Canadian Hidden Gems And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

As the Canadian market continues to navigate its third year of a robust bull run, driven by significant gains in the TSX and supported by easing inflation and interest rate cuts, investors are increasingly looking beyond traditional sectors for opportunities. Amidst trade tensions and economic uncertainties, small-cap stocks with strong fundamentals and growth potential present intriguing possibilities for those seeking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| Clairvest Group | NA | -8.94% | -11.82% | ★★★★★★ |

| TWC Enterprises | 3.89% | 13.21% | 11.52% | ★★★★★★ |

| Mako Mining | 5.45% | 22.24% | 62.70% | ★★★★★★ |

| Itafos | 23.13% | 10.69% | 44.01% | ★★★★★★ |

| Grown Rogue International | 26.48% | 33.74% | 4.14% | ★★★★★☆ |

| Corby Spirit and Wine | 58.35% | 10.79% | -4.77% | ★★★★☆☆ |

| Soma Gold | 142.85% | 31.11% | 38.09% | ★★★★☆☆ |

| Dundee | 1.89% | -35.40% | 52.34% | ★★★★☆☆ |

| Golconda Gold | 7.15% | 5.60% | 23.42% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Andean Precious Metals (TSX:APM)

Simply Wall St Value Rating: ★★★★★★

Overview: Andean Precious Metals Corp. is involved in the acquisition, exploration, development, and processing of mineral resource properties in the United States, with a market cap of CA$1.07 billion.

Operations: Andean Precious Metals generates revenue primarily from operations in the USA ($131.89 million) and Bolivia ($144.98 million).

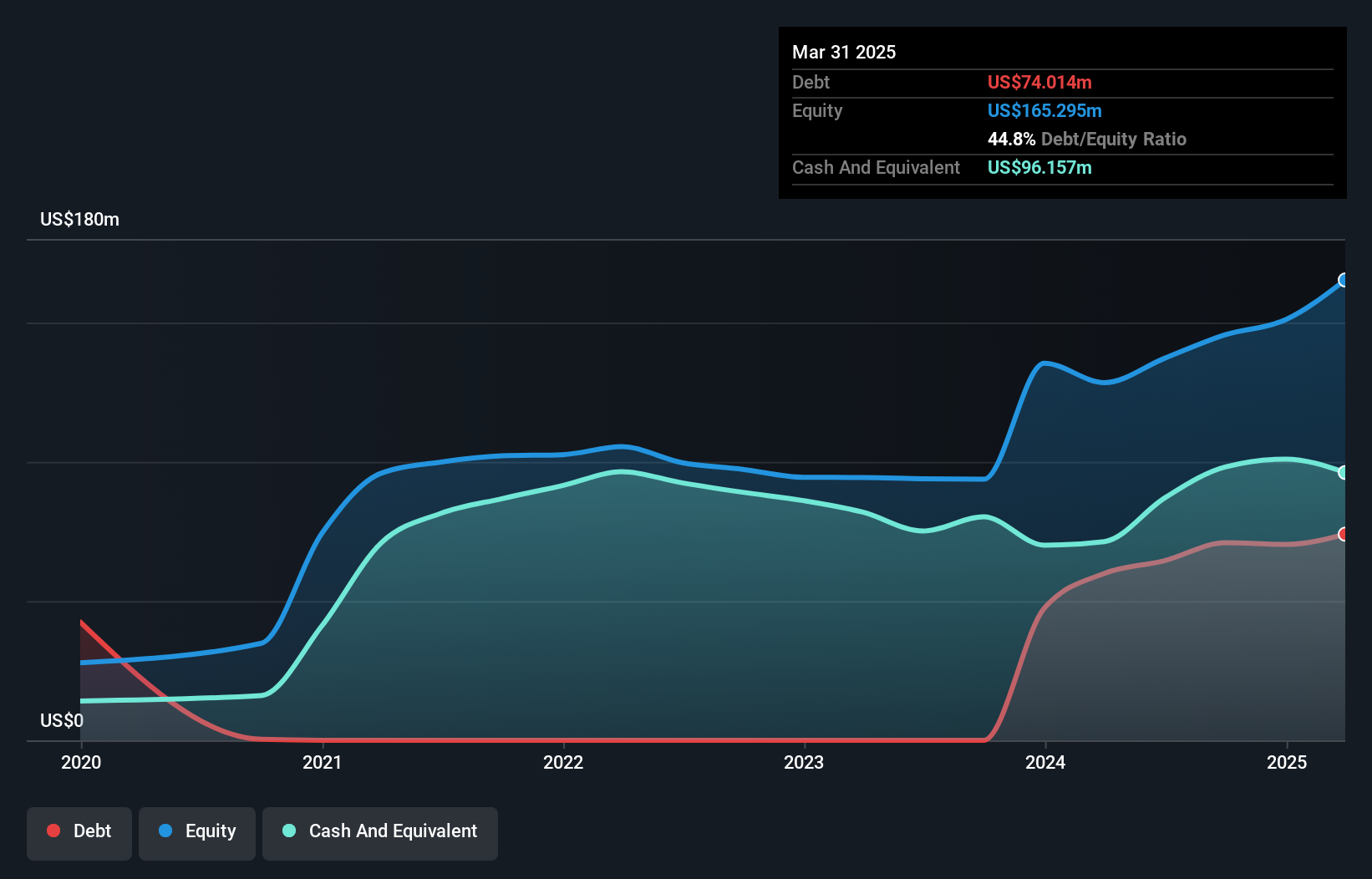

Andean Precious Metals, a nimble player in the mining sector, has seen its debt-to-equity ratio improve from 44.6% to 28.7% over five years, indicating prudent financial management. However, recent insider selling raises eyebrows about internal confidence. Despite a dip in net profit margins from 25.4% to 15.1%, the company is trading at an attractive valuation—93.7% below estimated fair value—suggesting potential upside for investors willing to navigate its challenges and capitalize on strategic initiatives like its long-term ore agreement with COMIBOL and ongoing exploration efforts at Golden Queen mine in California and San Bartolome operation in Bolivia.

Corby Spirit and Wine (TSX:CSW.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Corby Spirit and Wine Limited, along with its subsidiaries, is involved in the manufacturing, marketing, and importing of spirits, wines, and ready-to-drink cocktails across Canada, the United States, the United Kingdom, and other international markets with a market cap of CA$388.18 million.

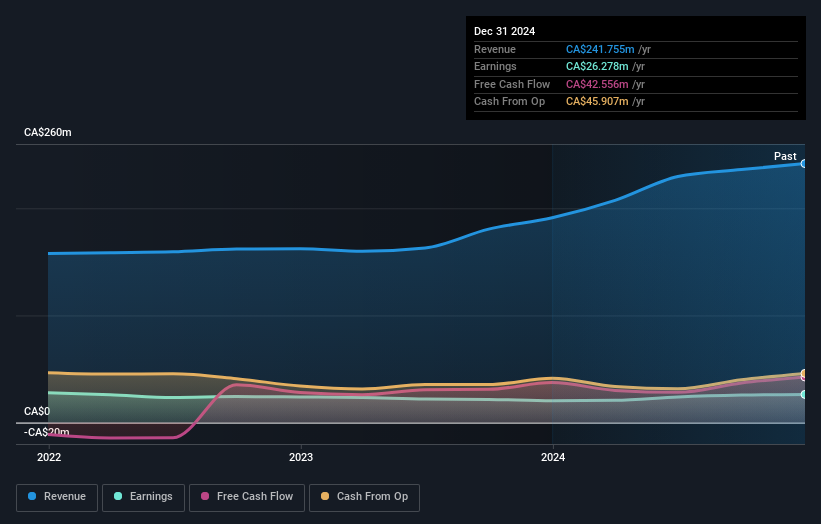

Operations: The company's primary revenue streams include Case Goods, generating CA$212.28 million, and Commissions, contributing CA$30.59 million. Gross profit margin trends could provide insights into the company's cost management and pricing strategies over time.

Corby Spirit and Wine, a notable player in the Canadian beverage scene, has shown impressive earnings growth of 14.7% over the past year, outpacing the industry average. Despite a challenging five-year period with earnings declining by 4.8% annually, Corby's recent performance highlights resilience and potential for recovery. The company's net income rose to CAD 27.43 million from CAD 23.91 million last year, reflecting its ability to capitalize on market opportunities such as exclusive rights to Vinarchy brands in Canada for two years starting September 2025. However, its debt-to-equity ratio climbed to 58%, indicating heightened leverage concerns amidst positive cash flow generation and well-covered interest payments at six times EBIT coverage.

- Unlock comprehensive insights into our analysis of Corby Spirit and Wine stock in this health report.

Evaluate Corby Spirit and Wine's historical performance by accessing our past performance report.

Alphamin Resources (TSXV:AFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Alphamin Resources Corp., along with its subsidiaries, focuses on the production and sale of tin concentrate and has a market capitalization of CA$1.37 billion.

Operations: The primary revenue stream for Alphamin Resources comes from the production and sale of tin concentrate, generating $579.49 million. The company has a market capitalization of CA$1.37 billion, reflecting its significant role in the tin industry.

