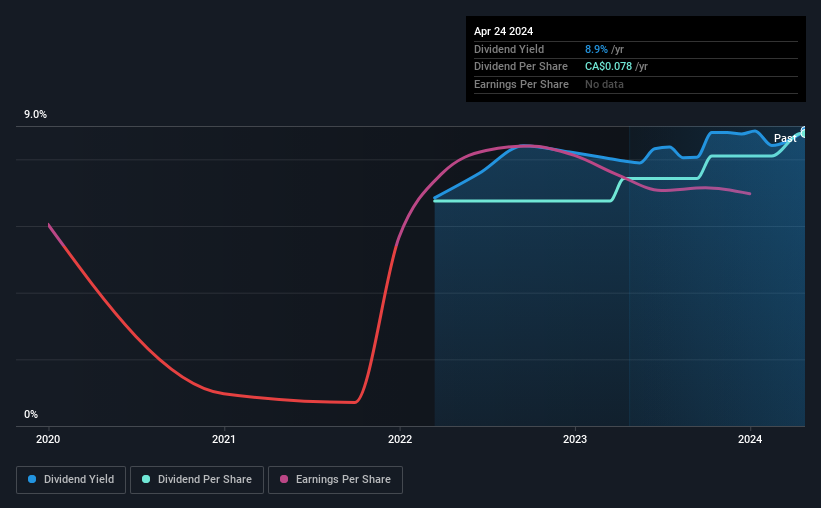

Source Rock Royalties Ltd. (CVE:SRR) has announced that it will be increasing its periodic dividend on the 15th of May to CA$0.0065, which will be 18% higher than last year's comparable payment amount of CA$0.0055. This will take the dividend yield to an attractive 8.9%, providing a nice boost to shareholder returns.

See our latest analysis for Source Rock Royalties

Source Rock Royalties Is Paying Out More Than It Is Earning

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Prior to this announcement, the dividend made up 190% of earnings, and the company was generating negative free cash flows. Paying out such a large dividend compared to earnings while also not generating any free cash flow would definitely be difficult to keep up.

Over the next year, EPS could expand by 19.1% if the company continues along the path it has been on recently. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 200% over the next year.

Source Rock Royalties Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The dividend has gone from an annual total of CA$0.06 in 2022 to the most recent total annual payment of CA$0.078. This implies that the company grew its distributions at a yearly rate of about 14% over that duration. Source Rock Royalties has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

Dividend Growth Could Be Constrained

The company's investors will be pleased to have been receiving dividend income for some time. Source Rock Royalties has seen EPS rising for the last five years, at 19% per annum. However, the payout ratio is very high, not leaving much room for growth of the dividend in the future.

The Dividend Could Prove To Be Unreliable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. Strong earnings growth means Source Rock Royalties has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Source Rock Royalties has 5 warning signs (and 2 which make us uncomfortable) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:SRR

Source Rock Royalties

An oil and gas royalty company, engages in acquiring and managing oil and gas royalties and mineral title interests.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion