We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Inter-Rock Minerals Inc.'s (CVE:IRO) CEO For Now

Performance at Inter-Rock Minerals Inc. (CVE:IRO) has been reasonably good and CEO Michael Crombie has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 02 June 2021. However, some shareholders will still be cautious of paying the CEO excessively.

Check out our latest analysis for Inter-Rock Minerals

How Does Total Compensation For Michael Crombie Compare With Other Companies In The Industry?

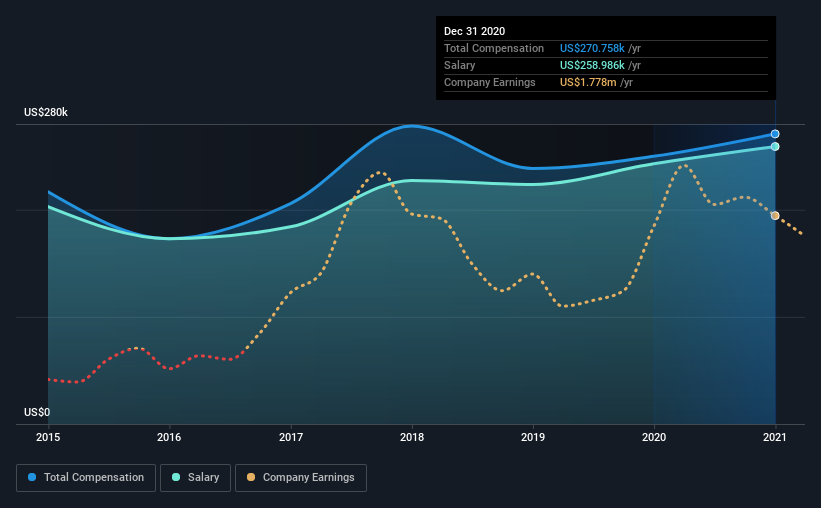

At the time of writing, our data shows that Inter-Rock Minerals Inc. has a market capitalization of CA$9.6m, and reported total annual CEO compensation of US$271k for the year to December 2020. That's a notable increase of 8.4% on last year. In particular, the salary of US$259.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below CA$242m, we found that the median total CEO compensation was US$180k. Accordingly, our analysis reveals that Inter-Rock Minerals Inc. pays Michael Crombie north of the industry median. Furthermore, Michael Crombie directly owns CA$316k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$259k | US$243k | 96% |

| Other | US$12k | US$7.0k | 4% |

| Total Compensation | US$271k | US$250k | 100% |

On an industry level, around 51% of total compensation represents salary and 49% is other remuneration. Investors will find it interesting that Inter-Rock Minerals pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Inter-Rock Minerals Inc.'s Growth

Over the last three years, Inter-Rock Minerals Inc. has shrunk its earnings per share by 4.3% per year. Its revenue is up 20% over the last year.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Inter-Rock Minerals Inc. Been A Good Investment?

Inter-Rock Minerals Inc. has generated a total shareholder return of 15% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

Michael receives almost all of their compensation through a salary. Although the company has performed relatively well, we still think there are some areas that could be improved. EPS growth is still weak, and until that picks up, shareholders may find it hard to approve a pay rise for the CEO, since they are already paid above the average in their industry.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 4 warning signs for Inter-Rock Minerals you should be aware of, and 1 of them is a bit unpleasant.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:IRO

Inter-Rock Minerals

Through its subsidiaries, produces and distributes specialty feed ingredients in the United States and Canada.

Flawless balance sheet and good value.

Market Insights

Community Narratives