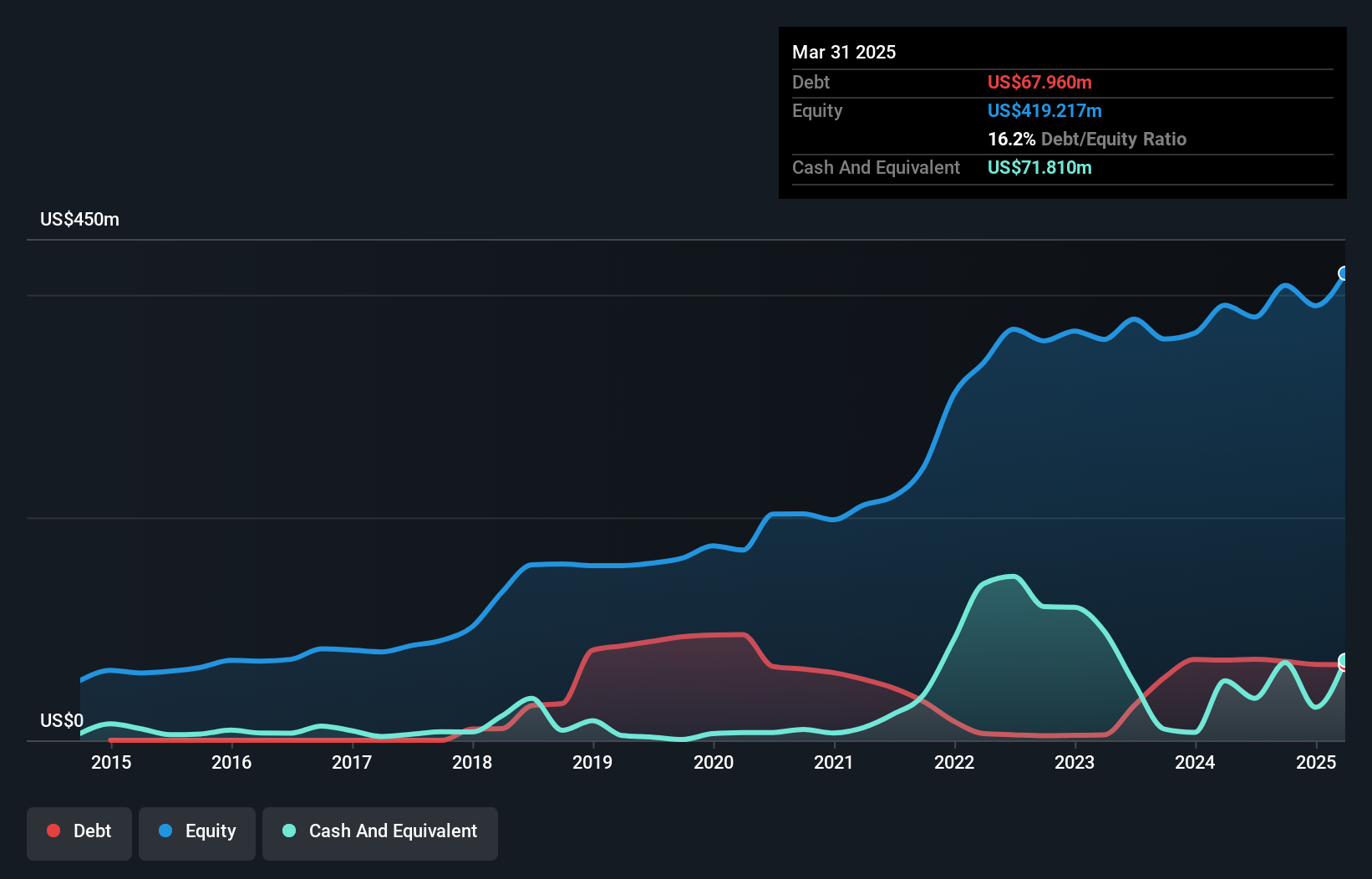

Alphamin Resources, a nimble player in the mining sector, recently reported third-quarter tin production of 5,190 tonnes, surpassing its target and marking a 26% increase from the previous quarter. This achievement comes despite earlier operational halts due to security concerns. Financially robust, Alphamin's earnings surged by 113.6% over the past year, outpacing industry growth of 32.3%. The company's debt-to-equity ratio has impressively decreased from 32.7% to 11.9% over five years, indicating sound financial management. Trading at nearly half its estimated fair value and maintaining positive free cash flow further enhances its appeal as an investment prospect in Canada's mining landscape.

- Take a closer look at Alphamin Resources' potential here in our health report.

Examine Alphamin Resources' past performance report to understand how it has performed in the past.

Make It Happen

- Discover the full array of 49 TSX Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CSW.A

Corby Spirit and Wine

Manufactures, markets, and imports spirits, wines, and ready-to-drink cocktails in Canada, the United States, the United Kingdom, and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives