A Fresh Look at Maple Leaf Foods (TSX:MFI) Valuation Following Launch of Musafir South Asian Product Line

Reviewed by Simply Wall St

Maple Leaf Foods (TSX:MFI) has launched Musafir, its new South Asian-inspired brand offering protein-forward products such as Halal chicken and vegetarian options. The company is expanding into culturally diverse foods to serve Canada’s evolving market.

See our latest analysis for Maple Leaf Foods.

Shares of Maple Leaf Foods have made a big move this year, rising 42% year-to-date with a total shareholder return of 54% over the past 12 months. Momentum has cooled in the past month, but recent buzz around the Musafir brand and a broader appetite for global cuisines is keeping the spotlight on potential growth and shifting perceptions of the company’s longer-term value.

If you’re watching how brands evolve to capture new markets, now is a perfect time to widen your search and discover fast growing stocks with high insider ownership

But with shares already up strongly in 2024 and trading below analyst price targets, investors must now ask: Can Maple Leaf Foods rally further on new product momentum, or is future growth already anticipated in the current price?

Most Popular Narrative: 21.9% Undervalued

Compared to the last close of CA$29.00, the most widely followed narrative suggests Maple Leaf Foods could be meaningfully undervalued based on future earnings growth and margin expansion. The current share price trails the narrative’s fair value estimate, setting the stage for a valuation supported by ambitious profit assumptions and operational transformation.

Ongoing investments in manufacturing automation (such as the Bacon Center of Excellence and the London Poultry facility) and supply chain optimization via the Fuel for Growth initiative are driving significant cost efficiencies, as reflected in expanding adjusted EBITDA margin, and are expected to further enhance margins and earnings long term.

How bold are the assumptions behind this price tag? The narrative centers on surging earnings, margin gains, and a rapid shift in operational efficiency. But can those projections really stick the landing? See which financial levers and forecasts are moving the market’s imagination in this popular take on Maple Leaf Foods.

Result: Fair Value of $37.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, near-term execution risks and rising input costs could quickly dampen optimism. This may make future growth far less certain than current projections suggest.

Find out about the key risks to this Maple Leaf Foods narrative.

Another View: What Do Multiples Say?

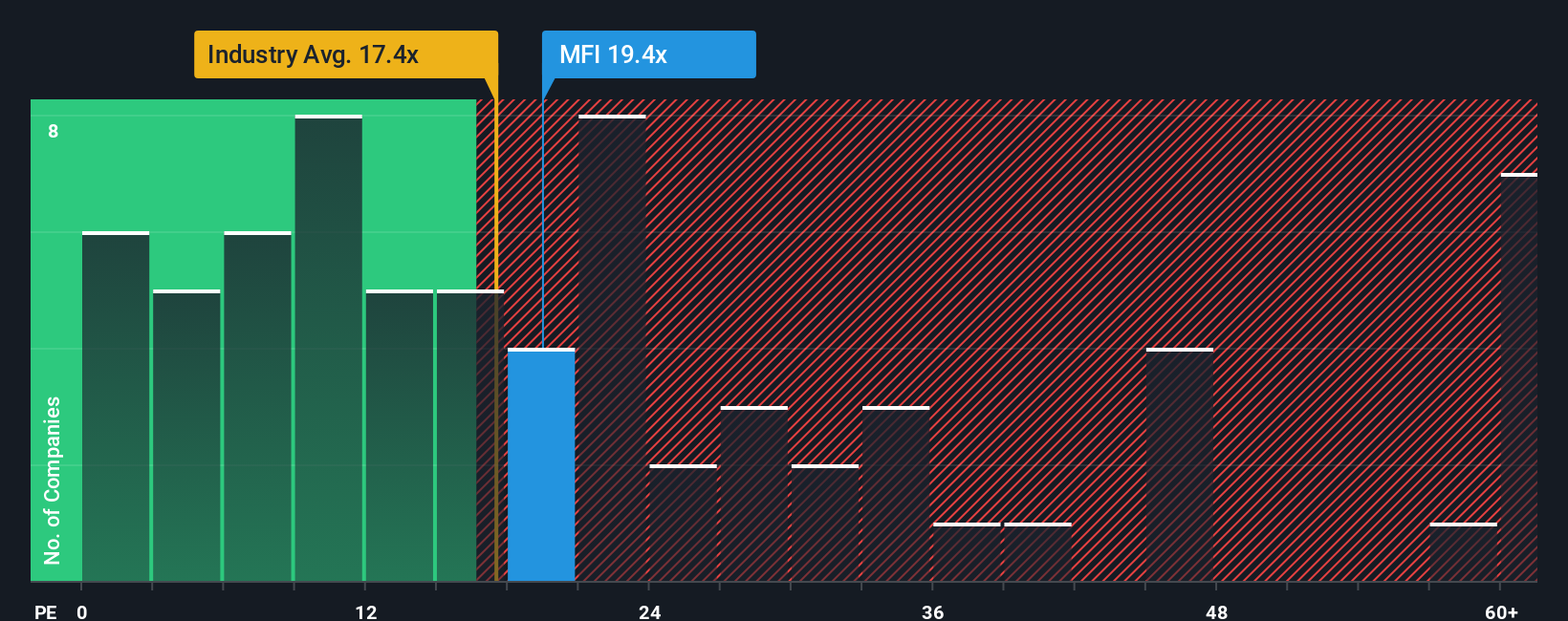

Looking through the lens of the price-to-earnings ratio, Maple Leaf Foods is trading at 20.3x earnings. This is higher than both its peer average of 18.7x and the North American food industry average of 17.4x, and it also exceeds the fair ratio of 11.6x. The gap suggests that investors may be placing a premium on future potential, but it also raises the question: is this optimism well-placed, or could the valuation come under pressure?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Maple Leaf Foods Narrative

If you see things differently or want to dig into the numbers for yourself, you can craft your own view in just a few minutes with Do it your way

A great starting point for your Maple Leaf Foods research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t hold back your portfolio’s potential. Tap into emerging trends, resilient business models, and advantage-rich sectors right now with these unique opportunities:

- Boost your growth game with these 24 AI penny stocks that are transforming entire industries through artificial intelligence leadership and inventive technology adoption.

- Unlock income potential by targeting these 17 dividend stocks with yields > 3% offering stable yields over 3%, which can be ideal for building reliable returns in any market setting.

- Own tomorrow’s financial disruptors by checking out these 79 cryptocurrency and blockchain stocks harnessing the power of blockchain and digital currencies at the core of financial innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MFI

Maple Leaf Foods

Produces food products in Canada, the United States, Japan, China, and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives