The Bull Case For Saputo (TSX:SAP) Could Change Following Surge in Insider Share Purchases – Learn Why

Reviewed by Sasha Jovanovic

- Over the past year, multiple insiders at Saputo Inc. have significantly increased their holdings, acquiring 2.38 million shares while only selling a small amount.

- This trend of net insider buying, coupled with considerable insider ownership, highlights growing confidence from within the company and suggests that insiders may view the current share price as undervalued.

- Given this increased insider confidence, we'll examine how this recent insider activity could shift Saputo's investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Saputo Investment Narrative Recap

To be a Saputo shareholder is to believe in the company's ability to capture long-term gains from branded and convenience dairy products while managing ongoing input cost and supply challenges. The recent surge in insider buying strengthens the case for internal confidence but does not immediately offset the short-term risk posed by rising consumer trends toward plant-based alternatives, which could threaten dairy demand. Amidst these insider purchases, the most relevant company announcement is Saputo’s accelerated share buyback program, which saw nearly 12 million shares repurchased in recent quarters. This aligns with efforts to support share value, yet the fundamental catalysts for near-term growth and the risks around sector shifts remain central. However, while insider alignment appears strong, investors should pay close attention to challenges such as...

Read the full narrative on Saputo (it's free!)

Saputo's narrative projects CA$20.7 billion revenue and CA$853.8 million earnings by 2028. This requires 2.7% yearly revenue growth and an earnings increase of CA$1,006.8 million from the current CA$-153.0 million.

Uncover how Saputo's forecasts yield a CA$34.36 fair value, in line with its current price.

Exploring Other Perspectives

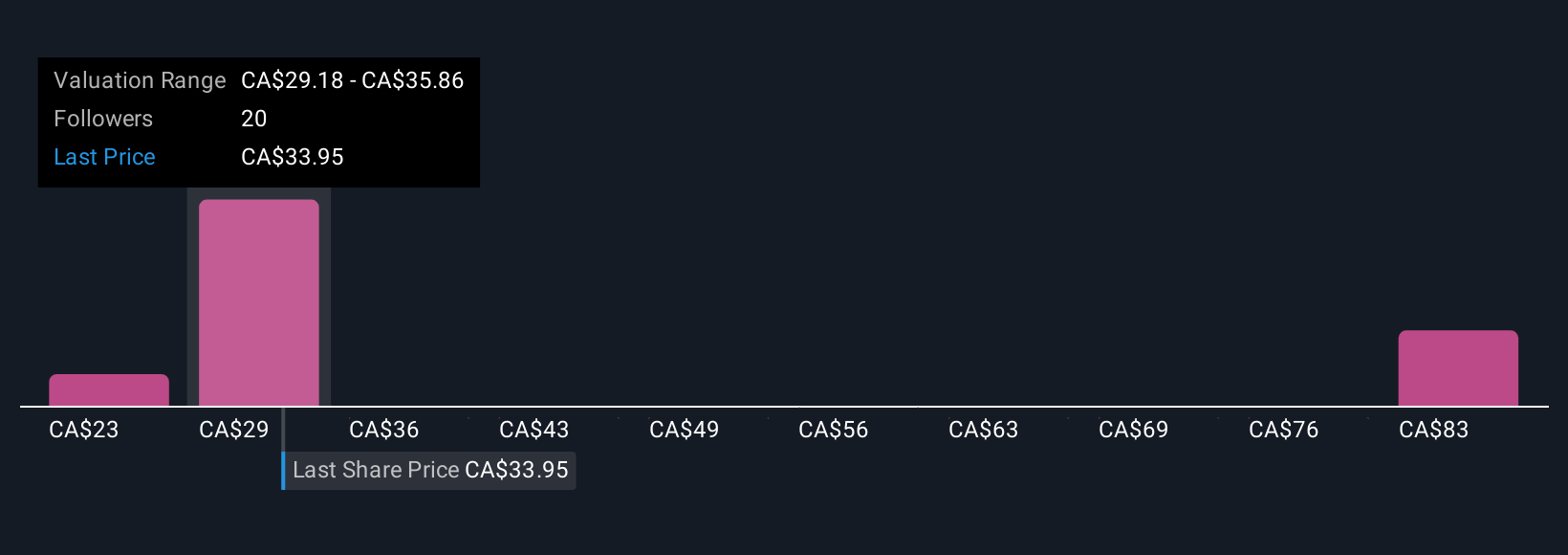

Seven members of the Simply Wall St Community assessed Saputo’s fair value between C$22.50 and C$89.20 per share. Their views reflect both optimism and skepticism, especially as industry-wide dairy demand faces pressure from shifting consumer preferences.

Explore 7 other fair value estimates on Saputo - why the stock might be worth over 2x more than the current price!

Build Your Own Saputo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Saputo research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Saputo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Saputo's overall financial health at a glance.

No Opportunity In Saputo?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SAP

Saputo

Produces, markets, and distributes dairy products in Canada, the United States, Australia, Argentina, and the United Kingdom.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives