- Canada

- /

- Metals and Mining

- /

- TSXV:CLM

TSX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The Canadian market has remained flat over the past week but has shown a significant rise of 23% over the last year, with earnings forecasted to grow by 16% annually. For investors considering alternatives to well-known stocks, penny stocks can present intriguing opportunities, particularly when they are backed by strong financials. Despite their somewhat outdated name, these smaller or newer companies can offer a blend of value and growth potential that larger firms may not provide.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.83 | CA$176.58M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.16 | CA$390.75M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.16 | CA$109.91M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.60 | CA$547.51M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.28 | CA$224.43M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$29.28M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.45 | CA$968.15M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.03M | ★★★★★★ |

Click here to see the full list of 920 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Consolidated Lithium Metals (TSXV:CLM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Consolidated Lithium Metals Inc. focuses on acquiring, exploring, and developing mineral properties in Canada, with a market cap of CA$5.52 million.

Operations: No revenue segments are reported for the company.

Market Cap: CA$5.52M

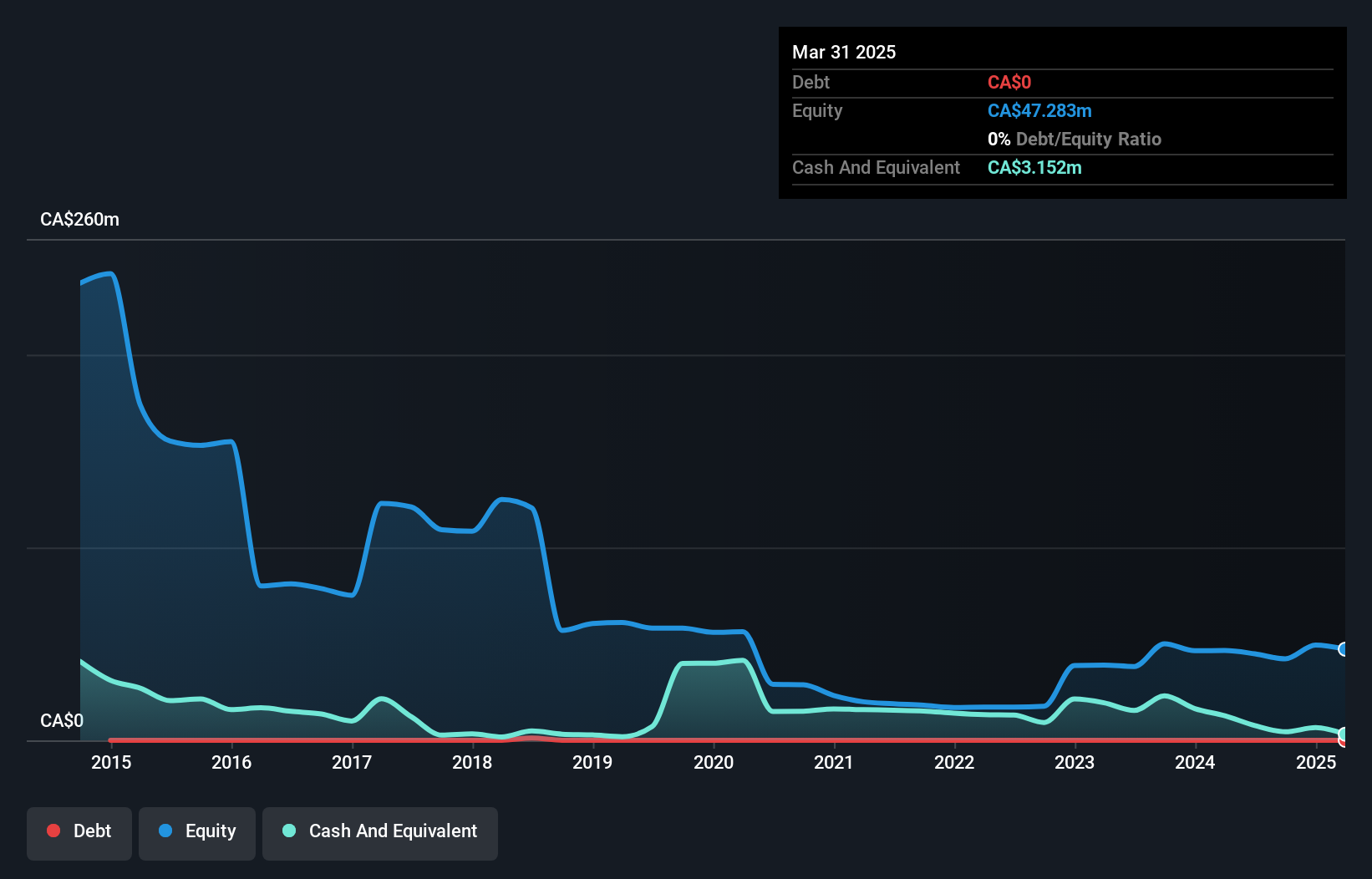

Consolidated Lithium Metals Inc., with a market cap of CA$5.52 million, remains pre-revenue and unprofitable, marked by a significant net loss reduction in recent quarters. The company is debt-free but has experienced shareholder dilution over the past year. Its cash runway was limited to one month as of September 2024, though additional capital was raised through private placements. Recent drilling results at the East Vallee Project indicate potential lithium-bearing pegmatites, which could be promising for future development. Despite high volatility and management's limited tenure, the board is relatively experienced with an average tenure of 3.8 years.

- Take a closer look at Consolidated Lithium Metals' potential here in our financial health report.

- Examine Consolidated Lithium Metals' past performance report to understand how it has performed in prior years.

Eco (Atlantic) Oil & Gas (TSXV:EOG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eco (Atlantic) Oil & Gas Ltd. focuses on the identification, acquisition, exploration, and development of petroleum, natural gas, and shale gas properties in Namibia and Guyana with a market cap of CA$68.48 million.

Operations: Eco (Atlantic) Oil & Gas Ltd. does not currently report any revenue segments.

Market Cap: CA$68.48M

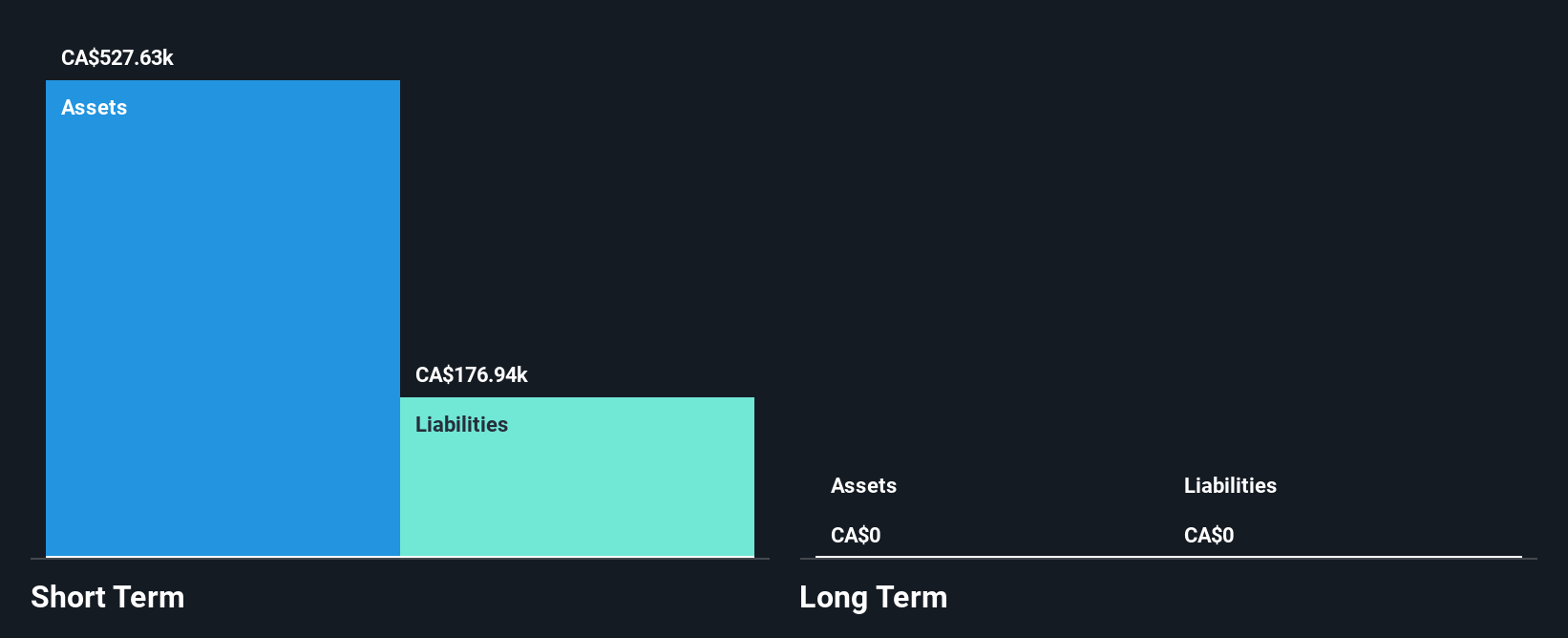

Eco (Atlantic) Oil & Gas Ltd., with a market cap of CA$68.48 million, is pre-revenue and currently unprofitable, reporting minimal revenue and increasing net losses in recent quarters. The company benefits from a seasoned management team with an average tenure of 13.1 years and an experienced board. It has no long-term liabilities and maintains sufficient cash to cover more than a year of operations at current expenditure rates, despite historical cash flow reductions. Short-term assets significantly exceed short-term liabilities, providing some financial stability without debt concerns or shareholder dilution over the past year.

- Dive into the specifics of Eco (Atlantic) Oil & Gas here with our thorough balance sheet health report.

- Gain insights into Eco (Atlantic) Oil & Gas' outlook and expected performance with our report on the company's earnings estimates.

TAG Oil (TSXV:TAO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TAG Oil Ltd. is involved in the exploration, development, and production of oil and gas across Canada, the Middle East, and North Africa with a market cap of CA$30.54 million.

Operations: The company generates revenue primarily from its petroleum exploration and production segment, amounting to CA$0.62 million.

Market Cap: CA$30.54M

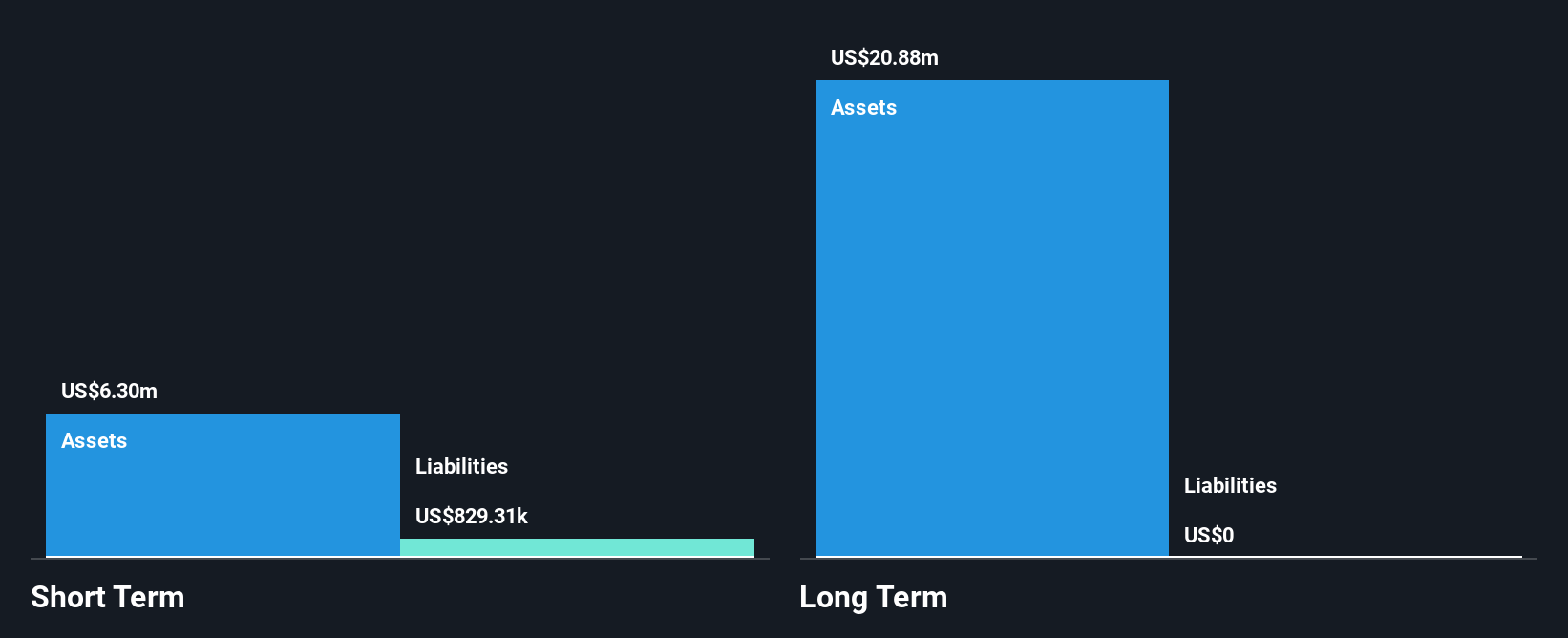

TAG Oil Ltd., with a market cap of CA$30.54 million, remains pre-revenue, generating less than US$1 million annually. The company recently reported increased net losses for the third quarter and nine months ending September 2024. Despite being debt-free and having short-term assets exceeding liabilities, TAG Oil faces financial challenges with less than a year of cash runway if free cash flow continues to decline. Strategic efforts include raising CA$10 million through public offerings to fund expansion in Egypt's Western Desert, aiming to capitalize on significant unconventional resource plays while stabilizing production at existing sites.

- Click here to discover the nuances of TAG Oil with our detailed analytical financial health report.

- Examine TAG Oil's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Take a closer look at our TSX Penny Stocks list of 920 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CLM

Consolidated Lithium Metals

Consolidated Lithium Metals Inc., junior mining exploration company, engages in the acquisition, exploration, production, and development of mining properties in Canada.

Moderate with adequate balance sheet.

Market Insights

Community Narratives