Inter-Rock Minerals (CVE:IRO) Shareholders Will Want The ROCE Trajectory To Continue

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So on that note, Inter-Rock Minerals (CVE:IRO) looks quite promising in regards to its trends of return on capital.

Return On Capital Employed (ROCE): What is it?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Inter-Rock Minerals, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = US$1.7m ÷ (US$22m - US$8.1m) (Based on the trailing twelve months to March 2021).

Therefore, Inter-Rock Minerals has an ROCE of 12%. On its own, that's a standard return, however it's much better than the 8.8% generated by the Food industry.

Check out our latest analysis for Inter-Rock Minerals

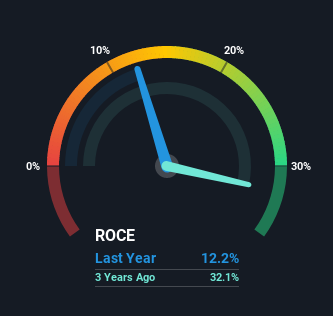

Historical performance is a great place to start when researching a stock so above you can see the gauge for Inter-Rock Minerals' ROCE against it's prior returns. If you'd like to look at how Inter-Rock Minerals has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What Does the ROCE Trend For Inter-Rock Minerals Tell Us?

Investors would be pleased with what's happening at Inter-Rock Minerals. The data shows that returns on capital have increased substantially over the last five years to 12%. The amount of capital employed has increased too, by 41%. So we're very much inspired by what we're seeing at Inter-Rock Minerals thanks to its ability to profitably reinvest capital.

The Key Takeaway

In summary, it's great to see that Inter-Rock Minerals can compound returns by consistently reinvesting capital at increasing rates of return, because these are some of the key ingredients of those highly sought after multi-baggers. Investors may not be impressed by the favorable underlying trends yet because over the last three years the stock has only returned 11% to shareholders. So exploring more about this stock could uncover a good opportunity, if the valuation and other metrics stack up.

One more thing: We've identified 4 warning signs with Inter-Rock Minerals (at least 1 which makes us a bit uncomfortable) , and understanding these would certainly be useful.

While Inter-Rock Minerals may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:IRO

Inter-Rock Minerals

Through its subsidiaries, produces and distributes specialty feed ingredients in the United States and Canada.

Flawless balance sheet and good value.

Market Insights

Community Narratives