change Following Heal Wellness's Eaton Centre Debut

Reviewed by Sasha Jovanovic

- Happy Belly Food Group recently announced that Heal Wellness has signed a franchise agreement and secured a prime location at Toronto's Eaton Centre, one of Canada’s busiest retail destinations.

- This move marks Heal Wellness’s first presence in a high-traffic, flagship venue and supports rapid expansion, with over 168 new locations in development and 626 franchise commitments across Happy Belly’s portfolio.

- We'll explore how entering the Eaton Centre reflects on Happy Belly Food Group's broader national expansion plans for its brands.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Happy Belly Food Group's Investment Narrative?

Being a shareholder in Happy Belly Food Group means buying into the vision of a fast-growing food franchise platform aiming for scale across Canada, with Heal Wellness’s Eaton Centre debut marking a high-profile milestone in its expansion story. The new location could provide a valuable credibility boost and exposure in a marquee setting, adding momentum to short term catalysts like new store openings and ongoing franchise signings that have already driven exceptional share price gains. However, the flip side is that the company is still unprofitable with a steep price-to-sales ratio compared to peers, and it relies on rapid expansion to justify its valuation. Risks include execution on its aggressive location rollout, newer management tenure, and whether rising brand visibility translates into consistent profitability. The recent news may sharpen focus on near-term growth but does not eliminate these uncertainties for investors.

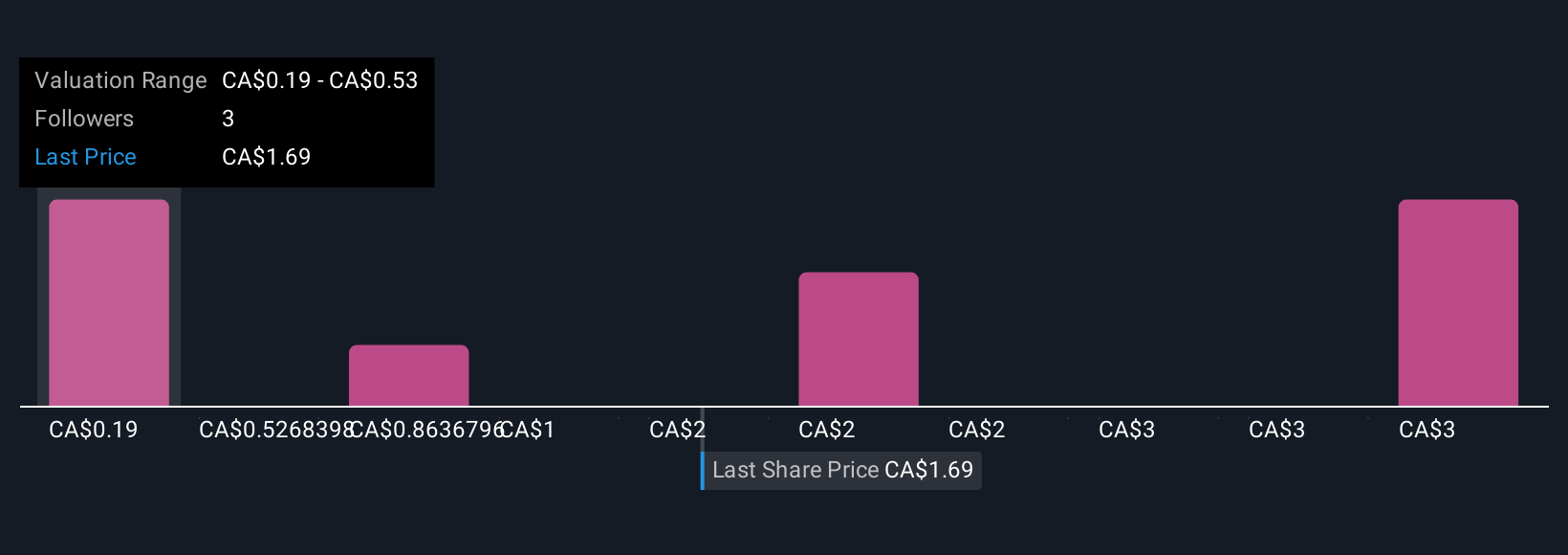

But, amid all the growth, a key risk about profitability remains important for investors to understand. Our comprehensive valuation report raises the possibility that Happy Belly Food Group is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 6 other fair value estimates on Happy Belly Food Group - why the stock might be worth over 2x more than the current price!

Build Your Own Happy Belly Food Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Happy Belly Food Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Happy Belly Food Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Happy Belly Food Group's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Happy Belly Food Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:HBFG

Happy Belly Food Group

Operates as a multi-branded restaurant company that engages in acquiring and scaling emerging food brands across Canada.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives