Flow Beverage Corp.'s (TSE:FLOW) Shares Not Telling The Full Story

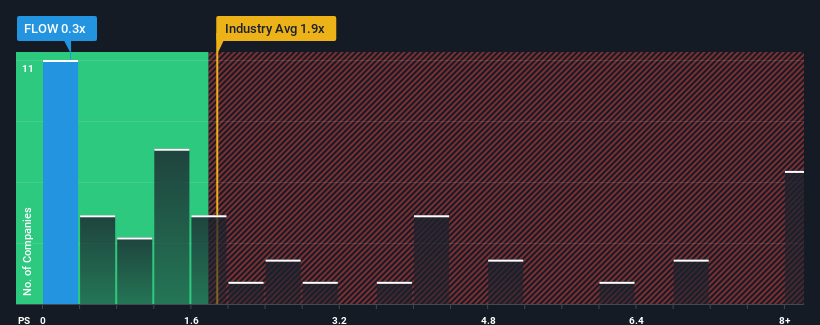

When you see that almost half of the companies in the Beverage industry in Canada have price-to-sales ratios (or "P/S") above 1.6x, Flow Beverage Corp. (TSE:FLOW) looks to be giving off some buy signals with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Flow Beverage

How Has Flow Beverage Performed Recently?

Flow Beverage could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Flow Beverage will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Flow Beverage?

In order to justify its P/S ratio, Flow Beverage would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 14% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 48% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 3.6%, which is noticeably less attractive.

With this information, we find it odd that Flow Beverage is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Flow Beverage's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Flow Beverage (2 are significant!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FLOW

Flow Beverage

Engages in the developing, marketing, selling, and distributing natural alkaline spring water-based beverages under the Flow brand name in Canada and the United States.The company’s spring water available in organic and natural flavours, such as blackberry+hibiscus, strawberry+rose, cucumber+mint, watermelon, grapefruit, cucumber, peach+blueberry, blood orange, meyer lemon, strawberry+kiwi, ginger+lemon, and pomegranate, as well as vitamin-infused water comprising elderberry, citrus, and cherry.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives