What Do Recent Swings Mean for Maple Leaf Foods Stock Value in 2025?

Reviewed by Bailey Pemberton

If you’re sitting on the fence about what to do with Maple Leaf Foods right now, you’re not alone. The stock has been on a rollercoaster lately, and it is catching the eye of investors wondering if the ride is just getting started or if it is time to lock in gains. Just in the last week, shares pulled back by 13.4%, and the drop over the last month sits at 11.2%. But zoom out and the story looks very different. Year-to-date, the stock is up 53.4%, and over the past year, it has soared by an impressive 65.7%. Dig even deeper and the gains stretch to a remarkable 90.7% over three years. That’s hard to ignore!

These swings haven’t happened in a vacuum. The wider food products sector has seen some shifts as consumer preferences change and input costs stabilize. While there hasn’t been one major news event driving this, there is a sense among investors that risk perceptions are evolving, especially as Maple Leaf Foods refines its strategy against the bigger industry backdrop. This mix of volatility and long-term growth has traders doubling back to check if the fundamentals still stack up.

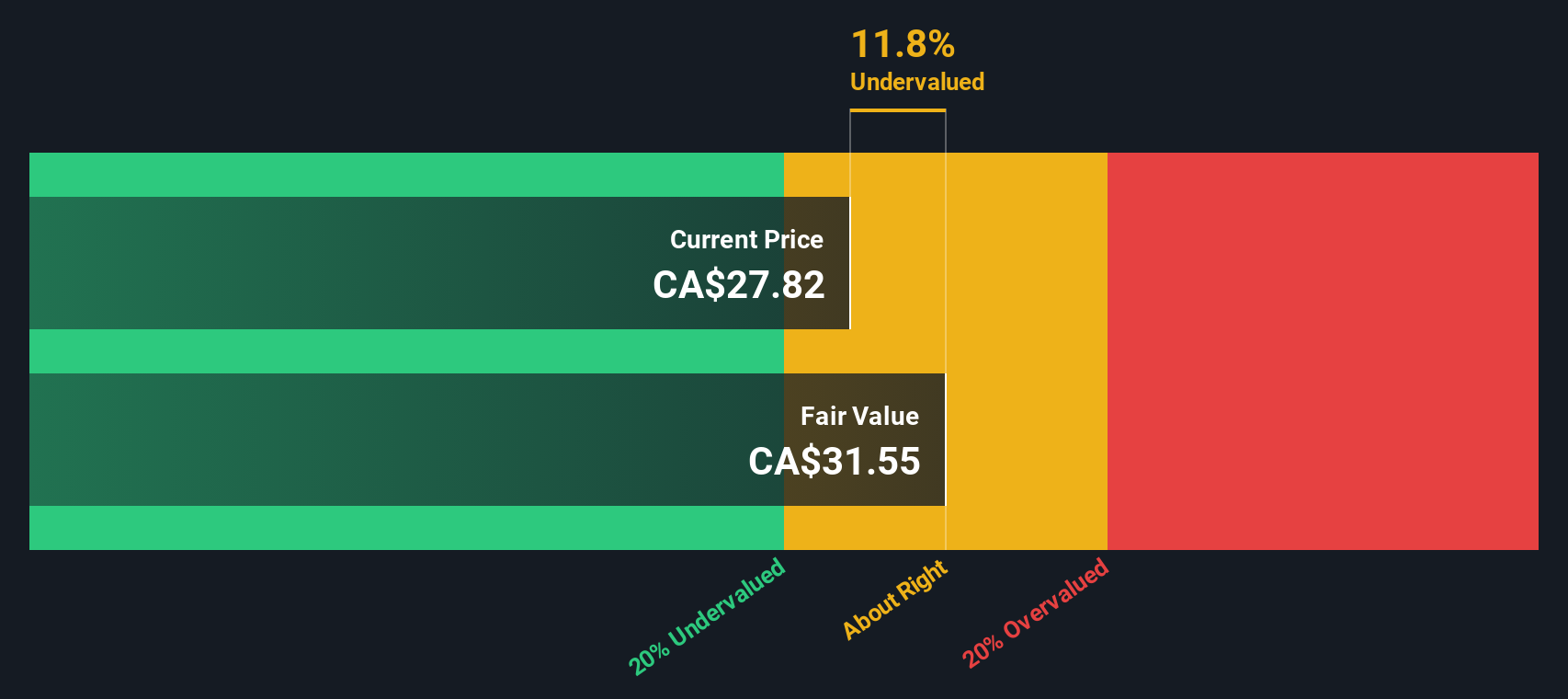

On that front, the company earns a valuation score of 3 out of 6. In other words, it is undervalued in exactly half of the traditional valuation checks. But are these methods telling the whole story? Next, we will dive into which valuation approaches put Maple Leaf Foods in the spotlight and why another perspective on value might be even more revealing by the end of the article.

Approach 1: Maple Leaf Foods Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by forecasting Maple Leaf Foods’ expected cash flows and discounting those future numbers back to today’s value to reach an estimate of what the business is truly worth. For Maple Leaf Foods, the latest twelve-month Free Cash Flow sits at CA$396.2 million.

Looking forward, analyst estimates project Free Cash Flow at CA$325.2 million by the end of 2026. Longer-term forecasts are created by extrapolating those analyst figures. This suggests Free Cash Flows may remain above CA$305 million per year through 2035, with some moderate growth and dips along the way based on Simply Wall St’s methodology.

Pulling all those projected cash flows together, the DCF model estimates Maple Leaf Foods’ fair value at CA$60.29 per share. This value is based on a 2 Stage Free Cash Flow to Equity model, which takes into account both the near-term projections and a longer-term view adjusted for future uncertainty.

Given that the intrinsic valuation shows the shares are trading at a 48.2% discount, the DCF model indicates Maple Leaf Foods is significantly undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Maple Leaf Foods is undervalued by 48.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

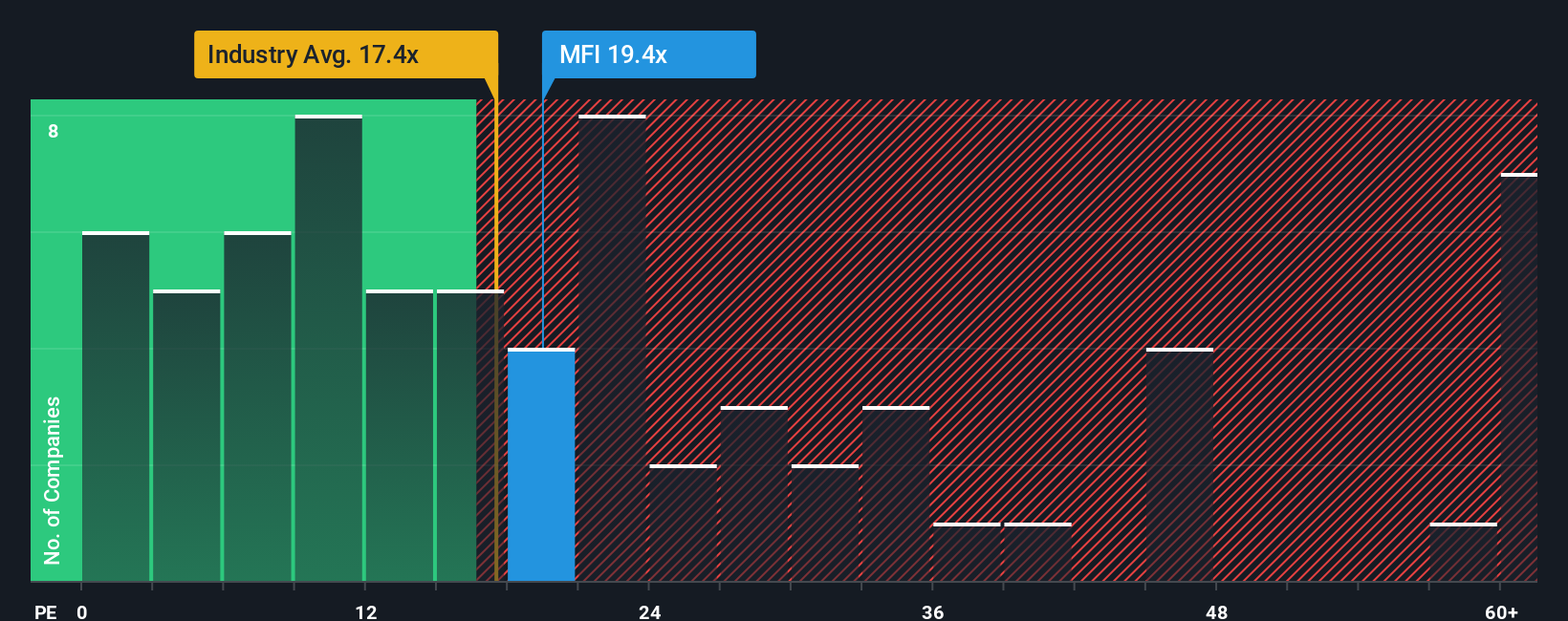

Approach 2: Maple Leaf Foods Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is the go-to valuation metric for profitable companies like Maple Leaf Foods. It relates the company’s current share price to its actual earnings, giving investors an easy way to judge what they are paying for each dollar of profit. A “normal” or “fair” PE ratio can vary widely depending on the company’s growth prospects and risk profile. Faster-growing or less risky companies typically justify higher multiples, while slower or riskier ones usually trade at a discount.

Maple Leaf Foods currently trades at a PE ratio of 21.8x. For context, this is above the average PE for the Food industry, which sits at 16.3x, and also exceeds the average among its peers at 19.6x. At first glance, this premium might raise eyebrows, but a straight comparison with peers and the industry can sometimes miss what makes a company unique, especially if its future looks particularly bright or if its risk is meaningfully different.

This is where Simply Wall St’s proprietary Fair Ratio comes in. The Fair Ratio estimates what a “just right” PE multiple should be for Maple Leaf Foods, factoring in its expected earnings growth, risk level, profit margins, industry features, and market capitalization. In this case, that Fair Ratio is 11.4x, which is much lower than both the actual multiple and the industry benchmark. Since the current PE is nearly twice the Fair Ratio, it suggests the market is pricing in more growth or quality than even these enhanced models project, making the stock look expensive by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

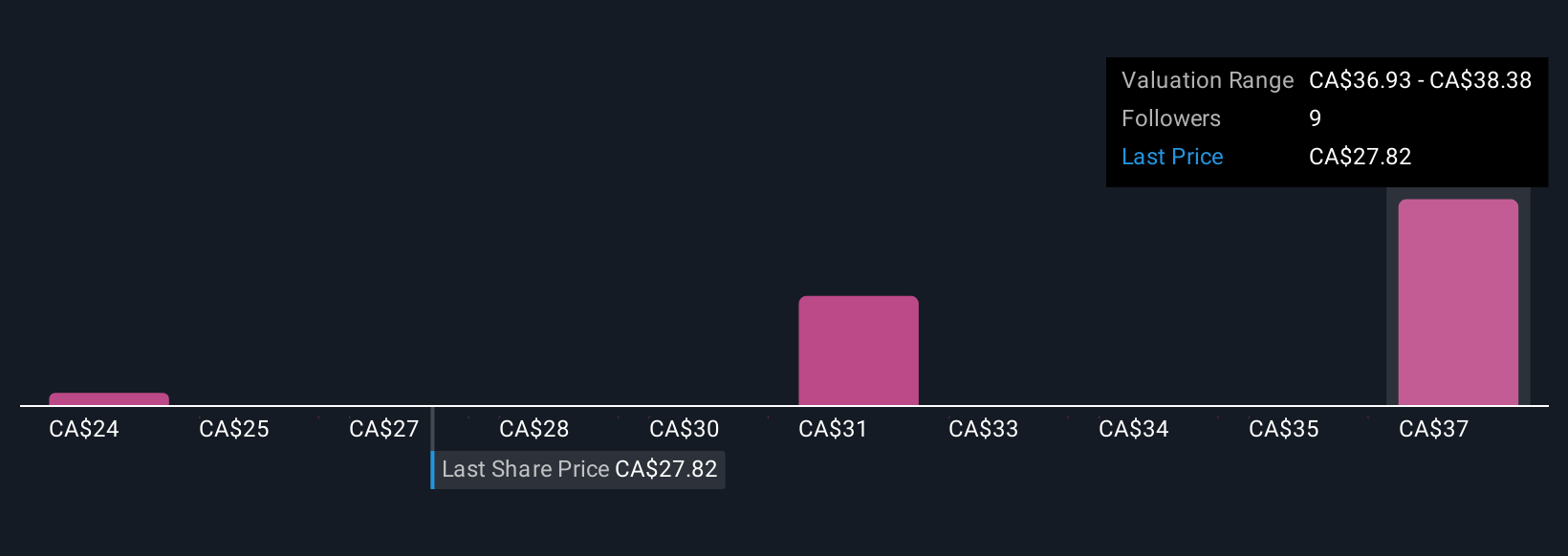

Upgrade Your Decision Making: Choose your Maple Leaf Foods Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are an easy and accessible way to give context to your story and beliefs behind a company’s numbers, such as your own fair value and forecasts for future revenue and earnings. Instead of just relying on static metrics, Narratives connect Maple Leaf Foods’ business story to your own financial assumptions, and then translate that into a fair value you can use for buy or sell decisions.

On Simply Wall St’s Community page, millions of investors are using Narratives to share, test, and update their perspectives as news and earnings break. For example, one Narrative might project Maple Leaf Foods thriving on high-protein food trends and automation, arriving at a fair value of CA$41.00, while another Narrative might set a cautious target of CA$30.00, reflecting concerns about margin pressures and market volatility. Narratives make these varied viewpoints visible and automatically update as new information emerges, so you can compare the current share price to your fair value in real time and make smarter, better-informed decisions with confidence.

Do you think there's more to the story for Maple Leaf Foods? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MFI

Maple Leaf Foods

Produces food products in Canada, the United States, Japan, China, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026