Flow Beverage Corp. (TSE:FLOW) Screens Well But There Might Be A Catch

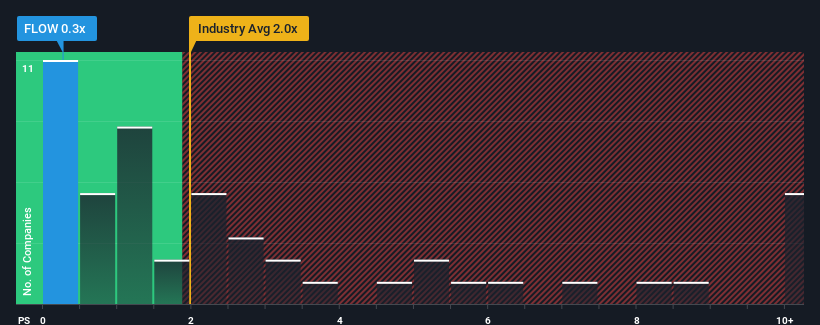

When close to half the companies operating in the Beverage industry in Canada have price-to-sales ratios (or "P/S") above 1.2x, you may consider Flow Beverage Corp. (TSE:FLOW) as an attractive investment with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Flow Beverage

How Flow Beverage Has Been Performing

Flow Beverage certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Flow Beverage will help you uncover what's on the horizon.How Is Flow Beverage's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Flow Beverage's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 123% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to remain somewhat buoyant, growing by 1.3% during the coming year according to the two analysts following the company. While this isn't a particularly impressive figure, it should be noted that the the industry is expected to decline by 11%.

In light of this, it's quite peculiar that Flow Beverage's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Flow Beverage's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Flow Beverage currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Flow Beverage that you need to be mindful of.

If these risks are making you reconsider your opinion on Flow Beverage, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FLOW

Flow Beverage

Engages in the developing, marketing, selling, and distributing natural alkaline spring water-based beverages under the Flow brand name in Canada and the United States.The company’s spring water available in organic and natural flavours, such as blackberry+hibiscus, strawberry+rose, cucumber+mint, watermelon, grapefruit, cucumber, peach+blueberry, blood orange, meyer lemon, strawberry+kiwi, ginger+lemon, and pomegranate, as well as vitamin-infused water comprising elderberry, citrus, and cherry.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives