Even With A 27% Surge, Cautious Investors Are Not Rewarding Green Rise Foods Inc.'s (CVE:GRF) Performance Completely

Green Rise Foods Inc. (CVE:GRF) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 27% in the last year.

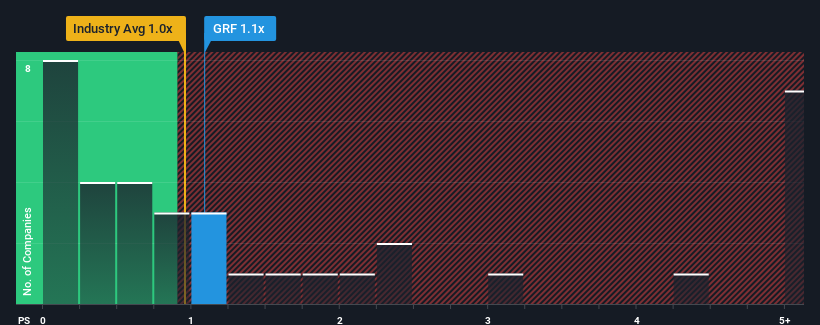

Although its price has surged higher, you could still be forgiven for feeling indifferent about Green Rise Foods' P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Food industry in Canada is also close to 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Green Rise Foods

How Has Green Rise Foods Performed Recently?

Revenue has risen firmly for Green Rise Foods recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on Green Rise Foods will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Green Rise Foods, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Green Rise Foods' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Green Rise Foods' to be considered reasonable.

Retrospectively, the last year delivered a decent 9.4% gain to the company's revenues. Pleasingly, revenue has also lifted 67% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

When compared to the industry's one-year growth forecast of 5.8%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Green Rise Foods' P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Green Rise Foods' P/S?

Green Rise Foods' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Green Rise Foods currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Having said that, be aware Green Rise Foods is showing 2 warning signs in our investment analysis, and 1 of those can't be ignored.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:GRF

Green Rise Foods

Green Rise Foods Inc. grows and sells greenhouse grown fresh produce in North America.

Good value slight.

Market Insights

Community Narratives