Did Business Growth Power Global Hemp Group's (CNSX:GHG) Share Price Gain of 150%?

It hasn't been the best quarter for Global Hemp Group Inc. (CNSX:GHG) shareholders, since the share price has fallen 23% in that time. But that doesn't change the fact that the returns over the last three years have been very strong. The share price marched upwards over that time, and is now 150% higher than it was. To some, the recent share price pullback wouldn't be surprising after such a good run. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

View our latest analysis for Global Hemp Group

With just CA$1,381 worth of revenue in twelve months, we don't think the market considers Global Hemp Group to have proven its business plan. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that Global Hemp Group will significantly advance the business plan before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Of course, if you time it right, high risk investments like this can really pay off, as Global Hemp Group investors might know.

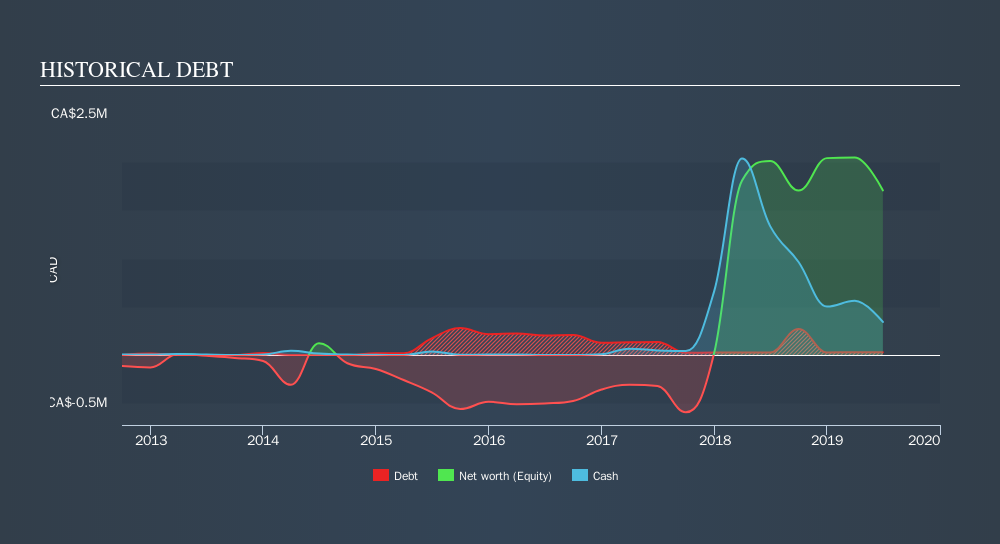

When it reported in June 2019 Global Hemp Group had minimal cash in excess of all liabilities consider its expenditure: just CA$78k to be specific. So if it hasn't remedied the situation already, it will almost certainly have to raise more capital soon. Given how low on cash the it got, investors must really like its potential for the share price to be up 84% per year, over 3 years . You can click on the image below to see (in greater detail) how Global Hemp Group's cash levels have changed over time. The image below shows how Global Hemp Group's balance sheet has changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, many of the best investors like to check if insiders have been buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. You can click here to see if there are insiders buying.

A Different Perspective

Over the last year, Global Hemp Group shareholders took a loss of 68%. In contrast the market gained about 3.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 36% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. Before spending more time on Global Hemp Group it might be wise to click here to see if insiders have been buying or selling shares.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About CNSX:GHG

Global Hemp Group

Engages in health and wellness, and industrial hemp businesses.

Medium-low with weak fundamentals.

Market Insights

Community Narratives