It's A Story Of Risk Vs Reward With Flow Beverage Corp. (TSE:FLOW)

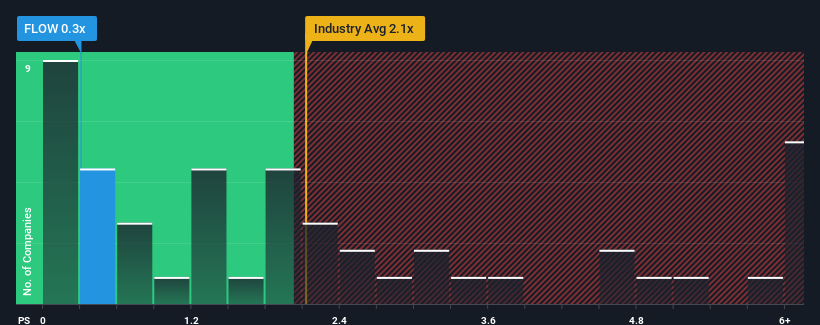

When close to half the companies operating in the Beverage industry in Canada have price-to-sales ratios (or "P/S") above 1.8x, you may consider Flow Beverage Corp. (TSE:FLOW) as an attractive investment with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Flow Beverage

What Does Flow Beverage's Recent Performance Look Like?

Recent times haven't been great for Flow Beverage as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Flow Beverage.How Is Flow Beverage's Revenue Growth Trending?

Flow Beverage's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 68% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 34% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 3.9%, which is noticeably less attractive.

With this information, we find it odd that Flow Beverage is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Flow Beverage's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Flow Beverage (of which 1 is a bit concerning!) you should know about.

If these risks are making you reconsider your opinion on Flow Beverage, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FLOW

Flow Beverage

Engages in the developing, marketing, selling, and distributing natural alkaline spring water-based beverages under the Flow brand name in Canada and the United States.The company’s spring water available in organic and natural flavours, such as blackberry+hibiscus, strawberry+rose, cucumber+mint, watermelon, grapefruit, cucumber, peach+blueberry, blood orange, meyer lemon, strawberry+kiwi, ginger+lemon, and pomegranate, as well as vitamin-infused water comprising elderberry, citrus, and cherry.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives