Investors Appear Satisfied With Maple Leaf Foods Inc.'s (TSE:MFI) Prospects

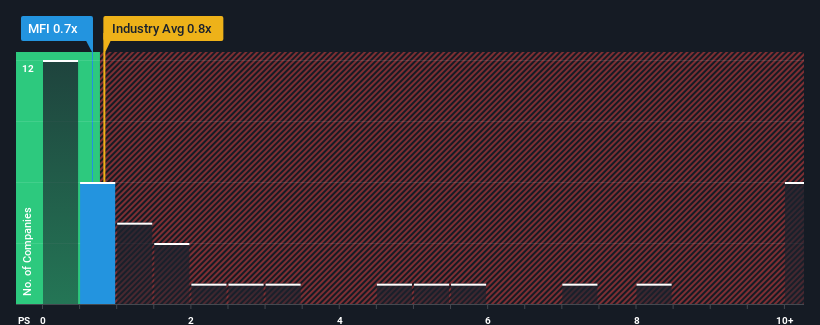

It's not a stretch to say that Maple Leaf Foods Inc.'s (TSE:MFI) price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" for companies in the Food industry in Canada, where the median P/S ratio is around 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Maple Leaf Foods

What Does Maple Leaf Foods' Recent Performance Look Like?

Maple Leaf Foods could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Maple Leaf Foods.How Is Maple Leaf Foods' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Maple Leaf Foods' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 4.3%. The solid recent performance means it was also able to grow revenue by 16% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 4.1% during the coming year according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 2.5%, which is not materially different.

With this information, we can see why Maple Leaf Foods is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Maple Leaf Foods' P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A Maple Leaf Foods' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Food industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Maple Leaf Foods you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MFI

Maple Leaf Foods

Produces food products in Canada, the United States, Japan, China, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives